How to think about the GameStop saga

I’ve been thinking about what happened with share prices of GameStop and other companies that were bid up last week and want to give you a few thoughts on what I think happened and why it matters. Part of this is about the mechanics of market functioning and another part is about the psychology of social media in a post-Great Financial Crisis world. So, this post will be one part finance and one part political economy.

Downtrodden companies

The first thing to realize is that the events surrounding GameStop, AMC, Tootsie Roll and similar companies happened because these are companies of faded glory. At heart, these companies have become the subject of a hedge fund-retail investor tete a tete because they were but are no longer marquee names.

Take GameStop, for example. This is a brick and mortar retail chain for video games and gaming merchandise. Think of it as the retail equivalent for gaming to what RadioShack once was for consumer electronics. In a word increasingly dominated by broadband Internet connections, why would you head on down to the local mall to a GameStop store to buy a video game? You wouldn’t – especially when that involves the risk of getting infected by COVID-19. So GameStop’s business model is under threat just as RadioShack’s was.

RadioShack went bankrupt in 2017. And the bet is that GameStop is headed that way too. Companies like AMC, Nokia, BlackBerry, Bed Bath and Beyond, American Airlines, Trivago, Koss, Express and Tootsie Roll aren’t looking much better either for related reasons. They are either dated brands or companies struggling due to the pandemic. And the result is a massive number of professional investors interested in profiting from the decline in their share price – so-called shorts.

Here’s the thing. Some of these companies are so unloved that the short interest in their shares is massive. Many professional investors have done the analysis on their earnings prospects and think their shares are sure to decline. Some might be forced into bankruptcy or even liquidation like RadioShack. And so they have piled into the shares by shortselling – borrowing the shares from investors and hoping to buy them back at much lower prices when their value declines. As last week unfolded, GameStop was reputed to have short interest that was 136% of its available share size. That means more people were borrowing shares and betting they would decline than people who actually owned the stocks.

Short-selling

The problem with shorting stocks is that, unlike with buying shares, you face unlimited downside and a limited upside. For example, if I buy a share at $10 and sell it at $100. I have made 9 times my initial investment. The most I could have lost is $10 if the company goes bust and the share value falls to zero.

But if I short the share at $10, thinking it is going to zero and it does decline, the most I can gain is $10 if shares go to $0. However, if a company’s stock price goes to $100 after I go short at $10, I would lose 9 times my initial investment. Not good.

Even unsophisticated investors know this though. And so, when everyone and his brother is piled into a short position in a stock, it creates the opportunity for a ‘short squeeze’. Now, normally, a short squeeze is performed by buying so much of the stock that it rises in price, causing those with short positions to abandon their position by buying the stock. Their purchases cause the stock to rise even more, forcing other shorts to cover their position and buy. Eventually, you can squeeze all the shorts out of the position this way, by forcing losses onto them.

There’s one problem with short squeezes though; you need a lot of money to make them work. You need to buy in size to move the price up and force shorts to cover. And if you’re a retail investor, you don’t have that money. If enough of you band together though, you might be able to move the needle. The combined weight of hundreds or thousands of investors buying small quantities of shares can move the stock price up and force enough short covering to create a squeeze. But that requires immense coordination and time.

Delta hedging

But with GameStop, a group of investors that chatted on the Reddit forum WallStreetBets found a better way to achieve their aim through the options market.

Standard option contracts give the option buyer the right but not the obligation to buy or sell 100 shares at a given price, called the strike price, at or before a specific date in time, called the expiry or maturity date. For call options, the buyer has the right to buy or ‘call’ for the share to the option seller at any time before the maturity date. And for put options, the buyer has the right to sell or ‘put’ the share to the option seller at any time before the maturity date.

What WallStreetBets investors understood is that the inherent leverage that the 100 shares create and the way the options market is structured made it a lot easier to force hedge funds shorting shares to capitulate, buy the shares and exit their short position at a tremendous loss.

The first structural issue to understand is delta hedging. Options markets are facilitated by broker-dealers whose only ostensible role (especially in the aftermath of the Great Financial Crisis and The Dodd-Frank Wall Street Reform and Consumer Protection Act) is to create liquidity, facilitate market flows as market makers. They are not there to take a speculative position. Their role is to make sure the market functions well for buyers and sellers of the options.

And so, they must fulfill orders for buyers of call options for GameStop. If they cannot find a seller, then they need to go into the stock market and buy enough shares of GameStop to make sure they are ‘delta neutral’. Delta measures the sensitivity of the value of an option to changes in the price of the underlying stock assuming all other variables remain unchanged. If a market maker allows the delta of its portfolio to change materially, it is effectively taking a market bet. And so, after selling the calls, it needs to buy enough shares of the underlying stock to prevent this and remain delta neutral, as close to a delta of zero across the range of its options inventory.

Gamma Squeeze

The problem with delta hedging when a share price is rising rapidly is that it forces broker dealers to buy a lot of shares. And the mechanical process of that delta hedging influences the price of the stock and causes it to rise further still, forcing yet more buying to remain delta neutral.

Knowing this, one could buy so many call options that it creates enough delta hedging to move the stock price materially higher. And, with a stock with a heavy short interest, that creates considerable losses for shorts – enough for them to cover their short, causing the share price to rise further still, creating more delta hedging and mechanical buying by the dealer community. Eventually, the stock price rises so much that your call option rises in value significantly. And you reap a lot more reward because of the leverage of options; the call option is for 100 shares, not one.

This is all fine and good except for one wrinkle; options have an expiry or maturity date. So, if you don’t get the shorts to cover before the expiry date, your option expires worthless and you lose your entire invested capital. It’s therefore a make or break strategy.

The question then is how to get the most bang for your buck to ensure your gambit works. This is where the concept of gamma comes into play. Gamma measures the rate of change in the delta with respect to changes in the underlying price. And clearly, if you want to get the greatest bang for your buck, you’ll want the rate of change in the delta to be as high as possible.

So, you want to make your gambit to cause pain for the shorts by forcing enough delta hedging by market makers to push the share price up to the strike price of your call options. Because there is so much gamma at these levels due to the massive options position you have made, the dealers are forced to buy even more shares to keep delta neutral. With shorts also forced to buy, that pushes prices up even more, causing more delta hedging, which forces yet more capitulation buying from shorts. The short squeeze has turned into a gamma squeeze.

If you buy enough short-dated, deep, deep out of the money options – where the strike price is the highest above the market price, you can get a nearly 100 to 1 gain as they go from deep out of the money to in the money.

Bigfooting the gamma squeeze

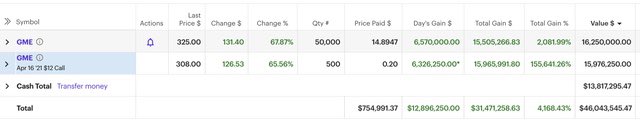

This is what the WallStreetBets crowd did with GameStop. And they also did it to a lesser degree with a few other names like AMC. The result was massive gains for the retail traders.

And, of course, there were massive losses for the hedge funds shorting the shares. Melvin Capital, for example, lost 53% in a single month of trading. That’s off the charts bad.

A lot of this activity was facilitated by no-commission retail brokerage accounts. Newcomer Robinhood is a marquee player in this saga, with many Millennial-age retail traders using the platform to make transactions.

Well, at the end of last week, many brokerage firms put the kibosh on purchases of GameStop and other shares. And the outrage was palpable. The narrative now firmly ensconced in the minds of ordinary Americans is that large and well-connected hedge fund millionaires got a rigged financial system to bend to their will. As soon as they started losing money, the brokerage firms effectively bigfooted the order flow process, used their weight to step on the retail investors’ ability to operate and stopped the hedge fund losses from happening.

Now there’s outrage. Dave Portnoy is talking about how people making these decisions should be in jail. And polar opposites in politics like Ted Cruz and Alexandra Ocasio-Cortez are agreeing that this whole process needs to be investigated. That narrative is not going to change. I don’t care what happens. This whole episode will forever be remembered as a David vs Goliath that was stopped because we live in a world in which the downsides of capitalism are only for you and me. The rich get bailed out.

My view

Here’s what I think happened though. First of all, we live in a world where regulators like the SEC have allowed what appears to be 136% of a stock to be shorted without any consideration for how that creates a ridiculous casino atmosphere. All of this is the result of some savvy WallStreetBets people realizing that this massive short interest made these stocks targets for a gamma squeeze if enough of them banded together. Hats off to their savviness. Bronx cheers to the SEC for allowing the shorts to pile in that much.

Second, no commission trading makes it easier to trade in a way that separates value from reward. I look at Robinhood as akin to the Facebook or Google business model. Offer a service to a mass audience for free and then monetize that data, that flow by charging someone else. That’s the kind of business model that I see as inherently suspect because it means that the audience thinks its the customer when it’s not. The goal of the business model is to make the audience dependent on or addicted to the product in order to sell access to that audience or that audience’s data to a third party. And Robinhood traders have to know that if they’re not paying for a product, effectively they’re the product.

Lastly, the whole narrative around squashing what was a righteous David vs. Goliath battle is flawed. The reality is this:

The Depository Trust & Clearing Corp., or DTCC, the main hub for U.S. stock markets, demanded large sums of collateral from brokerages including Robinhood that for weeks had facilitated spectacular jumps in shares such as GameStop. In response, Robinhood and some other trading platforms raised large sums of money to post with the DTCC to increase their backstop against losses. They also reined in the risk to themselves by banning certain trades. Robinhood also moved to unwind some client bets, igniting an outcry from customers.

GameStop and other share prices were rising so much that it was creating a liquidity squeeze for the brokerages. So they limited trading in those shares. Anyone who got into this trade late will likely be a ‘bagholder’ as the air will come out of the gamma squeeze, causing shares to plummet back to earth as the fundamental lack of earnings prospects moves center stage again.

But, it doesn’t matter. The narrative is set. And a big reason it will remain is because of the bailouts of the big banks after the US housing bubble popped. When the US housing market crashed and ordinary people were evicted from their homes, it was a trauma that created a global financial and economic crisis. ‘Retail investors’ in the form of ordinary citizens took it on the chin. So, the fact that basically no one at big banks went to jail for what were clearly fraudulent activities suggests to people that ‘the game is rigged’. And nothing since that time has shaken that feeling.

When we see hedge funds suffering losses and large institutions stepping in with moves that limit those losses, it brings back memories of great injustices from the Great Financial Crisis and the European Sovereign Debt Crisis. The message is that ‘the game is rigged’. And the Biden Administration needs to understand this underlying anger or it could find an angry electorate putting it in the same basket with other ‘elites’ –bigfooting the process in favor of their favored billionaires and corporations.

Comments are closed.