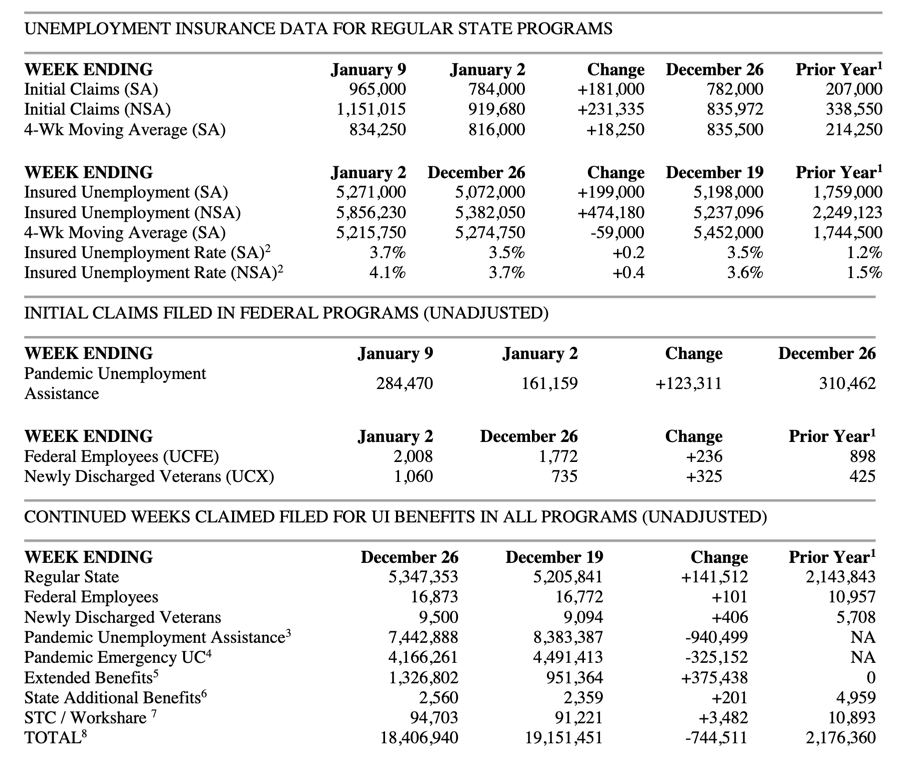

Jump in initial claims to 965,000

Jobless claims data around the holiday season is marred by lots of seasonality. And so, only in the coming weeks are we likely to get a ‘clean’ look at what’s going on in real time.

The latest report shows a step change that is worrying, with the unadjusted number well over my 1 million bogey for recession.

The seasonally adjusted 965,000 figure was well north of expectations for 795,000. This is one week’s data, but it explodes the concept that the ADP and jobs reports from December were not reflective of a deterioration in the labor market. Incipient talk of tapering QE may be halted just as it has begun.

I don’t have much more to say about the numbers. They’re bad. And if they stay at these levels for more than a couple of weeks, I continue to believe it would mean a double dip recession in the US. And I believe we are likely to see a continuation of economic restrictions that will sap GDP growth and lead to elevated jobless claims numbers.

The Economist has a good read on the magnitude of economic impact we could see in Q1 here. The long and short is that the economic shutdowns have less impact than last spring because of “less public fear; better calibrated government policy; and adaptation by businesses.” Essentially we are better acclimated to the virus-induced changes; they are less disruptive to our lives and to businesses. And that means less of an economic impact.

I am still hopeful that a combination of stopgap fiscal measures and a successful rollout of the vaccine will mitigate the long-term damage. But, this round of economic rollbacks will be back-breaking for some businesses. And so, there is more economic pain to come.

Comments are closed.