The last update I gave you on the market in the aftermath of the ECB’s policy statement was about central banks being too tight. The gist of my remarks was that CBs are all poised to tighten, if and when the data allow them to do so. This is certainly true with the ECB, which not only wants to end balance sheet expansion but wants to normalize rates under pressure from the Germans. But it’s also true in Norway, in Canada and in the US as well.

Adding volatility

This is going to be difficult for the markets to absorb. The fundamental policy pressure on markets is still toward tightening. But the data flow has been so bad that the incremental policy path is toward loosening. So, we have a fundamentally asset-market bearish policy stance overlaid with a short- to medium-term bullish policy change.

I believe this short-term adaptation had equity markets and corporate bonds rallying off oversold levels, particularly in the US. But if the data flow becomes more favorable, the fundamental tightening dynamic will re-assert itself and cause more downward pressure on equity and corporate bond markets. That means volatility.

Europe leading the way (down)

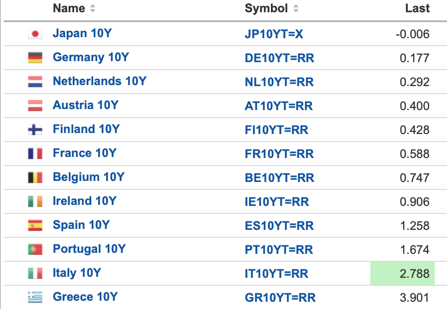

Look at Europe as a canary in the coalmine here. If you look at the 10-year government bond yields, across the spectrum, we are seeing a flight to safety and lower yields, as the real economy turns down under the weight of central bank tightening.

The Japanese 10-year is even negative. For me, the Italian 10-year stands out as the weak link because its yield often rises as the other yields fall due to market concern about redenomination and default risk. Think of Italy as the new Greece. So, to the degree Europe’s stresses become acute, we should see it in rising spreads between German Bunds and Italian BTPs.

Can the US resist?

I think the Fed is more keenly aware of the legacy of policy divergence that built up in 2017 and early 2018, which led to a strong dollar, sagging economic growth and increased market volatility. that’s why it has stopped rate hikes, not because there is some sort of “Powell Put”. The Fed wants to normalize, just like all the other CBs. But the data flow won’t permit it.

The leakage of weakness into the US is a key constraint here because S&P 500 EPS comps are hard to beat for 2019, especially as real GDP growth wanes. That’s a double whammy i.e. a fundamental economic slowing combined with what was already likely to be a deceleration in earnings growth.

Can the US resist the weakness then? I say no. I believe we will see the US economy downshift into a sub 2% growth stall speed by year-end, causing earnings to falter and potentially depriving companies of credit in a new, more restrictive economic environment. This is not a recession. But it does make the US more vulnerable to macro shocks.

Anecdotally, I am hearing about US-based banks reining in their credit supply in anticipation of weakness. Moreover, small businesses are also showing caution, with confidence at its lowest level among these enterprises since Trump took office.

My view

For me, this is a case of central banks pausing all around, watching the data flow. They want to resume normalization if they can. But the data flow says they can’t. China and Europe are leading the global economy down. And the questions are whether the US can resist and whether this downdraft seeps into credit via defaults and bankruptcies. The jury is out on those questions, meaning we could simply be having a mid-cycle pause just as we had in 2016. But irrespective that means increased volatility for asset markets.

For the US, it is not the household sector where the vulnerabilities lie. Instead, it is the corporate sector. The over-reliance on financial engineering for EPS growth and the increase in corporate leverage makes US companies more vulnerable to slowing credit growth. The proliferation of BBB credits tells you that.

In a true end of cycle period, we should expect to see distress in the most leveraged high profile names i.e. high yield names that have been market darlings like Tesla and WeWork.

Personally, I don’t expect to see a primary bear market in the US until we get confirmation via this kind of distress. The December downdraft was a head fake. Wait for credit distress for a real sell off to begin. And that will coincide with a recession.

Comments are closed.