Where are we economically right now?

Different parts of the global economy are in very different places right now. And the sense I am getting is that this will have meaning only over the medium term. Over the longer-term, there will be a collective recovery. How robust the recovery will be is yet to be determined. But, at the risk of sounded overly optimistic, I think the longer-term recovery will be ‘better than expected’. I will explain below.

European data flow

While China got out of the lockdown phase of this crisis earlier than most, it’s Europe that I find most compelling. That’s where market-led economies have had to simultaneously battle both the coronavirus pandemic and the sub-optimal institutional arrangements of the eurozone. Either of these could have been and still can be catastrophic for growth. But, so far, the Europeans have been up to the challenge.

The data coming out of Europe today speaks to this. I woke up to news from the German paper Handelsblatt showing that growth in the eurozone is stronger than expected (link in German here). And the data I have seen confirms this. Germany and France, for example

- Markit’s flash purchasing manager index for German services rose to 56.7 in July from 47.3 in June. 50.5 was expected by economists polled by Reuters.

- Markit’s PMI index for German manufacturing rose to 50.0 in July from 45.2 in June. This was also above consensus of 48.0. The composite PMI, therefore, ticked up to 55.5 from 50.3 in June.

- Markit’s flash purchasing manager index for French services also rose. The 57.8 level in July was even higher than in Germany. And it bested the 50.7 level from June and expectations for 52.3.

- Markit’s PMI index for French manufacturing rose to 52.0 in July. This was actually below consensus of 53.2. But, even so, the composite PMI ticked up to 57.6, ahead of expectations for 53.5 and a reading of 51.7 in June.

Now, PMI data are only rate of change-relevant, meaning that the numbers tell you what growth looks like, not what levels look like. And so, there’s a strong basing effect happening in Europe due to the strong downticks in data during the lockdowns. But, the numbers are good. And they are ahead of expectations. And for me, moving up ahead of expectations is what matters.

The US data flow

As I write this, I am still awaiting the US PMI data. But, in one sense, it really doesn’t matter because real time data flow out of the US has rolled over, particularly in the employment market. Like the European data, the US data reads we get today are backward looking. But, unlike in Europe where all indications are that forward economic momentum has continued, in the US it has stalled. And so, we should expect numbers to roll over and potentially miss expectations going forward.

In essence, the US is headed for a W-style recovery from the pandemic. And at this point, the question is not whether the data rolls over. It’s about how much it rolls over. As I wrote yesterday, I think the second leg down in the W will be limited – with policy errors potentially upsetting that outcome. But, let’s use jobless claims as a lens on why.

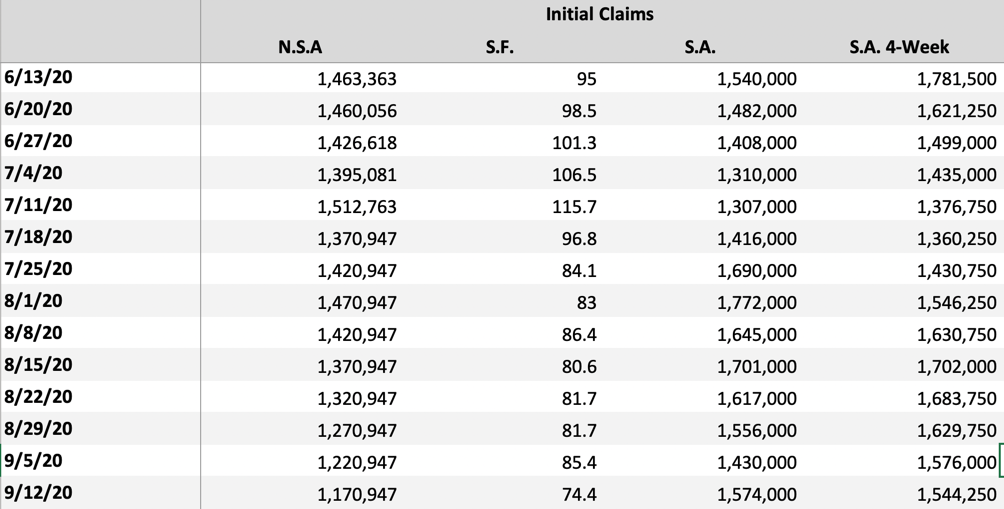

The first thing to note is that the number that came out last Thursday was distorted by a huge statistical quirk, in that the seasonal adjustment factor was high in a period of extremely elevated initial claims. What this effectively means is that all of the coronavirus-related claims are being divided by the same seasonal adjustment factor as ‘normal’ claims to get the seasonally-adjusted number. For example, last year, unadjusted initial claims were 243,621 with a seasonal factor of 112.1 getting you a 217,000 reported number. If you assume we had roughly the same number of non-pandemic related initial claims this year, it means there was an excess of almost 1.3 million claims in the week ending July 11 due to coronavirus. And those claims were adjusted down by the same 115.7 factor that the ‘normal’ claims were, giving us the impression that claims went down 10,000, when they had actually risen almost 109,000.

Going forward, the adjustment factor will move aggressively toward seasonally-adjusting upward. We go from dividing by 1.157 in the week ended July 11 to dividing by 0.968 for the numbers just reported yesterday to dividing by 0.841 for the numbers reported next Thursday. And this reaches its maximum in the week ended September 12 using a divisor of 0.744. Put differently, the pandemic-related claims for the week ending September 12 will be divided by a factor 55.5% greater than the ones filed in the week ending July 11, just as the ‘normal’ claims will be. So, to the degree we continue to see elevated pandemic-related claims, the numbers will look much worse than they actually are.

What we need to do is focus as much on the unadjusted number as the seasonally-adjusted number to determine how the second leg down is impacting the jobs picture. For example, the number released yesterday showed unadjusted claims declining 100,000 even as the adjusted number rose 100,000. What does this mean? For me, it means the data were better than expected, because in a worst-case scenario the unadjusted numbers could have risen 200,000 or 300,000. That they fell is a good thing, if only for one week. But, it confirms my present view that the second leg down will be muted. If the data change, I will change that view.

My view

Below is a hypothetical case for if unadjusted claims rise for two weeks by +50,000 and then fall by that much each week through September 12. That would still mean average claims rise by 350,000 from here through mid-August even though the situation is objectively relatively benign

This will drive US policy. And I think it will concentrate minds toward fiscal relief and continued monetary easing.

Meanwhile, I noticed that even the Russian central bank is able to lower benchmark rates to 4.25%. That’s a record low. 80%+ of all developed market government debt yields less than 0.5% right now. And negative-yielding developed market government debt has increased 44% year-to-date (link here).

What do investors do to keep up returns in that world? I think they reach for yield by taking on risk and duration. That works as long as government largesse prevents downside risk from materializing in the form of a second recession, earnings disappointments and debt defaults. And the two big variables there are the coronavirus and policy easing, both fiscal and monetary.

Despite the projected uptick in initial claims in the US and the expected undershoot in economic data, I don’t expect US risk assets to get pummeled in August. But, the risks are more acute in September and beyond, especially if the US fails to arrest the coronavirus spread or makes a huge policy error in supporting the still enormous number of people thrown out of work by the virus.

Have a good weekend.

Comments are closed.