The Fed overtightened. Now it’s behind the curve. Recession awaits

Sorry for the alarmist post title. But the Fed has completely bottled it. I’ve been warning for some time that it could go this way. And now, we are in in the endgame.

First, the Fed overtightened through 2018. Then, forced at gunpoint by financial markets into a retreat this year, it has been very slow to recognize the tightening financial conditions. Now, it is so far behind the curve that a major recession is breathing down our necks.

Let me put this all together below. And then I will tell you where I think it’s headed. By the way, this is my occasional free newsletter post. If you like what you see and what to read more, please sign up as a paying subscriber.

Before the overtightening

Let me say at the outset that this expansion has been doubted at every step of the way. Anytime there was a hiccup in growth, invariably there was a whole panoply of voices telling us we were headed straight for recession and a bear market. It never happened – at least not in the US. The US economy has proved very resilient over this past decade.

I think the period right before Fed overtightening was no different. Back in late 2017 as the Treasury curve flattened, people were screaming “recession”, telling us that the yield curve was flat enough to foreshadow recession in short order.

It didn’t happen. And I wrote about why I wasn’t worried. Instead, the US economy went from strength to strength as Congress passed tax cuts (for the rich) and we saw at least a temporary boost in economic growth.

In fact, the economy was so strong by early 2018 that a lot of pundits were excoriating the Fed for being weak, not normalizing policy quickly enough, and spawning financial bubbles. They said the Fed needed to hike, and hike big.

At that juncture, in December 2017, I was telling you that the Fed had been and probably would continue to be more hawkish than you thought. And indeed, the Fed got religion. As I warned throughout 2018 it would do, the Fed eventually went from telling the market it would hike three times in 2018 to accelerating its timetable and hiking four times. Jay Powell even mused aloud in October about the Fed’s being “below neutral” and needing to accelerate its timetable even more.

The overtightening

But, this was a mistake.

Behind the scenes, the overtightening scenario was building. The first time I wrote prospectively about the likelihood of a policy error was in November of 2017 when I warned that we were entering the most dangerous part of the business cycle. Here’s how I put it, talking about the last business cycle that ended in December 2007:

In retrospect, one could argue that the Fed’s late interest rate hike campaign was a policy error – that the Fed should have seen the flattening yield curve as a canary in the coal mine and resisted raising its policy rates despite any concern about elevated asset prices.

I think this is the Fed’s real conundrum this late in a business cycle. If the economy is running solidly and leading economic indicators are bullish, the Fed is hard-pressed to not raise rates in an environment in which headline unemployment is low and falling, asset prices are rich, and lending standards have loosened — even if the yield curve is flattening. Aren’t they supposed to take the punch bowl away?

I don’t have the answer to that question. Time and again, late in the cycle, the Fed has indeed taken the punch bowl away. And the result was recession and financial crisis.

That’s exactly why this is the most dangerous period in the business cycle.

So I started talking about overtightening in earnest in March 2018, saying that the flattening curve was a sign of concern regarding overtightening, not a harbinger of recession — meaning there was no reason to panic as long as the Fed understood what was happening in time. And as 2018 proceeded, I continued to beat the drum about this.

The point is a flat or inverted yield curve is just a signal. Risk free rates are mostly about future policy rates. So, an inverted curve isn’t forecasting recession per se, it is reflecting anticipated lower policy rates due to economic weakness. Or it could just be a sign of disinflation as real yields rise relative to nominal yields.

But to the degree it is a sign of recession, the recession happens with a lag. The central bank has time to unwind its overtightening if it reads the signal, as the Fed did successfully in 1994. And this time is no different. If recession is coming, it’s not baked into the cake in my view. But, policy error can get us there for sure.

Markets throw in the towel

Anyway, at some point, the market couldn’t take it anymore and we had a market meltdown, with stocks cratering and bonds soaring in December because of renewed fears of recession due directly due to Fed overtightening.

Now, when I say ‘overtightening’, I am talking about investor confidence and financial conditions, not the real economy. I think of the real economy as largely independent of the financial economy except through the impact that investor confidence and access to credit can have. And so, I see monetary policy affecting the real economy primarily through the financial conditions and interest rate conduit, creating winners and losers as interest rates change and investors gain or lose confidence in the prudence of incremental capital investments.

Jay Powell got it. In late December and January 2019, he repented. And he promised to ease off the brake, something he has done. But all of that previous tightening of financial conditions is still working its way through the system, particularly via the currency channel because, even after a 25 basis point cut in July, interest rate differentials between the US and the rest of the world are acute, perhaps even more acute than they were before.

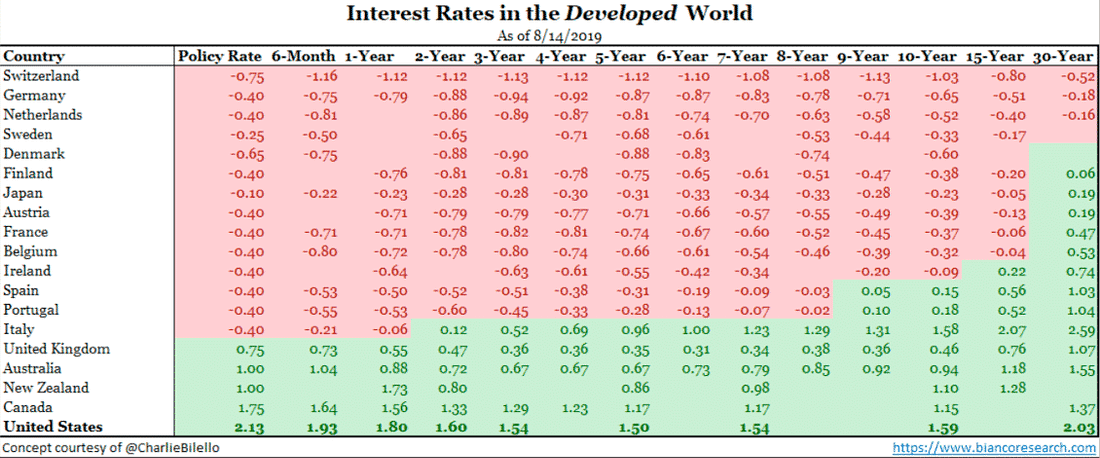

Look at the chart Jim Bianco drew up on this yesterday.

The Fed is well outside the norm here. In essence, we are at the point in the business cycle where even keeping rates still can be a stealth tightening when every other central bank in the world is easing. That is why the reserve currency, the dollar, is rising and curves are flattening.

Policy choices

In retrospect, I think the Fed’s 25 basis point move in July was a mistake. First of all, let’s remember there were two dissents at that meeting. So, there is certainly a faction at the Fed that wanted to stand pat in July. I can understand Powell’s desire to keep everyone onside as much as possible. And the incoming data at that time were so good, it fooled the Fed into believing it could take an incremental approach. But almost immediately after the cut, trade progress, global economic data, and financial conditions have all deteriorated aggressively.

In fact, we are now at the point where the US yield curve is almost fully inverted out to seven years. And the 2-10 year spread is flirting with inversion, joining the 3mo.-10 year spread in spooking markets about the potential for recession in the US. And just last night, the 30-year hit an all-time low yield.

Optimally, the Fed would move intermeeting here. But that’s not going to happen. And given the dissents we got in July, I think the most we can hope for from the Fed next month is 25 basis points. I could be wrong, especially if we continue to see market turmoil.

In sum though, I believe we may be headed for a situation in which a number of major economies tip into recession, trade tensions rise, financial conditions tighten further, and the yield differentials between the US and the rest of the world increase, forcing up the dollar. That’s a recipe for further inversion, an equity selloff, and a wholesale stop on incremental capital investments. And that would increase the likelihood of recession, which has been my base case for 2020 for the past two months.

At that point, the Fed could move again. But the die would be cast. They would not be able to undo what they had already done by waiting. And the transmission of further overtightening would mean recession. Now is the time to act.

Other factors

A lot of people are talking about stress in dollar funding markets, one of the key concerns surrounding tightening financial conditions. One avenue through which this tightening may be happening is the basis swap market, where people exchange floating rate financial instruments that are marked to different bases (ie. LIBOR vs T-bills) or currencies (i.e. USD vs GBP).

Before the debt ceiling was increased and the US budget impasse resolved, the US Treasury had been running down its balances at the Fed. With the deal solidified, we are going to see a flood of issuance that will tie up regulatory capital at financial institutions and put the squeeze on dollar liquidity.

The premia that investors are paying to swap euros, yen or pounds into US dollars is already at high levels. The anticipated further tightening of these markets will make things even worse.

It’s technical aspects of the financial markets that are creating tightened financial conditions. All of this is made worse by policy divergence, with the Fed remaining tight relative to the rest of the world. That accelerates curve flattening as punters frontrun the likely Fed (late) move to ease once it cottons onto all of this.

Recession

I don’t think the Fed gets it, frankly. It overtightened in 2018 and has been slow to unwind. Now, markets are in a panic. The only thing that can save the Fed here are the data. If we get improved economic data, it would alleviate fears of recession, loosening financial conditions. But right now, the combination of weakening growth globally and tightening financial conditions is toxic. It has brought us to the brink of no return. Personally, I am looking at the Treasury curve inversion out to seven years as the sign to throw in the towel. Until then, I have some hope the Fed or the data will change enough to avoid recession and crisis.

The real panic will begin when sellers in some of the ETF and ETN markets realize at the worst possible time that there is no liquidity in their underlying markets. Turning high yield bonds, for example, into an easily tradable equity-like market has been one of the great illusions of this business cycle. When contagion from equities hits high yield, that’s when it will get ugly. And the defaults, credit writedowns and recession will begin.

We’re not there yet. But the Fed’s not helping. Let’s hope they see the light…and soon. We’ve got several months before things get really ugly. But, legitimately we have much less time for the Fed to act before recession is baked in the cake.

Comments are closed.