In today’s piece, I want to focus only on what’s been happening rather than making any conjectures about what’s likely to happen. Sometimes, it pays just to take stock of where we are because that can help discern where we’re headed.

So, let’s start with the virus since that’s what is most on people’s minds in terms of driving adverse outcomes.

Surges and lockdowns I have noted

I won’t talk comprehensively here. Instead I want to note where I have seen surges, particularly where they weren’t evident in the past. According to Reuters data, there are 36 countries at or near peak infection levels. This includes the US, Canada and Mexico in North America. In Western Europe, it includes Denmark, Sweden and Germany. And in Europe, it includes South Korea and Japan.

I mention the specific countries outside North America because, apart from Sweden, all were able to have low first wave infection rates. And so, it shows that mitigation during the first wave does not guarantee successful mitigation over time. And across Europe, there have been economic lockdowns to control viral contagion. More can be expected, with Switzerland, for example, considering a shutdown. Sweden is of note because a large first and second wave there tells you their approach has not been successful in mitigating transmission. The King of Sweden says the Covid-19 strategy there has failed.

Within the US, the surge in the Midwest is past peak, with California now the epicenter of the crisis. California has seen some of the strictest lockdowns in the US. There, almost 400 deaths and over 60,000 cases were reported on December 16 alone. As a basis of comparison, the largest infection counts by country are the US, averaging 220,000 over the last seven days, followed by Brazil at over 44,000 and Turkey just below 30,000, The largest death tolls are in the US at over 2500 per day followed by Brazil, Italy, Mexico and Russia, where more than 500 people have died due to Covid-19 on average each day during the last seven. So, the epidemic in California is huge.

All of this is having a huge impact on the economy via (lack of) employment, (reduced) consumption patterns, and (reduced) business opening hours.

The US Economy

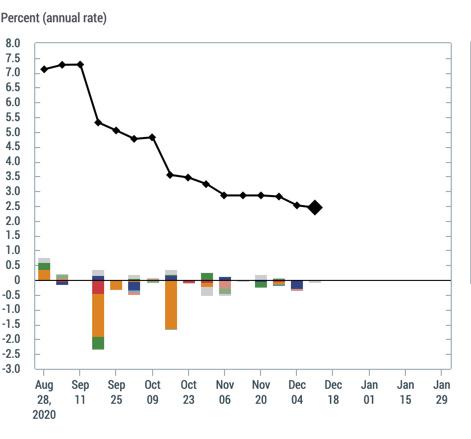

We should remember that the Atlanta Fed GDPNow tracker is still at 11.0% based on data through much of November. That’s much higher than blue chip consensus estimates for Q4 2020 GDP growth of about 4%.

The GDPNow data are highly anomalous though because the NY Fed is nowcasting at 2.45%, with the forecast steadily falling with incoming data.

And this trajectory is more in line with what economists are expecting and what I anticipate. At present, the NY Fed is also forecasting 5.9% GDP growth for Q1 2021.

To get to a recession from these levels, you would have to see a major downshift in the economy. And since I’ve said that’s my base case, the question is where that downshift would come. I see four primary sources:

- Reduced US federal government transfers, something Congress is on the verge of mitigating

- Reduced consumption due to lockdowns and restricted business closures

- Reduced consumption due to employment income loss; and

- Reduced state and local spending and employment due to budgetary constraints and a lack of transfers from the federal level

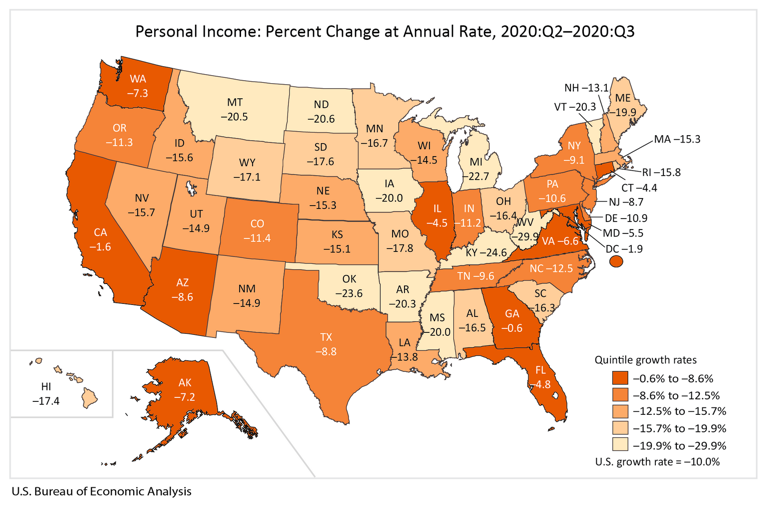

At present, we are seeing losses on all four fronts, which is why the NY Fed’s nowcasts are falling. For example, yesterday, the Bureau of Economic Analysis announced that personal income fell in every single US state during Q3 2020.

State personal income decreased 10.0 percent at an annual rate in the third quarter of 2020, after increasing 35.8 percent in the second quarter. Personal income decreased in every state and the District of Columbia, ranging from –29.9 percent in West Virginia to –0.6 percent in Georgia.”

This trend has continued through the fourth quarter and won’t be arrested until Congress passes a stimulus bill to avoid a US government shutdown that begins tonight at midnight. As that bill is unlikely to carry fiscal transfers to states, we are likely to continue to see reductions in consumption from the other three sources enumerated above.

US Employment

For most Americans, employment is the main source of income. So when there are large changes in employment, employment numbers are key in understanding what drives consumption. We’re in such a period now.

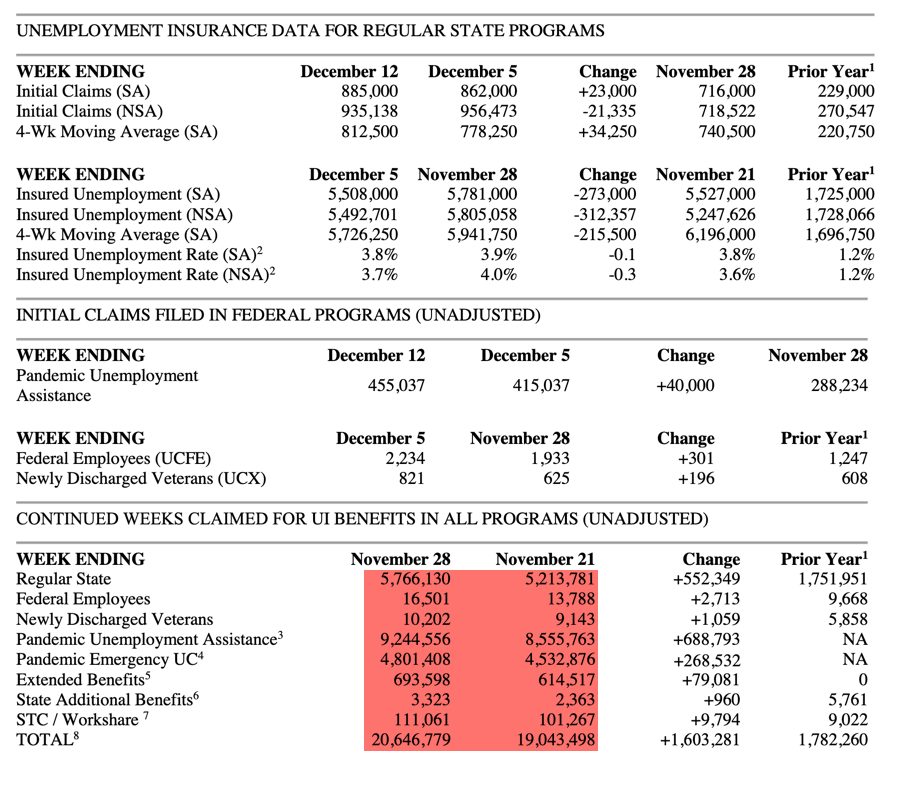

Unadjusted initial jobless claims have been above 900,000 for two consecutive weeks now. They had dipped as low as 725,000 in the week ending November 7. If we look at the seasonally-adjusted numbers, we are running at 812,500 on average over the last four weeks. That’s up from 743,500 in the week ended November 14.

Normally, I would say a rise of 50,000 weekly initial unemployment insurance claims on a sustained basis would be enough to trigger a consumption pullback that would trigger recession. But, there are so many cross currents occurring with fiscal transfers and mandated business curbs, it’s hard to use that rule of thumb. I’ve said 1 million claims on a consistent basis is the point where I would say my recessionary base case becomes baked in.

So, we’re still almost 200,000 lower than that, if we use the 4-week average seasonally adjusted figure of 812,500. I’ll refrain from looking forward too much here but I think the figure is going higher.

I should also note that those receiving unemployment benefits is now going up both in the traditional and in the Pandemic Unemployment Assistance buckets. See the areas highlighted in red.

Don’t be surprised if we see job losses in future US jobs reports in the new year.

Equity Markets

Against this backdrop, all three major US equity indices hit record highs yesterday. The main narrative supporting the disconnect is that the market is ‘looking through’ the poor near-term data and to the post vaccine period when pent-up demand will buoy consumption and employment. And so, think of it as an intertemporal shift with a lot of the lost revenue of today simply shifted back to 2021 and 2022.

I am deeply sceptical of this narrative though. There are lots of narratives being spun about why stocks do this or that. For example, in the lead up to the US elections in November, there was a lot of angst about electoral chaos, with people predicting Trump wouldn’t concede the election and that there would be violence on the streets. That’s exactly what’s happened. Most recently, for example, the Proud Boys came to here to DC this past weekend, resulting in altercations, stabbings, arrests. Yet, November was one of the best months in stock market history and we are at all time highs.

So, my conclusion is that you have to be very careful about accepting these narratives for why markets are doing anything. The reality is that passive investment flows are going into equity markets irrespective of the economic backdrop. And that money has to be deployed or stuck in cash. No one is paying money managers to be in cash during a bull market. And so, that exerts upward pressure on indices. How long can this go on? It’s been nine or ten months since we’ve officially been in a pandemic. And we are at levels higher now than we were a year ago. To me, that shows how hard it is to predict where markets will go over the short- or medium-term based on the economy.

Bonds

In the bond market, the dominant narrative is around the US Treasury market selling off, with the 10-year Treasury now trading at 0.92%. If the ‘looking through’ equity narrative is to be believed, it means higher bond yields. And so, while that may be good for those wanting to clip coupons at some point in the future, it’s not good for those invested in bonds at current levels. US Treasury yields have been in a broader uptrend since early August, rising from just above the 0.50% level to where they are today.

Elsewhere, bond yields have been sinking with yields at or near record lows and spreads to Treasuries re-approaching those levels right now. Going back to the ‘looking through’ narrative, this also rhymes with equity markets because an economic upcycle means less economic and financial distress. And that’s supportive of corporate bonds.

I am going to leave it there.

Currencies and Commodities

The big move in currencies is in the US dollar, particularly against the euro and the Chinese renminbi. The Euro is trading near multi-year highs at 1.2250. And the Yuan was at 6.53 per dollar last I checked. But, yesterday, the dollar fell against almost all major currencies, with the dollar index dropping to its lowest since April 2018. And I see local press reports in Sweden and Australia talking about how the dollar is at multi-year lows there as well.

For me, this is a crowded trade since everyone seems to be bearish on the US dollar right now. But it seems to be working.

Gold and Silver had taken a breather despite the selloff. But they are back on the uptrend. Whilst Bitcoin has been on a monster tear of late, up 26.5% in the last seven days alone. I mention these first since they are often seen as ‘money’ in opposition to the US dollar.

And commodities are also viewed similarly. When the dollar goes down, we should expect them to go up. And they are. Though crude has been going up the most recently along with soybeans. The uptrend in copper, natural gas has not kept pace.

My View

I am going to leave it there for where we are on the economic and market front. I would characterize the mood broadly as bullish on risk assets, dominated by the theme that we can look through the poor economic data of today because a vaccine for Covid-19 is already being administered.

And so, while the economic and news headlines are grim, markets are completely discounting them. I don’t know quite what to make of it, to be honest. There does seem to be a disconnect. But, that’s where we are. And I hope it was useful to you for me to lay it out as neutrally as I could do.

Comments are closed.