Fed asset purchases and Hyman Minsky’s two price system

Earlier this morning I tweeted an old blog post I wrote two years ago because I think it’s relevant to what’s happening in the economy right now. And so, I want to use this post to explain what that old post was about, and how that old post relates to today.

Before I get into the meat of this, though, let me point out that this newsletter is hosted at the URL http://www.creditwritedowns.com. And you can log in there to see content. My legacy blog is at creditwritedowns.com. It has all the old blog posts back to 2008 as well as an archive of the newsletter posts too. But the subscriber posts are not accessible. Everything you need is on the Pro site, which is hosted by Substack. I know this is a bit confusing, but it’s an outgrowth of my having switched from WordPress to Substack a couple of years ago.

Now, back to Minsky.

The Two Price-System

Here’s the tweet I am referring to.

Hyman Minsky and asset price inflation versus consumer price inflation – this explains a lot about what’s happening now with Fed asset purchases https://t.co/1wratk0nDw

— Edward Harrison (@edwardnh) June 18, 2020

I have pinned it to the top of my profile because I think it’s important. Here are some key bits from what I wrote back then about Minsky’s model:

…you don’t get a natural rate of interest when you use Minsky’s model. There is no general equilibrium because you have two completely different price systems. You have the cost plus markup system of output financed out of retained earnings for current output. And you have a totally separate system for investment that is inherently more speculative and uncertain.

In the one system, you need the economy to operate flat-out to drive inflation higher. When at full employment, demand exceeds supply. And so price rises until demand and supply balance.

But that’s not what drives inflation in the other system – the system that creates financial crises and potentially debt-deflation. In that system, inflation is endemic, meaning asset price inflation rises as the cycle lengthens and financing risk-taking increases.

What if the economy isn’t at full employment?

Using the Minsky model, it’s wholly possible that asset price inflation is through the roof even while consumer price inflation barely budges. For example, say you have a credit crisis that throws people out of work and causes mass unemployment. In that case, it would take many years to get back to full employment. You won’t see inflation rising robustly. Yet, during that period, the central bank could set interest rates at a level that encourages an increase in speculative and then, eventually, Ponzi financing. That’s a recipe for asset price inflation without consumer price inflation.

QE and asset price inflation

I believe this is where we are right now. The key difference between what I wrote in 2018 and what’s happening now is that it’s not necessarily low interest rates driving the speculative and Ponzi financing. It’s asset purchases aka quantitative easing that’s driving asset prices higher. Here’s how.

Monetary policy works mainly through interest rate channels and by shoring up liquidity in the financial system. So, its transmission is mostly financial in nature as the central bank alters its policy rate or buys and sells assets. And so, monetary policy only an indirect impact on output and income via the financial system.

The yield of Treasury bonds, as risk free assets, are mainly determined by expected future policy plus a term premium based on preferences of long- or short-dated assets. So, when the Federal Reserve buys Treasury bonds, it is engaged in a market where it has the most direct control because it sets the overnight rate of money. It’s buying an asset over which its activities have an influence. It’s intervention is therefore reflexive in nature.

So, even though the Fed must provide a bid that is above the last market quote to purchase the asset, its intention to buy of the asset itself moves the price before the transaction. For example, optimism about the economy because of quantitative easing caused Treasury rates to rise and prices to fall in the last decade because of quantitative easing, even though the Fed’s purchases were ostensibly geared at lowering rates.

There’s less reflexivity with other non risk-free assets that the Fed buys. First, the Fed also has to buy at a bid above the last market quote for the asset. That puts direct upward pressure on the assets in that particular market. Even though the aim might be to provide liquidity, you could also think of the Fed bid as a subsidy for the financial players in that market.

Moreover, the fact that Fed is buying financial assets at all creates optimism about the economy, which works to raise earnings expectations and asset prices more generally. So, the Fed’s buying feeds through into asset prices in a positive way.

My View

None of this means the economy is operating at full capacity. And so, none of this means there are consumer price pressures.

Right now, you have a situation where the economy was severely depressed but the Fed came in with such force that it created optimism about a V-shaped recovery. That put a floor under asset prices generally. And with the Fed now buying investment-grade bonds it will provide a meaningful extra bid for those specific assets.

But remember, just because people are optimistic that we will get a V-shaped recovery doesn’t mean we will have one. The Fed has moved expectations and that’s altered asset prices. And while this asset price inflation can trickle down into the real economy as financial conditions ease, there’s no guarantee the trickle down effect will be enough.

For example, during the last decade, every time the Fed stopped QE, Treasury bond yield actually declined. Why? Because economic expectations receded. And the Fed was forced to intervene again, boosting asset prices. Eventually the real economy swung into gear and the Fed could stop and even reverse QE. But, by that time, asset prices had already raced well ahead of the real economy.

What’s happening now with the extreme speculation in bankrupt and penny stocks and with equity markets more broadly is of a similar vein. The incongruity between on the one hand having double digit unemployment and over 40 million initial unemployment insurance applications in the last three months and on the other hand seeing the Nasdaq and Investment Grade bond ETF hit all-time highs – is mind-boggling.

I was going to say that, at least the massive gains in shares last decade came after the recession ended. But then I realized that the recession is over now too. The market is reacting to that. But, has it overreacted? Can the Fed continue to buy assets long enough to paper over the cracks in the real economy? My instinct tells me know. But, you have to leave open that possibility. We simply don’t know, as uncomfortable as that might be – especially if you are opposed to the inequality that extreme asset price inflation creates.

I wish I had more answers since the hallmarks of a mania are all around us. But, I think it’s better to follow the data. And right now, the data are saying recovery. They are not saying double dip, though they eventually may.

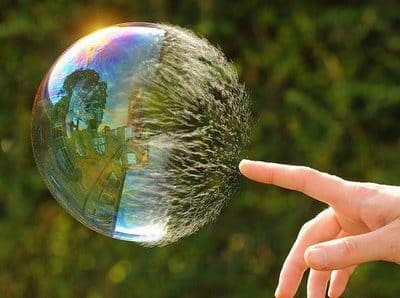

As for bubbles, they don’t pop, but instead rip and tear.

Comments are closed.