Pre-inaugural fiscal relief unlikely

I want to take stock of the economic landscape in the US now that the Thanksgiving holiday is past. There are three decisive variables in my view. The first is the ability of the healthcare system to deal with the coronavirus and keep economies operational. The second is the coming vaccines. And the third is fiscal relief to tide us from the first variable to the second.

I’ve titled this post with that third variable because that’s the newest piece of information. But I am going to write this in chronological order from variable one to three.

The pandemic

The first variable goes to questions one two and three in the last post I wrote before the holidays.

- How bad will the pandemic get before this wave can be arrested?

- How severe an economic brake will have to occur to get the virus under control?

- What short- and long-term impact will this have on businesses?

This pandemic is going to get very bad, bad enough to overwhelm the healthcare system in many jurisdictions. To make that point clear, let’s take stock of what we know.

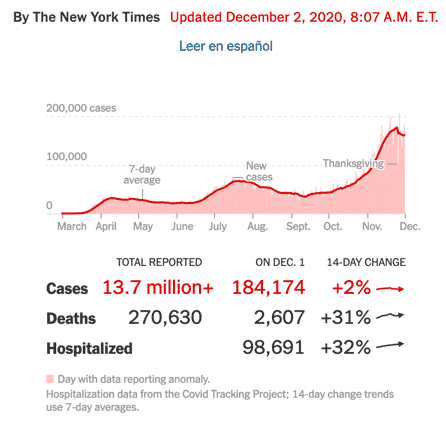

In the week before Thanksgiving, we saw 2,200 deaths due to coronavirus on three separate occasions. But then, as always happens during weekends, the death toll – and the case count – tailed off as reporting and testing dip during weekends. This occurred for four or five days through the reporting yesterday. Only today’s report from yesterday shows weekday-like numbers. And those numbers are big; at 2607 deaths, we are within striking distance of the all-time one day peak toll of 2752 from April 15. We are also approaching 100,000 hospitalized with coronavirus.

Now, the death toll is artificially high relative to pre-Thanksgiving numbers due to the long weekend. So I don’t expect those numbers to stay that high, though they will eventually go back to those levels. But the hospitalization numbers are what we need to look at because that’s where the rubber hits the road on overload.

The maths

From what I can ascertain, what happens is that a number of people contract the virus. And within days a segment of that group are sick enough to require hospitalization. And then, on average, within three weeks or so of contracting the disease 1.5 – 1.9% of those people die.

If the confirmed contractions stay as high as they were on Tuesday, that would mean 2762 deaths in three weeks, a record high. And the hospitalization number will be nearer to 110,000 by that time. That’s more than double a month ago when 46,738 COVID-19 patients were reported in hospital on October 30.

That’s a level that will mean the capacity of many healthcare systems – from frontline workers to beds – will be maxed out. And that will mean a rising death rate, consumer fright and government shutdowns. Think of overload as a step change on all three fronts – the ability to maintain patient health, the loss of consumer demand and the need to roll back economic activity.

So, when I asked “How severe an economic brake will have to occur to get the virus under control?” the answer is quite severe. We are going to see step changes that will put a halt on lots of economic activity all around the country. And that’s going to mean that GDP will likely contract.

Business implications

We know which companies will suffer the most: small businesses, leveraged businesses and enterprises leveraged to leisure, travel and retail. Many of these businesses were just hanging on due to pandemic assistance early on and the re-opening in the summer. Another shutdown, whether national or sporadic in nature is going to be a huge blow.

There are four sources of pain here. First, there is the consumer pullback. Retail will feel this because, at the margin, consumers will echo this shopper in Atlanta, interviewed by the Washington Post ahead of a lacklustre Black Friday: “I want to be conservative,” said Story, a 47-year-old Atlanta resident. “I’m not a scientist, but the best precaution is to stay in place.”

Then there are the government mandates. Here’s the Washington Post again:

After infections plummeted in early June, restaurants welcomed diners back inside. Movie theaters, fitness centers and bowling alleys reopened their doors. And the barriers came down on the bike pathway along the city’s cherished lakefront.

But with new coronavirus cases surging beyond the springtime peak, Chicago is now hunkering down. Statewide measures have closed some businesses and limited the capacity at others, while officials are urging residents to stay home. Again.

This is a loss on top of the natural pullback from consumers.

Third, there are job losses. I have talked to you about the increase in jobless claims. That makes tomorrow’s claims number and Friday’s jobs number important. Pantheon’s Ian Shepherdson says:

We find ourselves out on a very long limb .. with our forecast of a 250K drop in the ADP measure of private sector employment. … Our estimate is based largely on the Homebase small business employment data, which weakened sharply between the October and November payroll survey weeks …

Be prepared for an ugly initial claims number tomorrow and an ugly jobs number on Friday. Even if they are benign, we still have reason to worry going forward given the first two sources of pain.

Pre-inaugural fiscal relief unlikely

And finally, there’s government aid. I have repeated the post title because it goes to the politics right now.

As a reminder, if Congress doesn’t act, 12 million Americans could lose unemployment aid after Christmas. And there are also foreclosure and eviction moratoria that will expire. Collectively, these three fiscal cliffs will act as a negative income shock to the economy. And remember, this problem is also still operative: White House chief of staff ‘can’t guarantee’ the U.S. government will avert a December shutdown.

What I’m hearing is that the Republicans and Democrats are very far apart on fiscal relief options. Don’t be fooled by a bipartisan $908 billion relief package touted by the likes of Joe Manchin of West Virginia and Susan Collins of Maine. What I’m hearing says there is still a chasm between what Democrats want on this issue and what Republicans want.

And that’s not even considering what Donald Trump will sign. Senate Majority Leader Mitch McConnell of Kentucky has intimated that President Trump will not sign a large fiscal package. The best we can hope for in my view is a package McConnell has been discussing with Trump administration officials and Republican minority leader Kevin McCarthy of California. And then, we have to believe Nancy Pelosi and the House Democrats will change tack and sign up for that slimmed down package.

But remember, we have four separate cliffs to deal with: spending legislation to fund government, re-upping of pandemic assistance, expiry of the eviction moratorium, and the end of mortgage forbearance. Even if Congress and the President agree on a package, there is no guarantee all four issues will be resolved. In fact, it’s unlikely they will. I would go as far as predicting that, at most, only one of the four can be resolved.

The Vaccine

So, that’s what we’re dealing with as we await the approval and administering of multiple effective vaccines. This morning, the UK is the first Western country to approve a vaccine, authorizing the one from Pfizer and BioNtech. The first vaccine shot is just days away then. It’s only a matter of time before all other countries follow. So, relief is just around the corner.

The question is this: how much permanent damage will be done to the US economy before we get to the other side of this viral wave? As Neil Irwin put it yesterday:

The challenge is to keep everything going long enough to prevent irreparable damage to the ecosystem on which a huge share of American economic activity is built — office buildings filled with workers, hotels and airplanes that are full, vibrant street retail, and the public services that maintain it all — when so many individual elements of the ecosystem are under severe strain.

My view: a double dip recession is my base case now. Some companies will hit the wall and many people will lose their jobs due to the pandemic and lack of fiscal relief, doing permanent damage to the economy.

But the time for that damage to accrue may be limited. All indications are that the Biden Administration is ready to turn on the fiscal taps in a major way. Depending on the outcome of the Georgia Senate elections and the stance of Republican Senators, we could have a major change in fiscal policy coming in less than two months.

For now, that’s the state of affairs in the US economy. Let’s see what the jobs numbers on Thursday and Friday look like.

Comments are closed.