Risks to growth and inflation helping keep long rates down

As I write this, the US 10-year Treasury bond is yielding 1.457%, well under the trading range it had established during this quarter. And there are a lot of theories as to why this is happening. I want to spell out how I’m thinking about the yields and what the risks and opportunities are going forward.

So let me start with what the Fed can and cannot do to influence that rate and move from there to market participants and the outlook for real economy as the three main determinants.

The Federal Reserve’s role

Because of the Federal Reserve’s role as a monopoly supplier of reserves, it sets overnight rates with an iron fist. All of the discussion around interest on reserves and reverse repos is noise regarding how to best enforce its monopoly power in a world awash in excess reserves. But the macro picture is one where the Fed dictates the overnight rate and the market moves to that rate now and in the future. The same is true in Canada, New Zealand, the Eurozone, Japan and elsewhere in the developed world.

But as we move to out the curve, the Fed cannot control rates with an iron fist unless it actively intervenes in the market. It can influence rates by telegraphing forward policy guidance. It can even buy Treasury securities, adding to demand for those assets. But the Fed can’t dictate rates unless it actively engages in some form of yield curve control, something it is not willing to do. The result is that, while the Fed can influence longer-term interest rates, it cannot control them. And so, the term structure of Treasury rates, to a large degree, represents the market’s collective wisdom about future Fed overnight policy.

Right now, we are in the midst of a mooted policy paradigm shift where the Fed prioritizes employment over inflation. And so, after the market’s apparent disbelief in Q1 2021 regarding the Fed’s willingness to let the economy ‘run hot’, market’s have capitulated and temporarily accepted the Fed’s forward guidance and newfound religion on employment as a primary mandate.

The market’s role

This is a messy process, however.

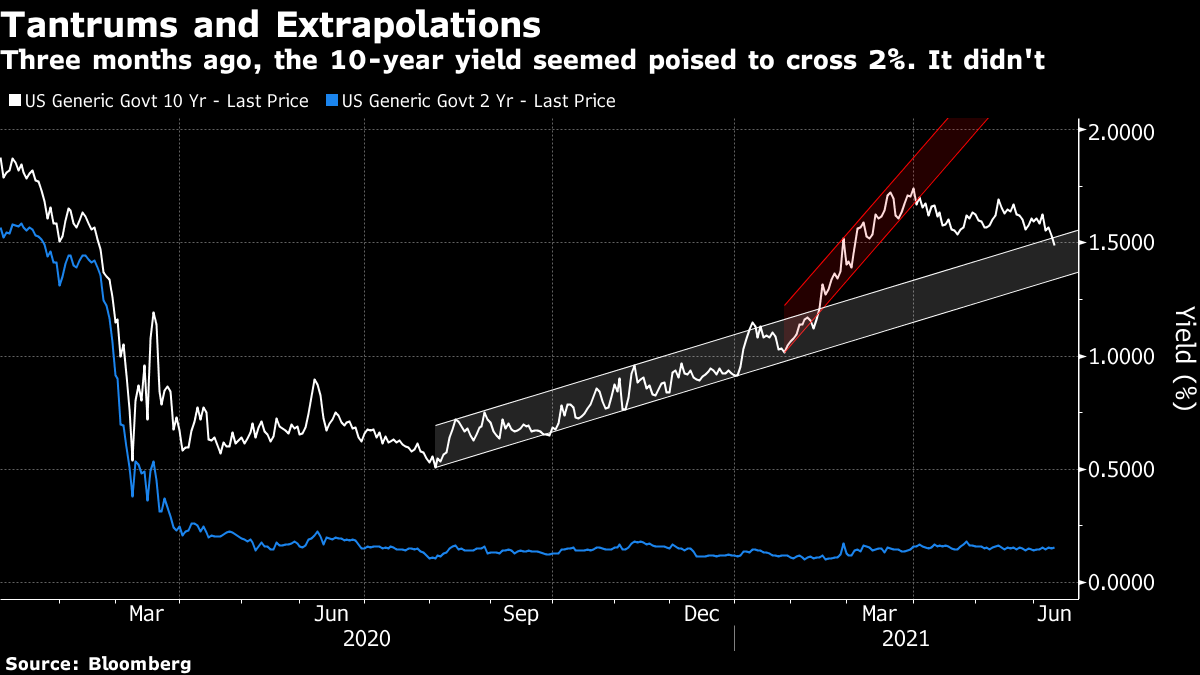

For example, take a look at the following chart from John Authers. I called it the chart of the day on Twitter yesterday.

The rate trend channel begun after the 2020 re-opening might still get us near 2% by year-end. But, the line kinks upward abruptly and become unmoored from Trend in Q1 as inflation expectations increased. This was the market frontrunning future Fed policy tightening. But that fromntrunning was an overshoot.

So, the Authers chart is making the case for thinking of Q1 2021 as putting Treasuries in an oversold position that we are now unwinding. And so we are heading back to trend. And we could well overshoot to the downside in so doing. Again, markets are messy and chaotic in the short run, but the best predictors we have in the long run.

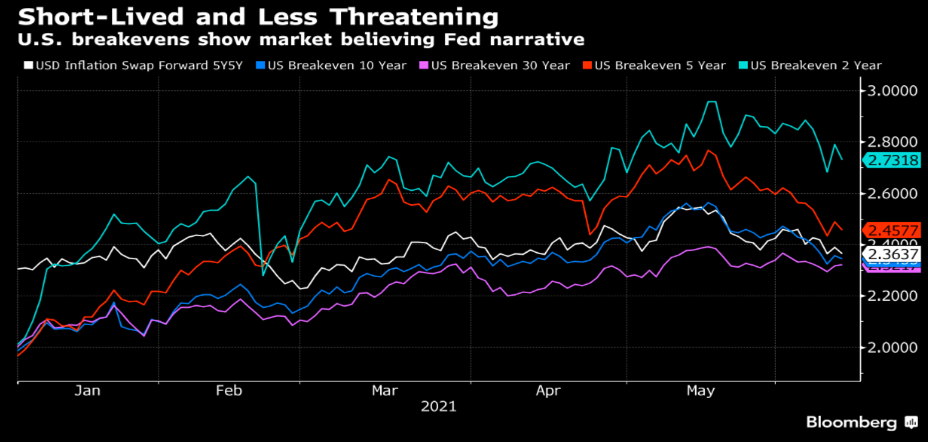

But what if the downdraft in yields is not merely an overshoot but a fundamental change in the frontrun of rates? Take a look at this chart from Bloomberg’s Sebastian Boyd.

He says the “gradual decline in breakeven inflations, and the widening spread between the two- and five-year measures suggest there’s no urgent need for the Fed to start tapering talk.” And clearly, if the Fed isn’t going to even begin to talk about unwinding accommodation, then they aren’t going raise rates anytime soon. Markets expectation of the Fed’s rate hike timetable has to shift outward and rates fall as a result.

I think both of those factors could be at play here. At a minimum, the move below 1.50% on the US 10-year breaks any momentum to the upside, as we are now below both the 50- and 100-day moving averages, with the 200-day all the way down to 1.16%.

The real economy

But ultimately all of this is predicated on the real economy, fiscal policy and the Fed’s reaction function. And having just spoken to Warren Mosler, founder of Valance and godfather of Modern Monetary Theory, I do wonder whether the real economy will have enough momentum to sustain higher rates. Let me explain why.

First, when it comes to fiscal and monetary policy, we should think of monetary policy having a direct impact on the real economy only through the interest income channel by providing interest income to the private sector since the government is a net payor of interest. That means that schemes like quantitative easing which involve a swap of interest bearing assets for reserves are net destroyers of private sector interest income, which also means their primary impulse is contractionary. It also means that the real economy primary impact of zero or negative rates is contractionary as it means less interest income for the private sector, again because government is a net payor of interest.

So, to the degree so-called accommodative monetary policy has any stimulative real economy impact, it is in goosing asset prices by moving investors into riskier, higher duration and higher yielding assets and by favoring debtors over lenders. The hope is that debtors will spend and invest more than lenders would. I would say that’s small beer, especially as compared to the contractionary impulse of robbing the private sector of interest income.

So we have to turn, second, to fiscal policy. And there, the wrangling in the US over private sector income support makes it clear that we risk a downshift in how much government transfers to the private sector as pandemic-related support is dialed back without necessarily any longer-term infrastructure or other spending to replace it. If you add the reduction in fiscal deficits to a continued loss of interest income, you have the makings of a potential slowing, a continued yield curve flattening and a greater loss of interest income.

And let’s remember, since everyone still thinks the Fed’s reaction function goes from higher inflation to higher rates and the concern now is inflation, the pain trade is still lower yields. And convexity will force duration-matching investors to buy in large measure if that pain trade crystallizes, resulting in a potential big move down in yields as shorts cover.

My view

I’ll be honest I think Warren is right about the primary impulse of rates coming via the interest income channel, which means the Fed has their policy choice somewhat backwards. To the degree inflation does move the Fed into action, it would cause them to send tightening forward guidance signals and help move long rates up, which would add interest income to the private sector and potentially accelerate any inflationary impulses, causing the Fed to ‘tighten’ even more aggressively.

That’s a ‘crash up, crash down scenario’ where yields rise to the point where Ponzi borrowers and some speculative borrowers are brought to heel, causing economic momentum to move into reverse and interest rates to crash down. ‘Crash up, crash down’ destroys risk-on assets on the way up and then lards up the system with NPLs on the crash down. It’s a risk that should give policymakers sleepless nights.

Right now, markets are moving the other way though, with yields below the 100-day moving average. But I think bond vigilantes are simply licking their wounds and waiting for more negative inflation prints to move the Fed’s forward guidance. Just maybe, the Fed will react. Just maybe the Fed’s newfound employment emphasis is not as firm as it might seem. It’s around Jackson Hole that we’ll find out.

Comments are closed.