No recession until at least late 2018

The US economy added 261,000 jobs in October bringing the baseline unemployment rate down to 4.1%, the lowest in nearly two decades. And while this number was short of expectations, revisions to the prior two months’ data meant a net gain above the consensus estimates. Going forward, the concern has to be that we are late in the cycle. So we need to think about how fiscal and monetary policy will develop.

The 261,000 number is the highest number in a year. The last time we saw this many workers added to American payrolls was June and July 2016. And before that, we have to go back to October 2015. So despite the miss that I predicted yesterday, the October number is a pretty good number. Moreover, September was revised up from a 33,000 job loss to an 18,000 job gain, with August revised up as well, from +169,000 to +208,000. That’s a net gain with revisions of 351,000 jobs. So this is a monster report.

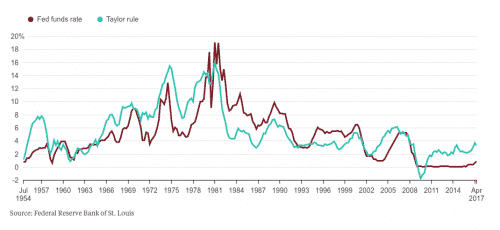

Of course, when you see these kinds of gains, combined with a 4.1% unemployment rate and wages up by 2.4% in the last year, you have a lock on an interest rate hike in December. And since we have a new Fed Chair coming in with Janet Yellen making way for Jay Powell, the first question is: how does the Fed respond? Ostensibly, US President Trump picked Powell over economist John Taylor in part because he believed Powell would be less hawkish. The Taylor rule, which was named after the Stanford Professor, says interest rates right now should be close to 4%.

Getting up to that level in a hurry would probably derail recovery. I doubt even Taylor would try to march the Fed quickly toward that goal. So I suspect that Powell will be even more cautious. But that’s not to say he won’t have a tightening bias with the unemployment rate at 4.1%.

Having said that, let’s remember that although the spread between the headline rate of unemployment and the most expansive definition of unemployment is back to pre-crisis levels, we are not back to the levels we saw in 2000.

Source: Bloomberg

Beneath the veneer of full employment is distress for many middle class Americans. And this is still a tepid recovery.

Bottom line: I expect some level of fiscal support for the economy from a Republican-controlled government looking to enact tax cuts. But these cuts will not be overly stimulative as they are geared to corporations and the wealthy where there is no distress. Meanwhile, the Fed will continue to raise rates to normalize monetary policy. And it will simultaneously begin to reverse quantitative easing. I see rolling year-on-year growth continuing in the mid 2% range in the near-term, making the possibility of recession unlikely until late in 2018.

Comments are closed.