I will continue my 2019 outlook pieces in the coming days. But we’ve seen a lot of data out today. I think what we’re seeing will have a bearing on rate policy, especially given what’s happening in the bond market, something I discussed earlier in today’s market commentary. And so, I want to make a few brief comments about what we’ve seen given the market volatility.

It’s been a mixed bag. But, fear is driving the market as Apple’s revenue guidance downgrade is a clear signal of slowing in China. And it’s that slowing which has precipitated fears of a pronounced global slowdown. I think those fears are warranted. But let me break down how I see today’s economic data and why Apple ended up trumping all the other data that came out today.

ADP jobs data were bullish, but the ISM was horrific

Let’s start with the jobs data from ADP. This comes from their press release:

Private sector employment increased by 271,000 jobs from November to December according to the December ADP National Employment Report®…

“We wrapped up 2018 with another month of significant growth in the labor market,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although there were increases in most sectors, the busy holiday season greatly impacted both trade and leisure and hospitality. Small businesses also experienced their strongest month of job growth all year.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses continue to add aggressively to their payrolls despite the stock market slump and the trade war. Favorable December weather also helped lift the job market. At the current pace of job growth, low unemployment will get even lower.”

The 271,000 gain was well above consensus estimates of 175,000. And it was the biggest job gain since February 2017. That’s bullish. And as I’ve been saying, I expect the US holiday season to have been very good for retail. Even so, increasingly, this is looking like lagging data.

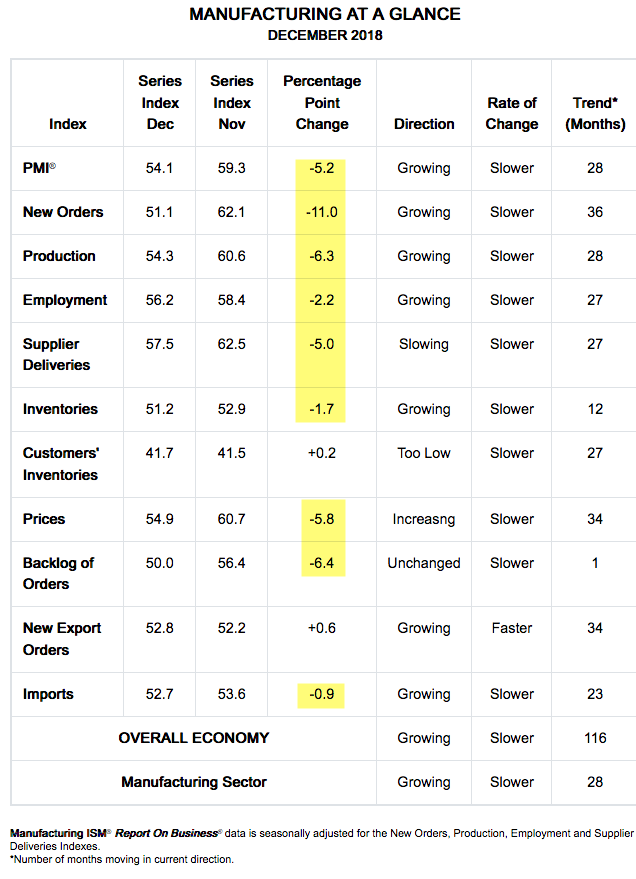

For example, data released today showed that the Institute for Supply Management’s U.S. manufacturing index plunged in December by the most since October 2008. The ISM manufacturing index fell 5.2 points to a two-year low of 54.1, missing all estimates in Bloomberg’s survey estimates. So, this was a truly horrible number.

Nearly all of the subindices were negative. And the new orders subindex plummeted by 11 points.

Here are a few comments from purchasing managers:

- “Growth appears to have stopped. Resources still focused on re-sourcing for U.S. tariff mitigation out of China.” (Computer & Electronic Products)

- “Brexit has become a problem due to labeling changes.” (Chemical Products)

- Customer demand continues to decrease [due to] concerns about the economy and tariffs.” (Transportation Equipment)

- “Starting to see more and more inflationary increases for raw materials. Also, suppliers [are] forcing price increases due to tariffs.” (Food, Beverage & Tobacco Products)

- “The ongoing open issues with tariffs between U.S. and China are causing longer-term concerns about costs and sourcing strategies for our manufacturing operations. We were anticipating more clarity [regarding] tariffs at the end of 2018.” (Machinery)

- “Business is robust for certain sectors [aerospace] and flat to downward for others [energy]. Tariffs continue to impact business direction and profit.” (Miscellaneous Manufacturing)

Notice the word ‘tariffs’ popping up again and again in a negative way.

Jobless claims were a push

Here’s how the Labor Department described the latest weekly claims numbers in an email this morning:

In the week ending December 29, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 10,000 from the previous week’s revised level. The previous week’s level was revised up by 5,000 from 216,000 to 221,000. The 4-week moving average was 218,750, a decrease of 500 from the previous week’s revised average. The previous week’s average was revised up by 1,250 from 218,000 to 219,250.

The 4-week average is generally what I look at. And so, there really wasn’t a lot there. The surge to 231,000 was a lot. But it could be seasonality or a one-week blip. Nothing else looks bad in the data set. Tomorrow we get the jobs number though. And the consensus estimate is for a gain of 178,000 in non-farm payrolls, with the unemployment rate remaining unchanged at 3.7%. Average hourly earnings are also expected to go up 3.0% year-on-year.

Apple adds to slowing concern with FedEx

So those are the numbers. The data are mixed. There’s nothing definitive pointing to a recession, not necessarily even a slowdown. Markit PMIs come out tomorrow though. So we can have a look see, not only in the US but also in Europe.

For me, the real concern was Apple, which never guides down in the middle of a quarter. And usually Apple beats by a good margin. For Apple to guide down, the revenue numbers must be pretty awful. And the question is whether this is Apple-specific or indicative of a wider slowdown in China that will hit everyone.

For me, this is reminiscent of FedEx because I think you can look at Apple as a bellwether. When FedEx warned last month, CEO Frederick Smith ended the conference call saying “most of the issues that we’re dealing with today are induced by bad political choices”. And he specifically named Brexit and tariffs – just as we saw in the ISM manufacturing survey today.

What the Apple announcement shows is another clear hit to global growth from a slowing China.

What does the Fed do here?

My baseline case before these data was that the Fed would look at the early January data and make a determination about whether to stick to 2 rate hikes, with good data meaning a ‘stay the course’ outcome. But not only have the data been poor, but also the bond market has deteriorated further. I am expecting full inversion from 1 to 10 years could happen within days at this rate. And that would be a clear warning sign for the Fed not just to pause, but to halt hikes altogether. Will the Fed listen though? I have my doubts.

My view is that the global economy does seem to be unraveling rather quickly. Now is a make or break time for all policy makers. If they make the wrong choices on tariffs, Brexit, rate hikes, what have you, it very well could tip us into a recession and financial crisis.

Comments are closed.