What’s your model on how real GDP grows durably?

Quick note here to follow up on the macro crystal ball post I wrote a couple of weeks ago (link here for subs). Michael Msika over at Bloomberg had a piece out on the return of capex powering the next rally. And for me it connected a lot of dots. Let me outline my thinking below.

What I wrote in the macro crystal ball piece was this:

there is a sequencing that I am looking for though. The sequence goes from consumers’ wages to consumption to industrial production to capital spending and corporate profits. That means wages should be key to the strength and durability of a recovery. While employment and capital spending are lagging indicators, rather than drivers of the business cycle.

So, in the wake of massive government transfers that have kept household balance sheets intact, we can look to employment trends to judge whether this cycle has legs. In Europe, employment schemes like Germany’s Kurzarbeit framework combine with the boost from government transfers to mean the first leg of the sequence from wages has been shored up. In the US, we are seeing lots of wage gains as the re-opening proceeds. Yesterday, I saw that Bob Burgess picked up on this and connected it to the potential for capex gains.

Is this the makings of a wage-price spiral or a one-time step change from poverty wages to a livable income?

I believe we’re seeing the latter. If so, it means a secular shift higher in consumption, giving companies reasons to invest instead of doing buybacks https://t.co/JTWt9YWlbt

— Edward Harrison (@edwardnh) June 9, 2021

Later I saw the Msika piece on the Bloomberg Markets Live blog, where he wrote about Europe:

Companies are ramping up spending in the post-pandemic world, increasingly favoring investments and expansion over returning money to shareholders. That’s likely to boost economic growth but also create stock market winners.

On point. Here’s the best chart he used.

He’s saying exactly what I was saying: when you see large segments of your clientele with cash to spend and wage growth that means they will be able to spend more into the future since wages are sticky, you will want to invest in the future. Companies on both sides of the Atlantic are seeing that at the moment. And that means there is greater prospect of a durable non-secular stagnation upturn.

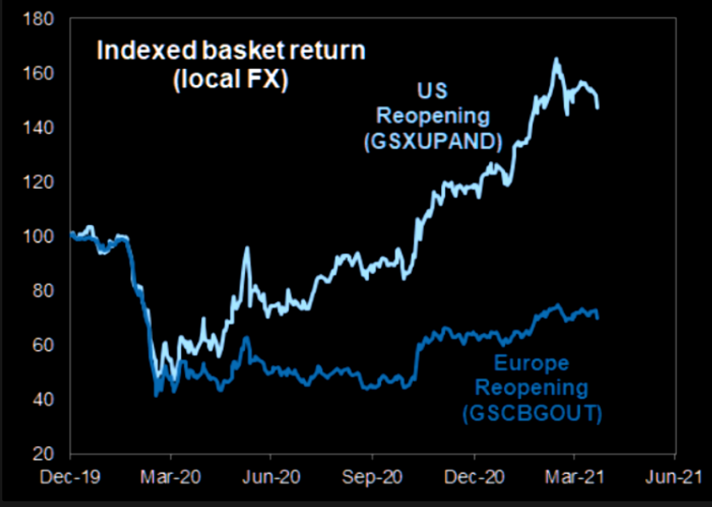

And to piggyback on what Msika is saying about Europe, remember this chart. I posted it in May.

It’s telling you there is room to run in Europe. And as Msika says, there will be stock market winners. He sees capital goods, oil services, technology, materials and carmakers with commercial units benefitting. That’s something to watch as Europe plays catchup to the US.

Comments are closed.