Musings on initial claims, the US economy and Tesla as year end draws near

For the second week in a row the raw jobless claims data have fallen, as has the uptick in the rate of increase in Covid-19 infections and death. Meanwhile, some 2.4 million people have been vaccinated worldwide, a Brexit negotiation seems to be nearing an end and the US government is likely to pass a massive stimulus for the US economy close to $1 trillion.

All of this is good news and is buoying the mood in equity markets and for risk assets as a whole. To give you a sense of how buoyant the mood is for risk assets, note that in late November Peru issued $4 billion worth of debt, including a century bond. And get this, the 100-year debenture, which expires in 2121, was priced with a yield to maturity of 3.23%. Now, that’s bullish.

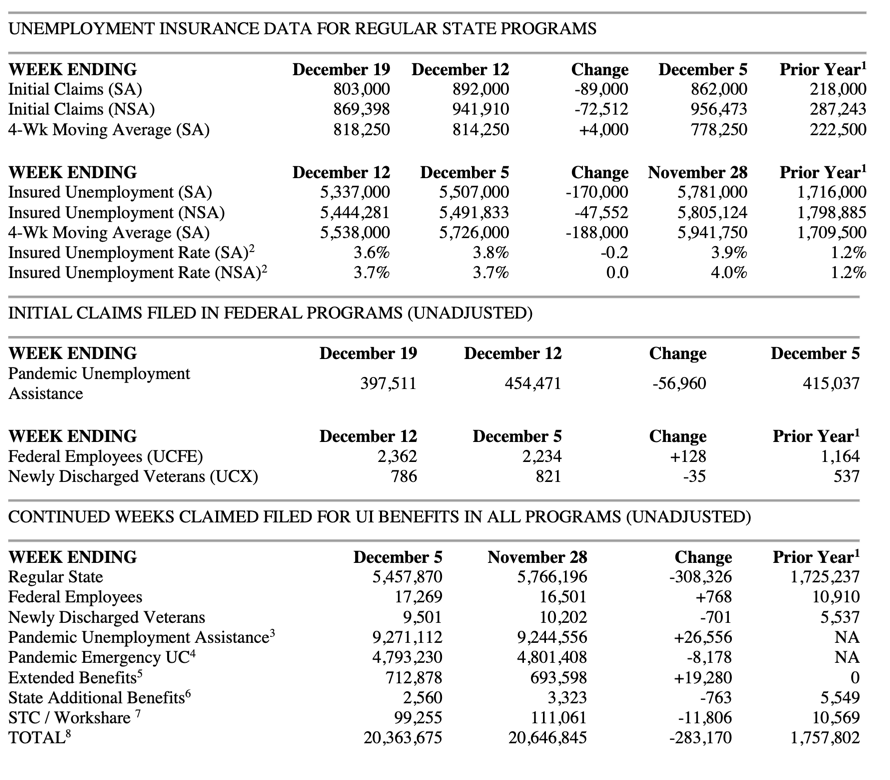

Initial claims

Narrowly speaking, the focus of this piece are the US jobless claims data that came out this morning. And while the numbers were high, they were moving in the right direction.

I am going to focus on the raw numbers for now because the holiday season is a period of heavy seasonal adjustment. And I am looking to see what the impact of shutdowns and economic rollbacks has been on unemployment. So, in that context, the 869,398 number for the week ended Dec 19 is a good figure. It’s down from 941,910 the week prior and 956,473 the week before that.

If you recall, I had said two weeks ago, when we saw about 950,000 initial claims, that we “could see a non seasonally-adjusted count over a million before year end.” And since then the numbers have receded. We’re not out of the woods yet – especially since we are likely to see a spike in Covid-19 cases in January, and because the hospital systems are increasingly overloaded, which is what precipitates shutdowns. Directionally though, these figures show some mild relief.

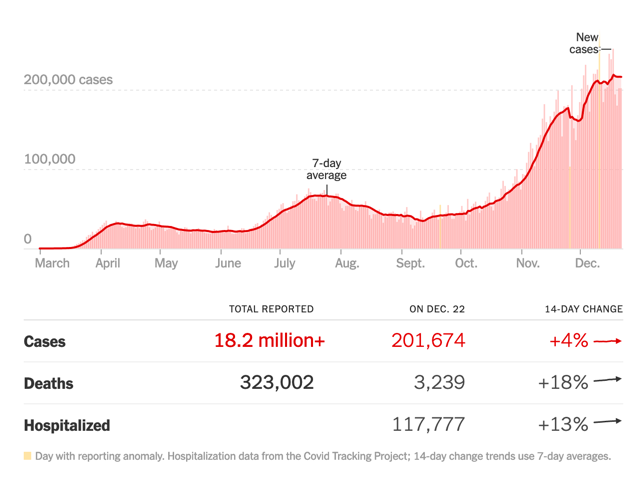

The coronavirus and recession

Again, driving the unemployment is the virus, particularly the November surge. That surge has calmed somewhat. But we remain at a critically high level in terms of cases, hospitalizations and deaths, with averages of all three still increasing, though at a slower rate.

Source: NY Times

It will be a few weeks before we can discern whether the slowing in the rate of increase continues. But hospitalizations are already so large that healthcare system overload has been reached and we are likely to see shutdowns maintain themselves or increase.

I will continue to maintain that this will lead to a global recession in large part because of Europe. There, the German and UK economic situations have worsened considerably as stiff lockdowns over the important holiday season are going to really sap the European economy of spending.

The (speculative) case for recession in the US remains my base case. And we will see whether this holds based on macro data from December and real-time data that start coming out in January. I would say the data have been better than I expected. And so, the situation is moving away from my base case, but not far enough away for me to change my outlook. I am also relatively optimistic about the fiscal response in the US in providing a safety net, at least for the next month or two.

My view

So, as we head into year-end, I have high hopes for the US recovery sustaining itself. And I am also hopeful that the vaccine rollout will make the economic pain in Europe more short-lived. But, the virus’ genetic mutation in the UK and South Africa points to known unknowns that add to residual risk.

Let me use this last space to update a narrative I was last writing about in September and October, the time that I said in the summer could be a period of pronounced market volatility.

First, how I put it in June, regarding where we were:

we are still in the uncertain phase where there are a wide dispersion of potential economic and market outcomes. But there is a phase shift that is upon us. And it has to do with the data flow.

As the re-opening now unfolds, the dispersion of outcomes will narrow with either a bullish or bearish skew. And when that narrowing takes form, only then do I think we could see a fundamental move.

I expected any downside risk for markets to play out by September or October. And though we had two corrections in that time, by mid-October I was mostly convinced we could signal all clear – as far as market outcomes were concerned.

That moved the timeframe for understanding the economy forward with these mid-October considerations:

- In Summer, we went to a steady state from the initial V-shaped basing on the re-opening. That’s a decent-sized gap up in GDP based on closing the output gap. This is the so-called reverse radical recovery.

- The slope of the GDP growth line is directly related to the ability of policymakers to prevent liquidity problems from become solvency problems and destroying jobs before we can fully adjust to the pandemic new normal or get a ‘medical bailout’ via a vaccine.

- Right now, we are in a period where the new normal has become onerous enough that many have flouted the rules and Covid-19 positive cases have skyrocketed. The result is two-fold. One, consumer behavior becomes more cautious. Two, government policy adjusts by both tightening social distancing protocols and creating safety nets for those affected by policy changes.

- Going forward the questions, therefore, are threefold. One, how pronounced did the spike in cases and deaths become before protocols tightened. Two, how much does consumer behavior and government policy change in response to the spikes. And three, how effective are the protocols and safety net provisions in mitigating worst-case public health and economic outcomes.

I think we have the answer to question one now. And we have pretty good answers to question two. It’s question three where the rubber hits the road in terms of outcomes though. And I think January is when this will come together. In January, we will have most all of the data on the holiday season spike in coronavirus and the economic impact.

From a market perspective, though, once the September and October jitters were over and the election was passed, it was the vaccine announcements which supported a fully risk-on move. And it may be the case that even a double-dip won’t derail that move given the prospect of post-vaccine new normal sometime later in 2021.

At the same time, the euphoric nature of equity markets is beginning to feel a lot more like the mania in the late 1990s for me than at any time since the late 1990s. And that’s troubling. At a macro level, my view is that bubbles always end badly, with latecomers, novices, and retail investors hurt most. But, when and how exactly that plays out is unclear.

One story in my head is Amazon. At one point, Amazon lost more than 90% of its value. But long-term investors still got rich. That’s the macro view today. But two things trouble me about that narrative. The first is that Amazon lost more than 90% of its value. That’s huge. And I doubt most people would hang on through a downdraft of that size.

The second thing is the fact that Amazon was pretty close to going under if you believe this 2017 lookback from Vox – which I do. They conclude:

If Bezos and his team had waited a few weeks longer to raise those extra funds, people today would lump Amazon in with other dot-com-era failures like Webvan, Kozmo, and Pets.com — big-spending companies with unworkable business models that collapsed under their own weight.

Elon Musk’s tweet about approaching Apple had me thinking about Tesla as Amazon again -as I did in 2018. He says:

During the darkest days of the Model 3 program, I reached out to Tim Cook to discuss the possibility of Apple acquiring Tesla (for 1/10 of our current value). He refused to take the meeting.

— Elon Musk (@elonmusk) December 22, 2020

I think we are closer to the end of the mania than the beginning now. And, for Tesla, it was already apparent in 2018 in my view. As I said then:

There’s no denying we’re in the midst of another technology bubble. Tesla has benefitted greatly because of it too. Eventually this bubble will pop. In a best case scenario, Tesla goes down with the rest of the technology sector but rises from the ashes due to its operational execution — just like Amazon did. In a worst case scenario, Tesla fails to execute and the Audis and BMWs of the world catch up before Tesla is cash flow positive. That’s a case in which Tesla shares go to zero as Tesla defaults on its bonds. Liquidation is the worst case for Tesla in that scenario. Either scenario is plausible at this point. Tesla shares are essentially a lottery ticket. Caveat Emptor.

It’s less about Tesla’s being a lottery ticket now and more how well it survives. Is it Yahoo! or is it Amazon? For a lot of other high flyers though, think Webvan, Kozmo, and Pets.com.

Comments are closed.