The strong dollar and Chinese reform

I have an interview on Real Vision with currency specialist Marc Chandler of Bannockburn Global Forex coming up later today. And I wanted to sort out some of my macro thinking ahead of it. Let me run by you what I’m seeing in the markets and what I think it means

The strong US dollar

While the US Federal Reserve has turned dovish, US interest rates are still the highest in the advanced world due to the Fed’s recent rate hike cycle. What’s more, other major central banks are matching or outdoing the Fed in terms of dovish policy. The ECB has LTROs and expectations are for the Bank of Japan to add stimulus too.

To me, this means a strongish – if not strong – dollar. If you look at the Dollar Index DXY, we are hitting near term highs above 97, breaking above the December levels the US dollar couldn’t pierce when the Fed was hiking and telling us it would hike even more in 2019.

Source: MarketWatch

I spoke to Marc last week. And he’s telling me we could even crest at 100, a level we have only seen once in the last decade, in late 2016. We are already into a sixth rising quarter of the dollar, dating back to Q1 2018. That has to stress the global financial system given the uS dollar’s role as leading reserve and funding currency.

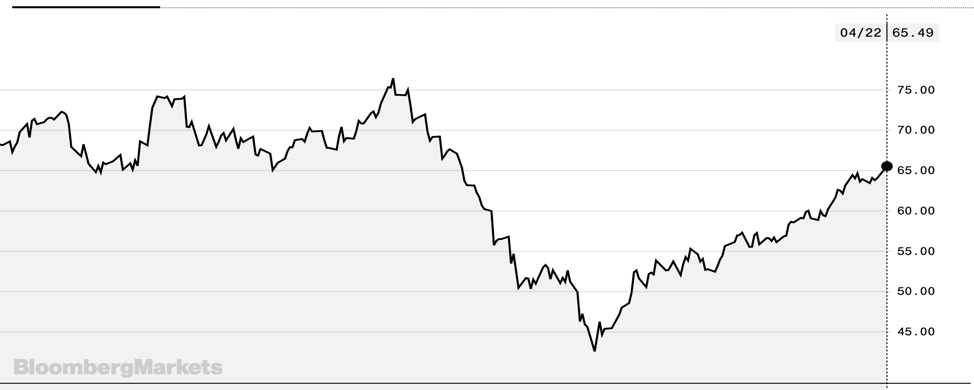

Rise in oil prices

The first place I would look for an impact is oil. However, we can see prices rebounding when the Fed turned dovish in December after the curve inversion scare that began in October caused prices to fall. That;s the opposite of what a strong dollar would predict.

Source: Bloomberg

That re-asserts the trend of rising oil prices that began early in 2016 after the shale oil shakeout ended. With the Trump Administration taking a hard line toward both Iran and Venezuela, there is further upside pressure on oil prices.

So, to the degree that oil is rising in US dollar terms, despite a strong US dollar, it tends to give support to the re-acceleration thesis I am now buying into.

Emerging market vulnerability

At the same time, I would look at emerging markets – typically strong users of US dollar funding – as vulnerable. Since early 2018, the thesis had been that it was time to rotate into EM as a relative value play. I see this thesis as flawed because volatility in global risk assets is likely to hit EM first before that relative value becomes realized. And, in my view, we have yet to see a major downdraft that makes a re-weighting toward EM tempting. Instead, I see greater EM vulnerability in the medium term due to dollar funding liabilities.

China

Then there’s China. This blurb from the South China Morning Post is interesting:

China’s senior communist leaders have congratulated themselves on saving the country’s economy from a hard landing during a trade war with the United States and have decided to focus on “structural reforms”, instead of stimulus, to move the economy forward.

The Politburo, the 25-member ruling body of the country headed by President Xi Jinping, reviewed China’s growth in the first quarter on Friday and concluded that market confidence has returned and economic performance was “better than expected”, the official Xinhua news agency reported.

The focus will shift to “reform and opening up” as well as “restructure”, according to the Politburo meeting that was held at a time when China and US are in the final stages of negotiations on a trade deal.

While the statement did not mention the stand-off with the US, the focus on reform echoed Washington’s demand for Beijing to make “structural” changes to its state-led economy.

From a forward-looking perspective, that’s a flag I wanted to put out there because it is going to limit upside global growth potential.

My thoughts

For now, I am fine with the global growth re-acceleration thesis. It is aiding animal spirits and lifting equity markets, particularly in the US. But I think this is a short-term phenomenon. Over the medium-term, beginning in the second half of the year, things are going to be different. How different depends on what the Chinese do and what impact it has on their growth and imports of commodities and other goods and services. For now, I am still in a bullish mindset. And I expect upside surprises over the coming weeks and months.

Comments are closed.