Although the title of this post focuses on Sweden, I intend it to mostly be a links post with various sub-themes. The idea is to share the news flow I am seeing across different countries.

Since this is the first links post in a while, there are a ton of links. I will try and divvy them up into buckets to make it easier to follow topic threads. Unfortunately, a lot of these sources are in foreign languages. But, I will also summarize. And then, you can use Google Translate if you find a source especially interesting.

The economy

Focussing on the economy in Europe first, it has to be noted that Sweden came out with a better than expected fall in GDP of only 0.3% in Q1 versus Q4 2019. Here’s the link:

- Svensk BNP föll mindre än befarat – Svenska Dagbladet

With even the UK expected to see a fall in GDP of 7%, it shows you the Swedish approach is working for its economy. Despite the bankruptcies in the hotel and restaurant sector I highlighted yesterday, for me this highlights upside potential for economy’s post-lockdown.

The GDP performance may also eventually put Sweden’s approach to the pandemic in a positive light because of the psychological benefits of not fully locking down but simultaneously testing and quarantining assiduously. It looks to me like the lack of a strong lockdown may cause consumers to be less fearful. And that adds to GDP. Only time will tell. Just note that my initial view on Sweden was mostly negative regarding the potential for R0s to rise. But they allegedly have R0s under 1 now despite their relaxed approach.

Below are some other links on the economy.

- UK economy set to shrink 7% or more, April PMIs dive – IHS Markit – Reuters

- Spain coronavirus tally stabilises but economic cost high – Reuters

- El paro registrado sube en casi 300.000 personas en abril y llega a 3,9 millones – El País (Unemployment is rising starkly in Spain)

- Spain Throws Lifeline to Companies Battling to Survive Pandemic – Bloomberg (Spain is intervening like crazy into the economy to prevent bankruptcies. I have my qualms about what they’re doing though because they are likely to be helping to misallocate resources. We’ll see.

- Pandemic slams Asia’s factories, activity hits financial crisis lows – Reuters

- My urge to splurge is over and won’t be returning soon – Irish Times (This speaks to the likelihood that spending will not come back to previous levels. Good first-person opinion piece

- Bundesbank must stop buying government bonds if ECB can’t prove need – court – Reuters

- Argentina ready to consider ninth sovereign default, says Guzmán – FT

The US

- Almost 23 million US jobs wiped out in a single month – Irish Times (jobs report median estimate is for a loss of 21 million jobs. That’s ten times the previous record under demobilization after World War 2. Records date back to 1939.

- Trump vows to bring Ireland’s pharma production to US – Irish Times

- We Are Living in a Failed State – George Packer, The Arlantic (Article saying the US’s response to the pandemic has been poor and is evidence of its deterioration as a state. You may find the tone stark but it’s a must-read piece even so.)

- Models shift to predict dramatically more U.S. deaths as states relax social distancing – Politico (This article suggests that the US economy will see a serious uptick in coronavirus infections and deaths when social distancing is relaxed. Even President Trump’s favorite Covid-19 model is showing a surge in likely infections and deaths because the US may be opening up too early)

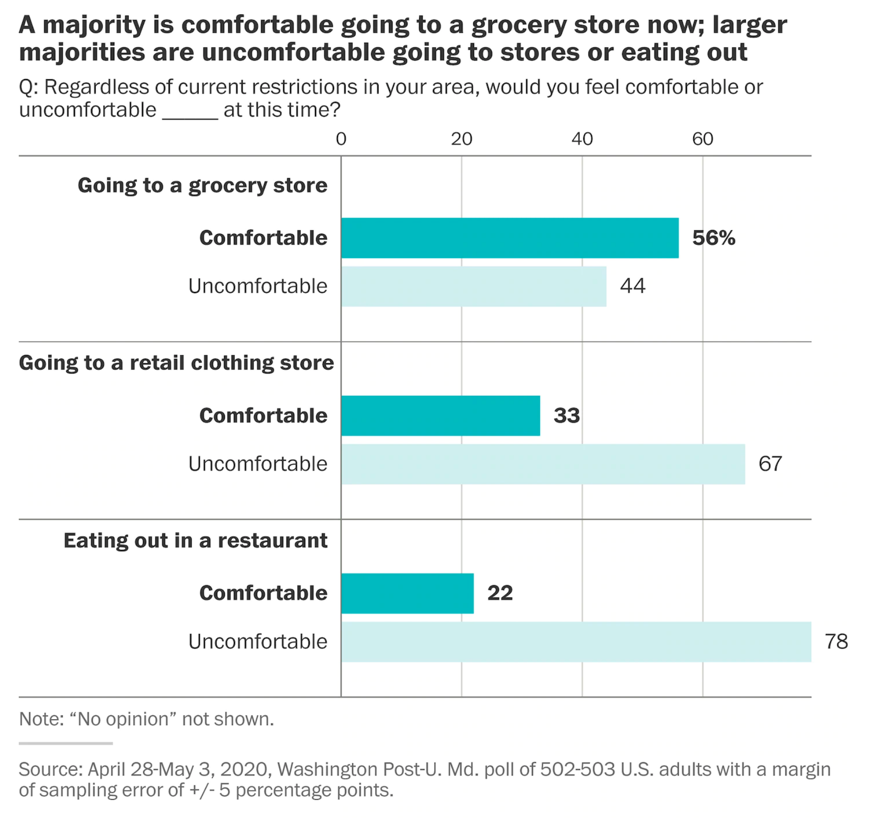

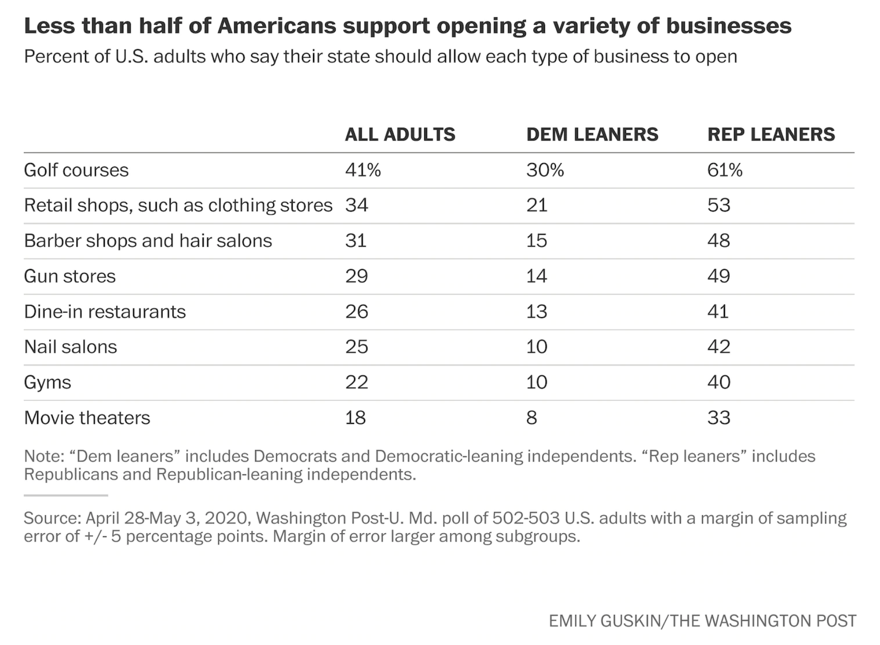

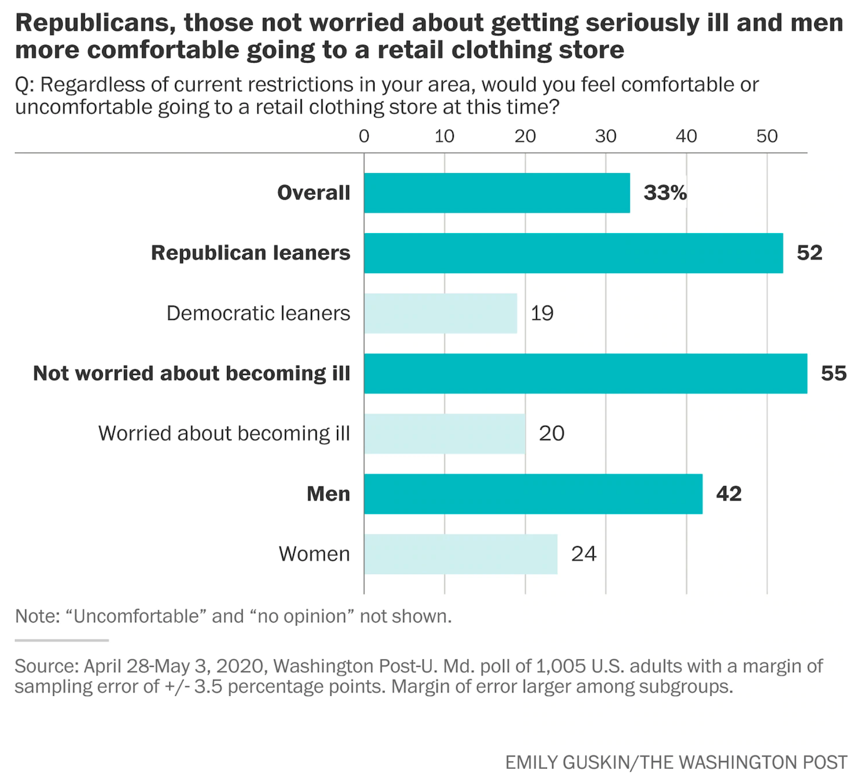

- Americans widely oppose reopening most businesses, despite easing of restrictions in some states, Post-U. Md. poll finds – Washington Post

That last article contains a lot of good information including several charts related to Americans’ mistrust of interacting with specific economic sectors of the economy. I believe it is further evidence that as the US does open, the spending lift will be incomplete because consumers will be fearful. Notice the polling partisanship though. I believe this will lead to R0s spiking more in red states going forward given the data in the article linked right above this one.

Economic sectors

The biggest takeaway here is that there will likely be bailouts. The airline industry was hit hard and first. We have already seen Norwegian Air get one. KLM and Air France are next and Lufthansa is in the works. That will make it easy for the US to start bailing out the airline sector too. or healthy companies like SOuthwest or Ryan Air, what will this mean? I don’t know but there will be a glut of capacity for years to come. Lufthansa’s chief says we won’t see a resumption of normalcy until 2023.

Also, if the airline industry gets a bailout, expect the hotel industry to get help too.

- UK new car sales fall to lowest level since 1946 – Reuters

- Volkswagen warns of rising costs as car market faces deep recession – FT

- Repsol bate previsiones en plena crisis del petróleo – Expansión (Interesting that Spanish oil giant Repsol has beat its earnings estimate amid a lot of bad news for the sector. One company to watch in the sector)

- Who pays the bill? The coming deluge of pandemic litigation – FT

- Ryanair passenger numbers sink by 99.6% in April – RTE

- Air Canada posts $1-billion loss as carrier faces ‘darkest period’ in commercial aviation history – Globe and Mail

- Lufthansa startet mit solider Bilanz ins Jahr – Doch ohne Hilfe wäre sie nun am Ende – Handelsblatt (Lufthansa had a solid balance sheet before the crisis. Now they are hemorrhaging cash. A bailout is coming)

China

The flow of anti-China news I am seeing has increased significantly since this crisis started. I think we are seeing a new Cold War beginning with China in the Russia role. And the negative sentiment from China is on multiple fronts across a wide swathe of countries. I see China’s influence in Africa as critical to understanding how it reacts to this turn. I will have much more to say on this front later. Here are some recent articles related to China.

- Trump administration pushing to rip supply chains from China – Globe and Mail

- Africa has a question for Beijing: will you forgive us our debt? – South China Morning Post

- China’s long-range Xian H-20 stealth bomber could make its debut this year – South China Morning Post

- Europe’s relationship with China is now one of mistrust and hostility – Irish Times

Coronavirus

- France’s early COVID-19 case may hold clues to pandemic’s start – Reuters

- Coronavirus: Bars, gyms, beauty parlours and other venues to reopen as Hong Kong eases Covid-19 shutdown – South China Morning Post

- Déconfinement : Paris va ajouter des voies cyclables et doubler les places en parking relais – Les Echos (This French article shows how the Mayor of France is preparing Paris for post-lockdown life by making park and ride free and encouraging bike usage)

- Corona macht Einbrechern weiter das Leben schwer – WDR (This is a German article on how break-ins are down 40% in North Rhine Westphalia, where my daughter is. When people are at hme all the time, it’s harder to break in. And coronavirus has made it harder to offload stolen goods)

- Heroïnegebruikers wenden zich vaker tot methadon – NRC Handelsblad (interesting Dutch piece showing thatcoronavirus is making it harder for heroin users to get their drug. SO they are switching to Methadon. See the article below from two weeks ago

- Special Report: Peruvian coca farmers to Paris pushers, coronavirus upends global narcotics trade – Reuters

- Las infecciones en sanitarios crecen un 40% en dos semanas y ya son la mayoría de los nuevos casos – El País (Terrible piece from Spain showing that workers responsible for sanitizing away coronavirus are getting the virus at an alarming rate. These people are frontline heroes who don’t get enough recognition.)

- Australia and New Zealand look to create ‘trans-Tasman travel bubble’ – FT

- With testing, Iceland claims major success against COVID-19 – AP

Technology, Privacy, and Surveillance

- Canadian senior executive quits Amazon over firing of employees seeking better working conditions – Globe and Mail

- France accuses Apple of refusing help with ‘StopCovid’ app – Reuters

Markets

- Hedge funds bet on gold as refuge from ‘unfettered’ currency printing – FT

- Ultra-Rich Families With Cash on Hand Pile Into Private Debt – Bloomberg

- Hedge Funds’ Best Ideas No Better Than the Rest of Their Ideas – Bloomberg

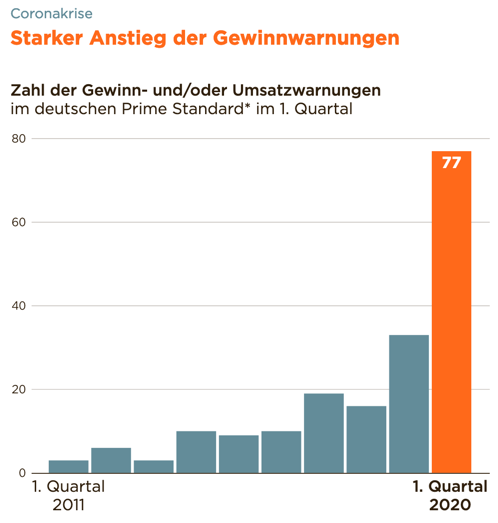

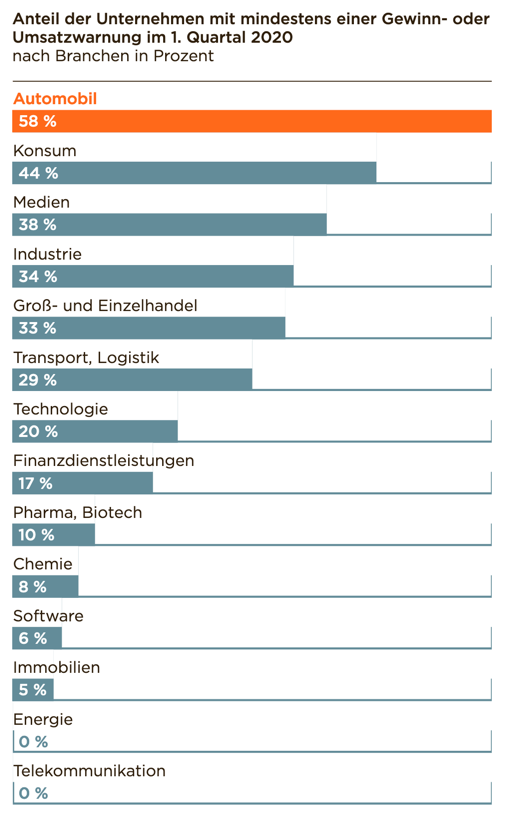

- Analysten kappen ihre Schätzungen für Dax-Konzerne so drastisch wie noch nie – Handelsblatt (German company analysts are downgrading earnings estimates like never before. This is across all industries. I think this is an important outcome for markets. And so, I have attached two charts to give you a sense of where the pain is greatest. The first chart shows 77% of companies warned, while the second shows you the auto sector hurting the most.

That was a ton of links. Sorry for the huge data dump. I hope it was helpful though. To be continued

Comments are closed.