Jobless claims, the fiscal cliff and a double dip

I think the title of this post lays out exactly what I intend to cover. It’s all about the US economy and its vulnerability to a double dip recession due to the fiscal cliff and rising jobless claims. To cut to the chase, I haven’t been overly concerned that the W-shaped recovery would end in a double dip except for the addition of policy errors. But those errors are almost right on top of us. And the potential for a double dip is greater today than it was when I wrote the last newsletter entry on Monday. A more complete review follows below.

The macro framing on the recession

Before we look at the data, let’s frame the issue first, going back to the coronavirus’ first wave, the lockdown. And then we can work forward.

Back in March, two weeks before the Fed came in guns blazing, I explained my view on social distancing, lockdown and quarantine and policy responses. The gist was that it had “become clear there will be some policy response”. But, as I put it then, we had “yet to hit the wall of coronavirus infections and deaths that awaits. And this is going to overwhelm our healthcare system and precipitate serious lockdown and quarantine measures. We are facing a crisis like we haven’t seen in our lifetimes.”

But, policymakers didn’t respond promptly; they delayed, creating uncertainty. And all hell broke loose. As the first wave of infections and deaths crescendoed, the lull in market volatility turned abruptly, and we fell into a panic as the Fed stayed on the sidelines. Eventually, the Fed rode to the rescue, and relieved financial markets responded with a V-shaped recovery.

The problem, as I put it then is that, “the coronavirus situation will last for weeks and months to come as more and more countries are forced into the lockdown and quarantine approach to slow the virus down. This is a matter of life and death because we now know that the virus is considerably more lethal for the elderly than influenza is. But, the downside of this approach is a massive hit to the economy.”

So, to me the global lockdown response was obvious. We got that response. But, at the time, (foolishly) I added “now we have to explore potential policy responses and whether they will be enough to prevent a global recession.” Today, we learned the US economy contracted at a 32.9% annualized rate in the second quarter. So, yes, it’s foolish to have known there would be a massive hit to the economy and, then, in the next breath, to question whether we would have a global recession. Of course, we were going to have a(n) (historic) recession if we locked down the entire global economy.

The macro framing of the W-shaped recovery

For all my faults, I am a fast enough learner to pivot pretty quickly. I stopped talking about the potential for global recession and started talking about the pure agony of a global lockdown. In fact, my view quickly became one where the premature lifting of lockdown was the obvious policy response we would see (in the US). And you combine that with an all-hands-on-deck approach to monetary and fiscal policy and you had the makings of a V-shaped initial economic spike from the recession.

Here’s where the issue became murkier. And we are still dealing with the consequences. The V-shaped spike is a basing effect. If your economy disintegrates because of a shutdown, you’re going to get a V-shaped uptick simply as a statistical artifact of having plummeted so hard and so fast. The question is what happens next.

Back in June, I discounted a pure V-shaped recovery and outlined two realistic outcomes: The reverse-radical and W-shaped recoveries. In the former, you get the V-shaped pop. And that’s followed by a longer, tougher slog back to normal. In the latter, you get the pop too. But, it’s followed by a setback, a stalling, or even second recession.

My view has always been that a reverse radical outcome is dependent on the policy response, on both economic and public health fronts. If you cock that up, you get a W, not a reverse radical. And the worse the policy mistake, the more pronounced the second leg down, with a double dip a worst case scenario.

For example, in late April, I was saying that I expected “Europe to outperform the US over the short- to medium term as it exits lockdown in better shape.” That was purely based on public health policy and the likelihood of a late departure from lockdown or a premature lifting of lockdown in the US and a large second wave. The US decided to leave lockdown early to goose the economy. And we are now paying the price with a W-shaped recovery

What comes next?

So, all of that is lead-up to where we are now. Europe is outperforming because both the social safety net and public health policy responses have been more robust than in the US. And the only question now is how bad is the W going to get in the US.

On Monday, I wrote that coronavirus cases are peaking in the US such that “death counts will rise and then fall by the time schools open in late August and early September. ” So, my baseline has been that the second leg of the W would be much more muted than the first – and obviously so, unless we get a second full scale lockdown, something I have been saying won’t happen because of the economic destruction of the first.

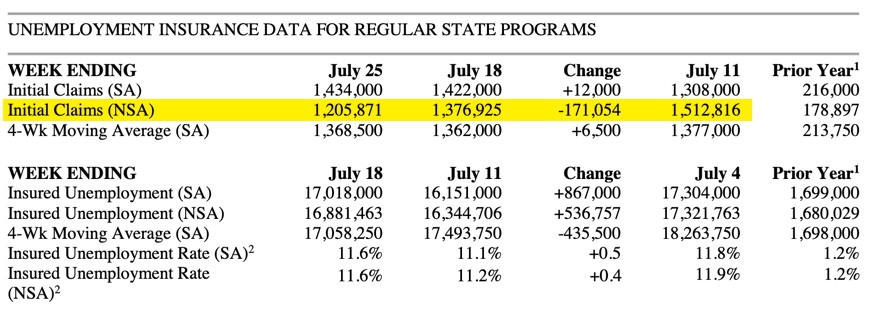

On jobless claims, the numbers that came out today were good. The headline alert I got from MarketWatch said “Jobless claims rise for a second week as pandemic recovery fails to take hold.” I told you this would happen. But I think that’s inaccurate. Look at the data.

Jobless claims have plummeted over the past two weeks. The reason they look to be rising is the seasonal adjustments. And I think those adjustments are too severe to accurately represent what’s taking place in the economy right now. It doesn’t matter though. The narrative that’s building now is that the second wave is crushing the economy. Jobless claims are rising as a result, they say. And Congress and the White House are sending us over the fiscal cliff at the same time.

Two of those statements are undeniably true. But policy choices matter. And what I’m hearing says to me that, yes, we are going over the fiscal cliff – irrespective of the narrative around rising jobless claims.

The prospects for a quick agreement between the Trump administration and congressional Democrats on a new round of aid for the ailing economy faded on Wednesday, as President Trump undercut his own party’s efforts to negotiate a deal and a top White House official declared that a lifeline to unemployed workers would run out as scheduled at week’s end.

With negotiations barely started to find a middle ground between Republicans’ $1 trillion plan and Democrats’ $3 trillion package, Mr. Trump poured cold water on the entire enterprise, saying that he would prefer a bare-bones package that would send “payments to the people” and protect them from being evicted.

“The rest of it, we’re so far apart, we don’t care,” Mr. Trump said before leaving the White House for an event in Texas. “We really don’t care.”

This is not good.

My View

Let’s remember what I wrote ten days ago.

President Trump might act as a lame duck if the polls move against him and he thinks he can’t win in November. He will have nothing to lose in not compromising with the Congressional Democrats. And that might mean US policy that’s even less than sub-optimal and more like a scorched earth policy that ends us in a Depression. Not a base case, but certainly imminently possible

Watch future policy responses with this in mind. When I wrote that, I had a second scenario in mind though. Instead of conceding defeat and going scorched earth, Trump may be thinking he needs to do whatever it takes to win. And that mindset would be even worse for the US economy.

For example, this morning, Trump suggested we delay the November US presidential election. I see this as a trial balloon. He’s floating the idea in preparation for potentially doing it. That’s essentially a coup d’etat.

I am not being alarmist. It’s time to hit the panic button. The US – and the world – is now facing its biggest crisis since World War 2, with the US President looking to prevent his departure from office by any means necessary in the middle of a global pandemic and economic depression. As we speak, the US is headed for a fiscal cliff that could mean double dip. And a double dip equals Depression with a capital D, not a small D. I don’t think any manner of Fed policy intervention will override that.

I am not optimistic. On its face, this pandemic crisis seems solvable. We could even get through this in a reverse radical-style recovery, with the right public health and economic policy responses. It’s a question of political will.

But the US political system is badly broken. And no worst case scenario – neither political nor economic – can be ruled out.

Comments are closed.