The pandemic, gamma squeezes and intergenerational conflict

You know this is going to be a redonkulous post by the name. So I am warning you ahead of time. It’s going to be super macro – so half thought piece and half tactical. Let’s see how many different interrelated topics I can manage to synthesize before I hit send.

Let me also apologize for not writing for a week. I have developed a case of vertigo and am trying to deal with that while doing things at Real Vision. And the newsletter lost out in all of that. I almost never write on weekends. But I feel like I need to check in with you. So I am using this Saturday to update you on my thoughts.

Where are we?

So let’s start here with where we are economically and what about my macro thoughts on the economy have changed. The difference today is I want to talk about the near-term, medium-term and the super long-term too. So, I am going to speak in relatively broad terms.

In terms of the near term, you know I have been saying that my base case is recession because of the ongoing wave of COVID-19. I believe the data coming out of Europe this winter will confirm recession there. And that includes the UK, beset by the virulent Kent mutation strain B117. My initial call was that this would be enough to create a global recession. This is a more contentious assertion because the US, China, Japan, and emerging markets are big considerations there. And absent a downdraft in the US, EM, or China, it’s hard to make that claim.

I don’t see EM or China hurting here. Much of EM Asia is doing, having handled COVID-19 better than developed economies. So, the next question is what happens in the US. On January 8, I wrote you on this, saying the following:

with the blue wave now confirmed, I would expect that fiscal and monetary stimulus would be enough, if present conditions continued, to prevent a recession in the US. But I don’t expect present conditions to continue. Nor do I expect fiscal stimulus to be large enough to overcome the income losses likely to occur in Q1 as the third US wave of the pandemic reaches its peak.

[…]

I am, therefore, despite some optimism related to the jobless claims data, more convinced of a Q1 recession in the US than I was in December.

Since that time, the latest backward data prints have confirmed my upbeat view on present conditions. Even initial jobless claims are showing downward movement after a brief spike. So it’s where the virus goes and its economic impact where the rubber hits the road.

The virus and the US

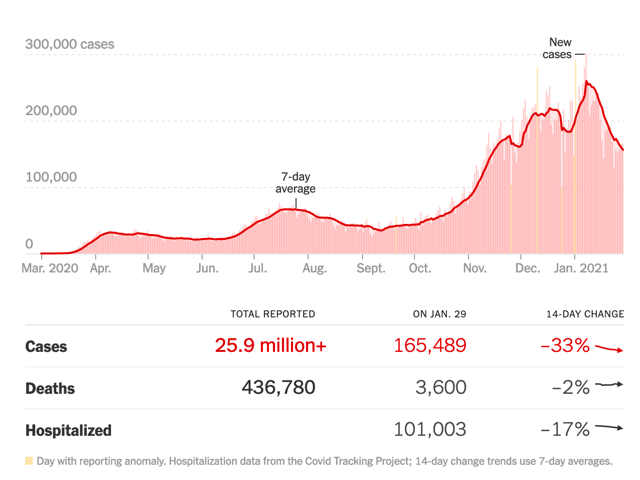

Cases have fallen relatively aggressively and viral deaths in the US have leveled off as have hospitalizations. In fact, hospitalizations have been falling according to the New York Times.

Think of the lagged moves as case counts to hospitalization to death. So the fact that case numbers are declining more rapidly than hospitalization, which is declining more rapidly than deaths tells you that the direction is down. Cases are the leading indicator, with hospitalization following and deaths lagging.

So this tells me that the third US wave is mostly over. Because of how poorly social distancing protocols have been administered in the US and because we are inside during winter, we should expect US case numbers to always remain elevated. But based on the numbers, the holiday spike is in the rearview mirror. All that remains now is any spike associated with the Kent B117 variant and the mutations out of South Africa and Brazil or any other more virulent strains that are cropping up.

The vaccination race against time

So, that means we are in a foot race with the virus. The question is how quickly we can get through vaccination to protect people before the virus mutates and causes further damage.

I don’t write this lightly because just days after my own mother received her first shot, I learned a friend’s mother was hospitalized and intubated. She has now died. A group of five of us have been texting and zooming these past few months. And last night we zoomed without my friend, who is grieving. My heart breaks and my eyes teared just writing that. But I have to write it. I need to express how this virus has a very personal impact on each of us, me included. I want this pandemic to be over yesterday.

For me, given what happened to my friend and his family, I think about my own family, with my mother half way to supposed immunity to the original Covid-19 virus strain. Her second shot is February 5th and there are three more weeks before the coast is supposed to be clear. And so, I wrote ‘supposed’ twice deliberately because we just don’t know about the mutations and vaccination efficacy or the mutations and reinfection.

The Washington Post wrote recently of how Maunus, Brazil, a city previously reputed to have reached so-called herd immunity to COVID, has been ravaged by a new Covid-19 strain mutation. Mutations to the spike protein have made this mutant more virulent, leading to a big second wave that includes cases of reinfection where those infected in the first wave have antibodies that were evaded by the mutant strain, causing a positive diagnosis for Covid in this second wave.

The goal, therefore, is to immunize as many people through vaccination as possible to both stamp out community spread in the present as well as to prevent unchecked spread that leads to mutations which are more virulent, deadly or can escape vaccine immunity and cause infection. There are outcomes where we do that and develop a new normal that is similar to the old. There are other outcomes where vaccination lags enough that we see a new wave of the virus due to the more virulent strains – still my base case and causing the US to have a recession. And then there are outcomes where the more virulent strains escape the original vaccines enough to delay herd immunity in a material way such that the new normal is delayed or materially altered relative to the old normal.

Economic outcomes

For me, the new normal is the big question. If you look at the last two posts, I wrote both about the reflation trade and yield curve outcomes over the near- and medium-term (see here and here).

And while there is still significant uncertainty there, it’s the new normal that matters most. The narrative dominating present financial conditions is one that sees a new normal where a mid-year economic re-opening is met with pent up demand that jump starts an economy where consumer behavior is broadly similar to behavior in the pre-pandemic situation. And this is seen as bullish. There are a multiplicity of outcomes there though.

For example, I spoke to Nomura Research Chief Economist Richard Koo just yesterday morning. And he told me that he worries that, even in the most benign outcomes, we could see a new normal which borders on secular stagnation and disinflation because this was the situation for long parts of the decade after the Great Financial Crisis. His view is that the balance sheet recession and deleveraging we saw then could potentially continue due to precautionary savings by consumers and private businesses alike, scarred by the economic shock of Covid-19. That’s a future in which, after an initial pop in demand and output for three to six months, we see consumers and businesses deleverage to repair their balance sheets as the nasty financial experience of the Covid crisis has taught them to do so.

I don’t have a firm view there. But I do think we will see a pop. And I also believe this crisis will alter consumer behavior meaningfully. So, it makes sense that it could have an impact on savings rates too. Let’s see. I talk to economist David Rosenberg next week about his view. So I am looking to picking his brain on this.

If I had to build a base case then, it would be one in which the economy sees a brief flirtation with recession due to another spike in cases due to the mutant strains. But because the spike is staggered, because we have adapted to the realities of economic life under Covid and because we are rolling out vaccination that will eventually work against the mutants, this won’t be severely debilitating. And any economic strain will pass. I prefer this case only slightly to one in which we see economic weakness but no recession outside of Europe. And by the end of the year, in both these cases, most people in developed economies are vaccinated.

So by 2022, we should get a pop in demand, followed by a new normal. And what that new normal will be is still very much in doubt. The jump start and Covid-period savings spend could make it a better new normal. But, precautionary saving and adjustment to changed consumer behavior could make it a worse new normal. We’ll just have to wait and see.

The new normal and the populist revolt

This uncertainty regarding the new normal highlights the issues at play following the Great Financial Crisis and fuelling some of the rhetoric roiling equity markets over the past week. If you think about how Barack Obama used to position it, the economy following the GFC was not great, but it was ok.

Nevertheless, the sense I got was that large swathes of the developed world disagreed with that assessment. Populism rose as a result, both in the US and Europe in particular. The populist revolts in Europe were initially more severe because of the European sovereign debt crisis. But that revolt, which led to Brexit despite the UK’s monetary sovereignty arguably manifested itself in the election of Donald Trump.

The existing mainstream narrative regarding Trump is that he is a nativist whose rise to power is a manifestation of racism of large swathes of the population in the US, a country which practiced slavery until 1865 and segregation for 100 years afterwards. But, you don’t get millions of people switching allegiance from Obama to Trump without there being some underlying non-racial animus. To use a very poor historical precedent because it provokes strong emotions, not all Germans were racists before 1933. But latent racism was stoked by the Nazis, giving people license to express their hidden prejudices. And once social norms changed, things escalated toward genocide.

Let me tell you a story about this from a roundabout context. A week ago, I saw an article about ‘suburban retrofitting’ – where the housing stock and infrastructure in older suburbs is being adapted to a new reality. That led me to thinking about a mall in the DC suburbs that I frequented as a child when it was a high end shopping mecca, which eventually led me to thoughts about the absolute over the top transformation of downtown Bethesda – the city I live in – from one and two-story ‘country town’ as my mom put it when thinking about it when she came here in the 1950s to a high-rise densely packed urban landscape.

One casualty of that transformation is a shop I have walked by 100s of times, the boutique retailer Claire Dratch, which was opened in 1948 by a German-Jewish immigrant who moved to the DC area and escaped the Holocaust. When she died in 2016, the Washington Post ran an obituary about her with this relevant passage:

Claire Bacharach was born on Dec. 17, 1919, in Seligenstadt, Germany, which she described as a small community where its few dozen Jewish families mixed easily with the dominant Catholic population. As a child, she often accompanied her best friend to midnight Mass at Christmas.

After the Nazi rise to power in the early 1930s, the social dynamic changed ominously. “Friends no longer walked with me, or sat in the train with me, or wanted to be seen with me,” she later recalled. “I was no longer welcome to participate in school functions. My name could not be mentioned in the class yearbook.”

She was devastated and, at 16, made her way to the United States to live with her elder sister in Chicago. Her father, a butcher, was beaten during the anti-Semitic attacks of 1938 known as Kristallnacht.

Her parents managed to escape the next year just before the borders were sealed on the eve of World War II. Once vigorous, they were now broken — “two crippled, elderly people” — that she barely recognized. But they avoided the fate of many of the town’s remaining Jews, who were rounded up and sent to concentration camps.

I’m thinking of this in a Tutsis and Hutus way or a Yugoslavian War way because when I was an American diplomat in Germany in the mid-1990s those were conflicts that I was personally connected to via work. And they were unfathomable. How could people who were living next to each other in peace and tranquility be literally at each other’s throats, killing each other, months later?

This is who we are. And when a society is wrenched by economic or demographic change, people are much more pliable in terms of their ideology and social norms adjust accordingly. All it takes is one actor to take advantage of that, stoke latent animosities and lead a people toward a prejudiced, racialized world view. And once those animosities have been animated, it is hard to keep them in check.

I am actively looking for ways to get the hell out of the United States as a result. To use a financial term, let’s call it tail risk insurance.

The gamma squeeze and intergenerational conflict

But let’s think about this from an intergenerational perspective for a second. If you were born when the Clintons, Donald Trump, or Joe Biden was born, you saw the United States at the apogee of relative world power. And the decay in its relative position might sadden or alarm you. Intrinsically, that’s a putting Humpty Dumpty back together world view of what ails America. In the case of Trump or Biden, you might differ in approach. But the overall thinking is one of re-animation of what was good, rather than one of scepticism about the entire structure of the society or economy.

The Millennial generation has to have a different world view. If you were born in 1985 for example, you may not remember the Oklahoma City bombing but you saw the Columbine High School shooting, a massive bubble in shares pop and 9-11 occur just as you were getting into high school. And then you went through the wrenching experience of the GFC and the coronavirus lockdowns and pandemic just as you were entering adulthood and trying to get a foot on the economic ladder. None of this tumult would be happening while the US still seemed ascendant or dominant as it did in the 1960s and 1970s during the tumult that the likes of the Clintons, Trump, and Biden saw.

That has to color your preferred policy responses. And so when I see what’s happened with the GameStop saga, where individual investors bandied together to send the share prices to the moon, I see talk of intergenerational conflict. It’s a situation where “OK, Boomer” isn’t a shorthand quip to dismiss an older person as clueless. Instead, it’s shorthand for a loathing of a generation that has bequeathed a world beset by pandemic, student debt, and joblessness while the rich get richer and everyone else is subject to the rigors of competition in a globalized world.

I won’t go into any great detail here. I just want to leave this as a marker. But, if you combine what I wrote about the Pandora’s box of social norm erosion and populism and what I wrote about intergenerational conflict during the ongoing ‘gamma squeeze’ conflict, it suggests a longer-term need for a massive systemic overhaul. Putting Humpty Dumpty back together again – as we did when we prosecuted the aftermath of the GFC without S&L crisis-style criminal convictions – isn’t going to work.

Let me leave it there for today because that’s a lot to digest. It’s a relatively dark and sombre tale. As I’ve said I am very encouraged about the near-term, both due to economic and COVID-19 related data. But, I do have an unrelenting sense that we are in the midst of a longer-term crisis of confidence in the Western economic model. It started with the Great Financial Crisis. And it has continued with the pandemic. For me, the best outcome, barring wholesale change, is one where the sustained use of public sector support during and after this pandemic creates a safety net that catches the developed world’s most vulnerable and reassures its middle classes. Maybe, with that reassurance, we can reverse the erosion of social norms. Let’s end this with that hope.

Comments are closed.