How transitory is transitory, housing edition?

In yesterday’s post, the question was this: how bad do inflationary impulses have to get – even if they’re just transitory – to matter? The Fed is telling you they have to get pretty bad for it to react. And with US Treasury bond yields sat at 1.58%, the Treasury market is telling you the same thing.

What’s the housing market saying though? Bill McBride has the answer here:

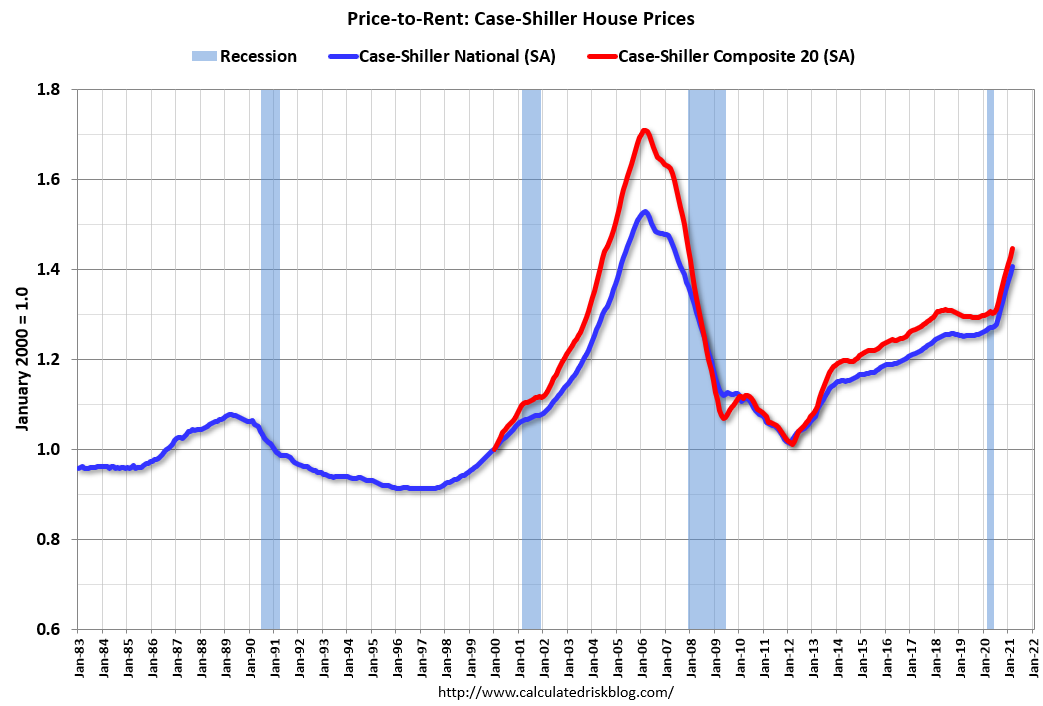

On a price-to-rent basis, the Case-Shiller National index is back to March 2005 levels, and the Composite 20 index is back to August 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to late 2004, early 2005.

This is what that looks like in chart form.

Source: Calculated Risk

Just because inflation is transitory, doesn’t mean it’s not meaningful. Short-term phenomena can have long-term impacts.

Comments are closed.