Contextualizing the horrible jobless claims numbers

So it turns out the dip in initial jobless claims last week was just an artifact of the Thanksgiving holiday. This week we played catch up and then some. The question now is where we go from here. Some thoughts on that below

Big Head Ed

Before I deep dive for you here, I want to pat myself on the back first. That’s because Economists David Rosenberg and Albert Edwards both quoted me recently – which makes me very happy. Now Dave actually took me to task (anonymously, of course) for soft-pedaling my downbeat view of the macro outlook. But I know he values my writing. So I am still happy to get a mention.

The back story here is that, almost two years ago, Albert was calling Dave “the excellent David Rosenberg” in praise of Dave’s prose and just kind of throwing my name into the mix without an ‘excellent’ tacked on.

I wrote a piece bitching and moaning about it, attaching these two snapshots as evidence:

But I reckon I’ve upped my game now — to where Albert doesn’t need to give me the excellent moniker to signal his appreciation. It’s simply implied!

The economic call

That’s all a long-winded and self-referential wind up to going a bit glass half full on my ‘double dip’ call. Let me give you the good news first.

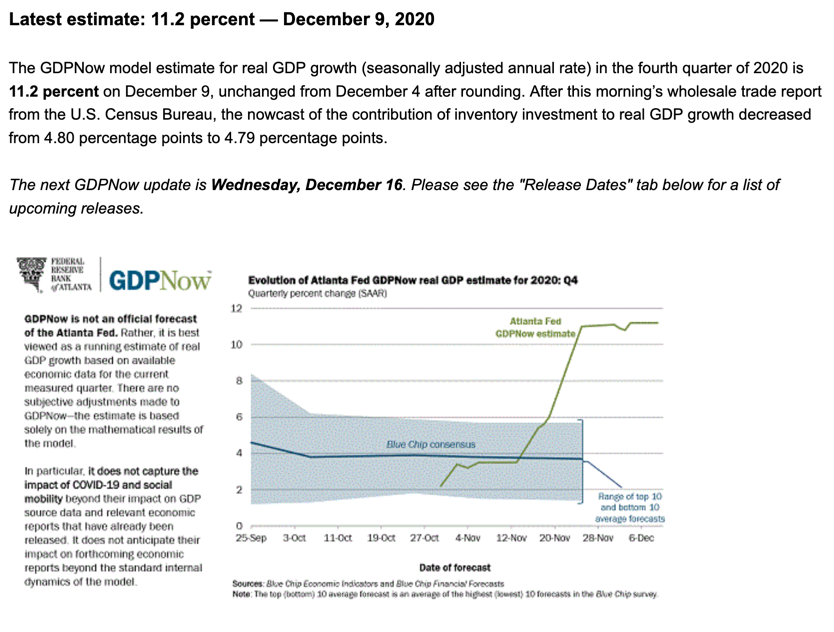

How far does the economy have to backpedal to get the Atlanta Fed’s GDPNow tracker to show zero growth for Q4? We’re tracking data that’s cumulatively two months in on a three month quarter and the nowcast is up to a gargantuan 11.2%. Mind you that’s not the 30%+ growth of Q3. It’s still pretty robust though. And so that speaks to a level of growth that’s much better than expected as the tracker goes up and up.

Notice that the Blue Chip consensus is dipping though. And to call a recession, it really doesn’t matter how good the quarter was. What matters is how pervasive, deep and long the slump is. An economic recession can start anytime; it doesn’t have to coincide with a quarter’s beginning, which is why the two quarters of contracting growth is just a rule of thumb, not a hard and fast rule.

The point is that we do need to decelerate a decent amount to go to zero. And while Q4’s numbers won’t get there December of January’s still could.

Jobless Claims

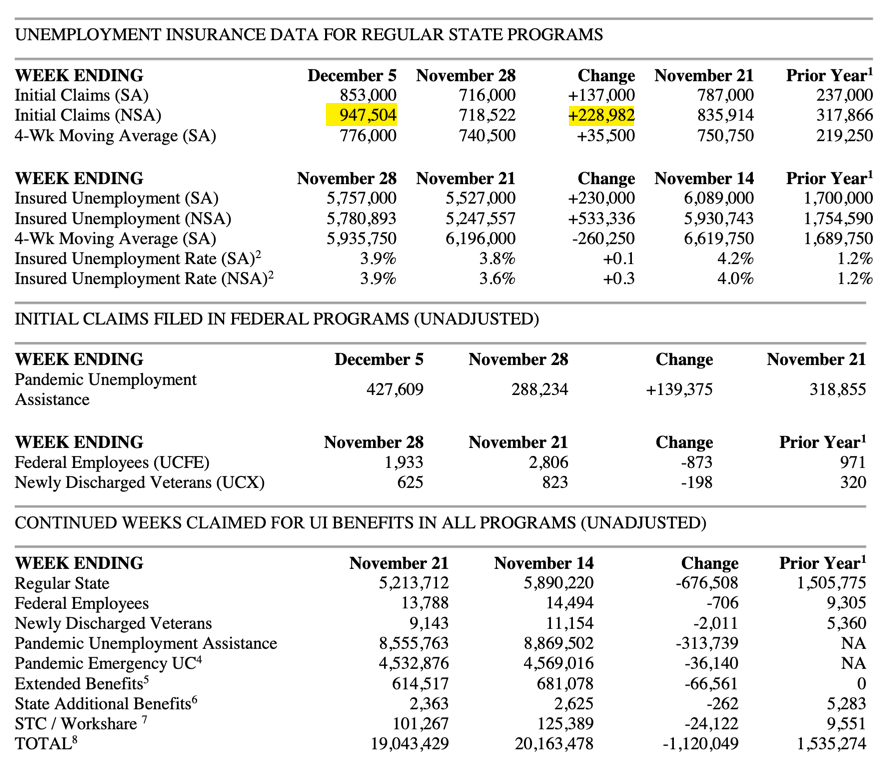

This is the context for jobless claims. Now, I’ve highlighted the two numbers that stand out for me in the latest claims report below.

It’s the raw non seasonally-adjusted initial claims figure and the change compared to the week prior. Those two numbers are exceedingly high. The questions are these:

- How much of the uptick was due to claims rising the week after a Thanksgiving holiday?

- How much higher can economic rollbacks and partial shutdowns send claims going forward?

- How many claims do we need to get and how long can this go on before it causes the economy not to just downshift but to fall into recession?

I think a lot of the last initial claims number is a holdover from Thanksgiving. Say 100,000 are holdovers. But the number’s still higher without those. And Covid-19 hospitalizations and deaths are also spiking higher. Just yesterday we had a record number who died of coronavirus, with the number going over 3,000, more than died during 9/11. I expect shutdowns to accelerate simply to prevent healthcare systems from imploding.

So, claims can and probably will go much higher than today. We could see a non seasonally-adjusted count over a million before year end. And as the seasonal adjustments decline somewhat into year end, that would mean reported numbers that will surprise.

Now, remember, any stimulus won’t flow for weeks. So whatever the US Congress is doing to arrest the economic pain won’t be felt in full measure until February or March. In the meantime, given what we know about human behavior in the US and the existing infection and hospitalization numbers, we should expect the pandemic to worsen further still from here.

My view

It’s this poor virus spread outlook that has me thinking recession. Every day is worse than the last in terms of news on that front. And worse to come is baked into the cake based on what we know about the last couple of weeks’ infections and hospitalizations. If we go to 1,000,000 weekly initial claims and stay there for a month or more, I think that will be enough to push us over the edge.

Luckily the vaccines are coming. But, unfortunately, it won’t be soon enough for some.

Comments are closed.