The retail sales data coming out this morning makes clear that the recession that began in February is now over. The forward-looking questions go to what the shape of the recovery looks like, what the policy response will be and how asset markets respond.

The data

I don’t think it’s obvious that the recession is over given the number of jobless claims we are still seeing. But, we do know that unemployment tends to continue rising even after an economic cycle has hit its trough. The continued high initial claims data are lagging indicators then.

On the other hand, the retail sales number today was massive, and is just the latest in a parade of data showing that May was vastly superior to April economically, with retail sales spiking 17.7%. You don’t get that kind of jump during a recession.

Year-on-year the numbers were down 6%. And they were down 8% from the February peak. So I saw a lot of comments to the effect: “This spike is meaningless because the economy was shut down in April”. So what? Dating a recession is not about the economic output levels, it’s about the rate of change. Output at the end date of a recession is by definition lower than when it began. After all, a recession is supposed to be a period of economic contraction.

For example, the Great Depression was a double dip with a cycle low at March 1933 that was much lower than the previous cycle peak in August 1929. Estimates are that GDP fell 15% in that time frame. Recession returned in 1937 and lasted until only 1938. But the economic performance during the entire decade of the 1930s was so horrific, it is considered one long Depression.

Now what?

Dating the recession is mostly just a statistical exercise. The real questions concern future growth. And that’s much more uncertain. Here are five factors playing a principal role:

- Post-lockdown consumption habits

- Post-lockdown employment trends

- Post-lockdown fiscal policy responses

- Post-lockdown monetary policy responses

- Post-lockdown social distancing and viral contagion

Let’s take them one at a time.

Consumption and employment

We have seen the consumption rebound tremendously in May, more than double the 8.0% bounce expected. That should make us optimistic about the potential for a V-shaped recovery. But, I would contend that this is just an initial bounce, and, that it, therefore, includes some pent-up demand.

True post-lockdown consumption patterns are likely to be different. And I strongly suspect consumption will be lower and savings greater as people consume less on events, airplane travel and restaurants and increase precautionary savings.

I could be wrong about the increased savings, but I doubt I am wrong about consumption patterns being altered. People will choose to maintain some measure of social distance for a long time to come. And so, that simply means some industries will be winners and others losers. This change alone will introduce economic friction. So, we’re not getting back to 4% unemployment anytime soon. For example, Atlanta Fed President Raphael Bostic says he expects unemployment in the US will be around 10% in the fourth quarter.

And since the difference between 4% and 10% unemployment is very large in terms of overall consumption levels, the US economy won’t be firing on all cylinders even in best case scenarios. If we lose some employment, but also lose some consumption from those who are still employed, we will have further negative knock-on effects for incomes and employment. I think 10% is an optimistic number for the year-end unemployment level. Let’s see how this unfolds.

Policy responses

Given the downside risk, you’re going to need to maintain accommodative policy if you want to prevent a second recession. For example, the Paycheck Protection Program, enhanced unemployment benefits, and credit card and mortgage forbearance are all time-limited programs. The thinking in the Trump Administration now is that the economy will soon be in a place where all of this stimulus isn’t necessary. But how soon will it be there? We don’t know.

Larry Kudlow is now calling the $600 enhanced unemployment checks a ‘disincentive’ to work. He told CNN, “I mean, we’re paying people not to work. It’s better than their salaries would get.” So, he expects them to stop in July. But, the risk is that this will come too soon – and that the end of the PPP and mortgage and credit card forbearance come to soon too.

Since we don’t know when the economy will be in the right place to handle a big reduction in stimulus, we can’t know what the consequences of withdrawing that stimulus will be. At a minimum, though, we can say the withdrawal presents downside risks, even the risk of a second recession.

The same is true about the Fed’s accommodation, of course. But, I think monetary accommodation is less helpful to the broader economy. In fact, one could argue that the Fed’s buying corporate bonds – as it announced yesterday it plans to do – is a net negative, because it pushes up asset prices artificially.

The Fed initially said it was buying bonds to maintain the smooth functioning of monetary policy and prevent liquidity from drying up. But, there’s no problem with liquidity in bond markets. We have had $1.6 trillion in corporate debt issuance in the US already this year. Global corporate bond issuance is almost $6.4 trillion — that’s 71% of 2019’s total already.

So, somewhere the Fed’s mandate has morphed from providing liquidity to stuffed-up bond markets to maintaining easy financial conditions. And that benefits no one except Wall Street. In a world in which unemployment is high and the corporate bond ETF LQD is at a record high, the incongruity between Main Street and Wall Street is risible.

The virus

If that’s not enough uncertainty for you, there’s always the situation surrounding the virus. For example, a recent study claims to show that a mutated coronavirus strain is much more transmittable than other types.

A marginal genetic mutation in the coronavirus that causes COVID-19 significantly increases the ability of the virus to infect cells, according to lab experiments carried out by Scripps Research.

Coronaviruses take their name from spikes on the surface of the virus, giving them a crown-like appearance and allowing them to bind to and infect host cells. The mutation found by Scripps significantly increases the number of spikes, making it far easier for the virus to attach to cells.

“Viruses with this mutation were much more infectious than those without the mutation in the cell culture system we used,” explained Scripps Research virologist Hyeryun Choe, PhD, senior author of the study. “The number – or density – of functional spikes on the virus is four or five times greater due to this mutation.”

In a report posted to the pre-publication site bioRxiv, Choe and her fellow authors state that the mutation, labelled D614G, is the reason why some regions such as New York and Italy have seen a rapid outbreak of the disease, overwhelming local health systems, while other areas such as California experienced a more manageable spread rate. The report is currently being peer reviewed.

What will this mean regarding infection rates and deaths? It’s unclear.

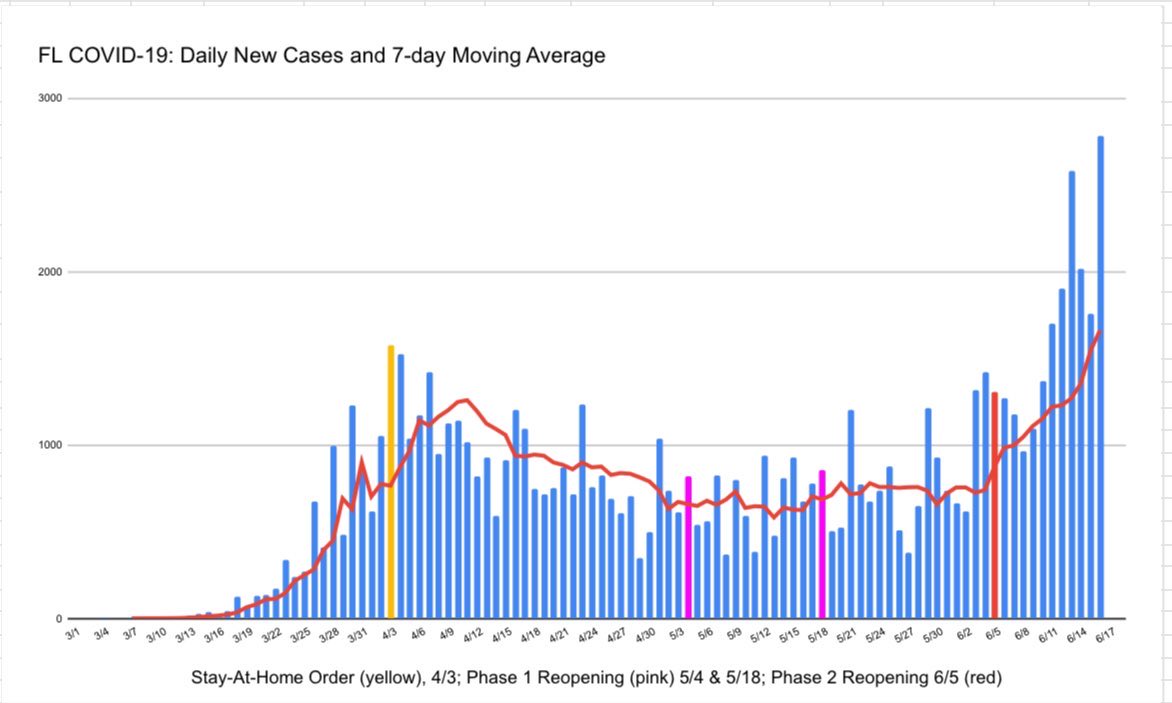

Equally unclear is what the surge in coronavirus positive tests and hospitalizations in the US will mean. For example, how much of the spike pictured below in Florida Covid-19 cases are attributable to increased testing?

How much of this is due to poor post-lockdown social distancing habits? We don’t know. And we don’t know whether worrying surges in hospitalization rates in places like Texas will result in more deaths. It is still too early to know. But we have to be worried.

What is clear is that Americans fear a second wave of novel coronavirus infections. And if a large second wave does come to pass, it will have negative economic and health consequences, just as those warning about premature re-opening predicted.

My view

I would reiterate my longstanding position that economic risks are skewed to the downside. I recognize that the re-opening numbers have been good, better than expected. But I told you in late April already that re-opening was bullish. I am looking forward to September and October now. And all I see is downside risk for the economy and for markets.

The re-opening rally pullback seems to be over now. The market is back in bullish mode today. But that only makes me more concerned about the ferocity of another leg down if the data disappoint going forward. I think there is simply too much optimism about the medium-term economic outlook relative to the probabilities of outcomes. And the higher asset prices go, the greater I believe the disappointment will be.

Short-term, we are back in a growth over value, oil bullish, dollar bearish world. Medium-term, I expect that to flip almost 180 degrees until we see another wave of policy stimulus. Longer-term, it will depend on how early and effective that stimulus is. For those of you looking at a great macro take on the longer-term dollar-bearish thesis watch Julian Brigden’s interview on Real Vision. He spells it out better than I can.

Comments are closed.