Five important macro themes on my mind today

The news flow is eliciting five themes for me right now. And I will dive into them briefly below. They are gold, the US dollar and rates, Europe, Covid-19 in the US and US fiscal stimulus. I am not going to take a hard view here. I simply want to outline the framing in each case.

Gold

Let’s start with precious metals because gold hit an all-time high this morning. There are three themes for me: inflation, negative real interest rates and liquidity.

One lens to see the rise in gold through is through precious metals as a store of value when interest rates are negative after accounting for inflation. Everywhere in the developed economies, yields are negative in real terms across the curve just as they were the last time gold prices took flight after the Great Financial Crisis. That too was a period of financial repression, where central banks suppress yields and investors are forced to seek risk and duration to hit return targets.

Another lens is where gold and silver are just assets being bid up with all other assets in a massive wave of liquidity. Everything is rising in price in the US right now: housing, stocks, bonds, bitcoin and oil. Why shouldn’t precious metals rise too. I’m sympathetic to this view. So what happens if the we hit a liquidity speed bump as we did in March? Then gold should decline in price like risk assets, as people reach for the safety of cash or Treasuries..

A third lens is where gold is a play on rising inflation expectations. For me, the drop in the US dollar is the corroboration of that lens in that the US dollar is falling against the euro and against a basket of commodities including oil and the precious metals. To the degree this dollar fall is reflationary – a juxtaposition to the liquidity event in March that saw a crunch in US dollar funding – we should expect commodities to rise, oil prices to rise, and gold to rise. Silver, which is a precious metal, with industrial usage is now catching up perhaps to match this reflationary view of the US dollar fall.

The US dollar and rates

The US dollar index is getting smoked right now. It’s clear, then, that the liquidity crunch is well and truly over. But, if the dollar is falling, what else is this telling us? I have a couple of suggestions.

One, it is telling us that US interest rates are going nowhere. First, in terms of potential disenchantment with US dollar assets – like Treasuries, that revulsion is expressed in currency terms, not rate terms. That means that the Fed, as monopoly supplier of reserves dictates and the market acquiesces.

If the Fed wants negative real rates across the curve, it will get them. The Fed has unlimited firepower to keep rates low. And they could even move markets to rate targets without buying a single Treasury bill or bond. This is how it works in the market for fed funds. The Fed says jump. And the market participants cry, “how high.” The Fed doesn’t need to ‘defend’ the fed funds rate. The market moves to the rate.

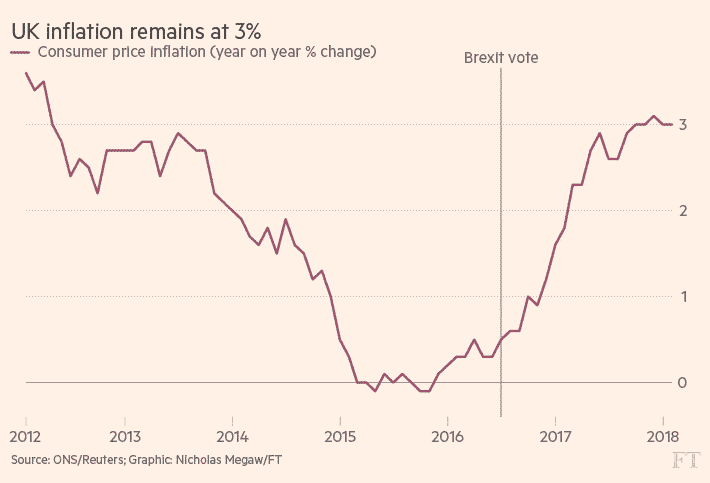

So-called bond vigilantes express their vigilantism via currency. Look at the UK experience in 2018. Here was a monetarily sovereign country with large deficits, the overhang of Brexit and rising inflation that saw rates pinned near the zero lower bound, even out to 10 years. And the British pound sterling isn’t even the primary global reserve currency

Clearly, if bond vigilantes expressed their vigilantism via rates, we would have seen UK gilt rates through the roof. But rates aren’t the domain of the vigilantes. The currency is the release valve. And the UK still has negative real rates across the curve. Now the US does as well. Bond vigilantes forcing monetarily sovereign rates higher is a myth that needs to die.

Long-term yield movement largely reflects changing bond market expectations about future central bank rate policy. And low US rates across the curve show an expectation for no upward movement on overnight rates anytime soon.

Europe

Another place where the US dollar is significant is in relative growth rates. DXY, the dollar currency index, is heavily weighted toward the euro. And you can think of the move lower as a proxy for the strength of the euro. And while one lens to view dollar weakness through is regarding reflation and easing financial conditions, another is relative weakness of the US economy.

The euro area economy is for once set for a sprightlier recovery from crisis than the U.S., thanks to starkly different responses to the coronavirus.

America’s failure to get a grip on the pandemic is putting the brakes on its rebound compared with Europe, where many former virus hot spots managed to resume economic activity without causing a similar surge in infections.

Crucial for a sustainable recovery is confidence that the virus is no longer out of control, and Europe’s relative success may help encourage shoppers to spend and businesses to invest, further propelling demand and growth. The region has also done a better job of protecting jobs and incomes, at least for now, with furlough programs keeping millions of workers on payrolls.

Put simply: the US dollar is weak because the US economy is weak. And the US economy is weak because the US response to coronavirus is weak. For example, in the US, baseball has just started. And a massive outbreak within the Florida Marlins team has thrown the whole season into turmoil. The season could be cancelled altogether. It now makes sense that Canada wouldn’t let the Toronto Blue Jays accept American teams into Canada to play them because you don’t see the same raging coronavirus numbers in Canada. And in Europe, you don’t see them either. That’s why European sports leagues have done just fine during their restart. Even the UK’s Premier League was able to end the season yesterday without a major outbreak.

Coronavirus

When you have 1,000 people dying of Covid-19 a day for four days straight as we did last week in the US, that tells you the virus is raging out of control. And that has to have an impact on the economy. I have been saying I think the impact will be much more muted than it was when we had full-scale shutdowns in March. And that’s both because the rollbacks will be targeted and limited and because people have found ways to adjust that they needed to find earlier in the year.

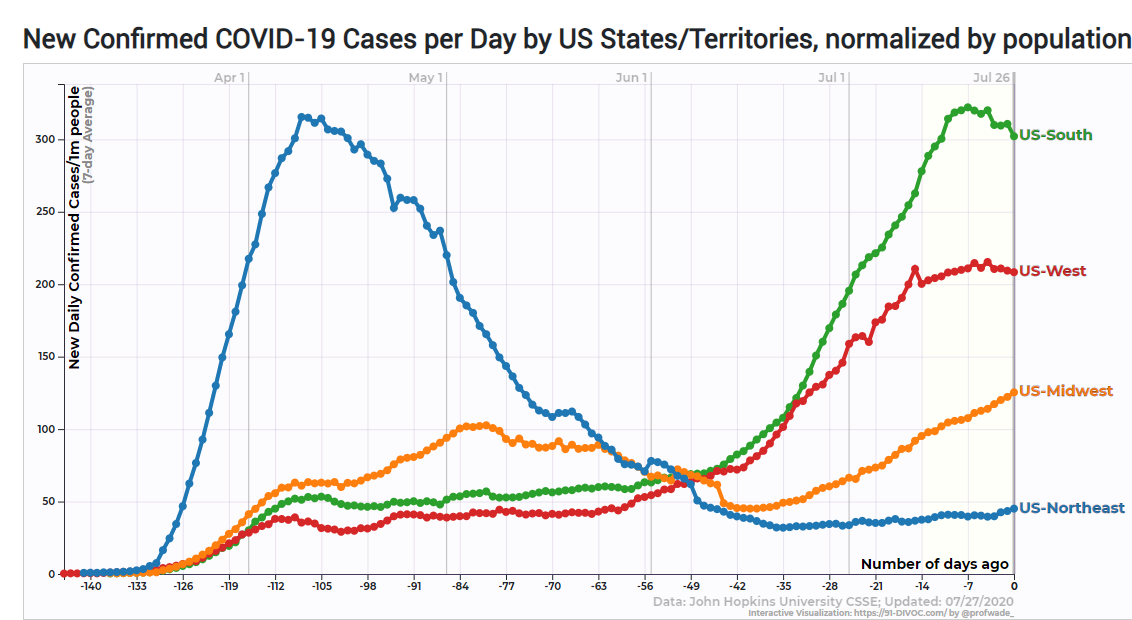

If you look at the numbers, they are rolling over in the places where they had mushroomed in the South and West of the US.

Source: Ernie Tedeschi

I think that means we are peaking in this second spike. The US Midwest is the outlier. Overall though, that means death counts will rise and then fall by the time schools open in late August and early September. Coronavirus spread will still be a much more potent threat to the US population than it is in Europe. But, I believe the second spike will diminish in significance. And we’ll have to look to how the indoor flu season evolves to see whether we get a third spike in the US.

Stimulus

The risk to my relatively balanced view is less about the virus, I believe, and more about policy errors. Think that extra $600 in unemployment benefits will last until the end of July? Think again.

The additional $600 in weekly jobless benefits provided by the federal government is officially set to end July 31. But states will pay it only through the week ending July 25 or July 26, a significant blow to unemployed workers counting on that money to bolster state benefits that average just $370 a week.

“The (Federal Pandemic Unemployment Compensation) $600 can be paid for weeks ending no later than the week ending prior to Friday, July 31, 2020,” the U.S. Department of Labor said in a statement. “For all states except (New York), that is Saturday, July 25th. New York’s end date is Sunday, July 26th.”

Translation: the additional relief that people were getting from Pandemic Unemployment Assistance has already lapsed. Here’s Matt Klein on this in Barrons:

Unfortunately, the extra $600 will have already expired by the time you read this in print. The Labor Department says the last PUC benefit gets paid in “weeks of unemployment ending on or before July 31, 2020.” Many states—including California, Texas, Florida, New York, Illinois, Pennsylvania, and Ohio, which together are home to half of the U.S. population—will stop paying benefits this weekend because of how they define a week of unemployment.

There are several proposals to keep the emergency payments flowing, including one that the House passed back in May, but so far these have been blocked in the Senate. Some say they want to cut the $600 per week supplement to just $100, although others, apparently ignorant that the deadline has already passed, have said they may temporarily extend the current benefits until a deal is negotiated. At this point, the best possible deal would restart an expired program and compensate the jobless with back-pay—although even that probably won’t be enough to prevent a nasty decline in consumer spending.

My View

Right now, asset prices are ripping on the back of a reflationary view of the world. So, we have a reflationary situation here that could come unstuck because of a policy error – creating a fiscal cliff that throws the US economy into turmoil.

And if the US economy comes unstuck, what does that do for the US dollar, asset prices and global liquidity? That’s what I’m asking myself right now. In a worst case scenario, there is a flight to liquidity, which is Treasury and US dollar bullish, but risk asset-bearish. In a baseline outcome, we get a delayed fiscal solution, but one that causes loss and deprivation for some including evictions.

I believe we get a W-shaped outcome in the US, and that the US becomes a developed economy growth laggard. The question now goes to how much the poor fiscal and coronavirus response makes that outcome even worse.

Comments are closed.