More on the fiscal cliff and a double dip

The new normal

We are in the middle of a grand social experiment. That’s the overriding thought I had this morning as I looked out my bathroom window on the empty streets below. Some of the longer-term impacts of this experiment are clear – like the lack of commuter traffic. But much remains to be determined.

That’s the head space I am in as I write this morning. I have developed a new normal, settling into my pandemic lifestyle better than many of those closest to me. I leave the house to ride my bike – which allows me to see my mother and sister. But that’s pretty much it. And I am fine with that. I don’t need more. I desperately wanted to celebrate my deceased friend’s life back in June. And was heartbroken that I couldn’t. But, I am fine with my day-to-day.

How long will this new normal last though? I may be fine with it for now. But, for how long? And what about people who need people more than me like my 14 year-old son? How long can he handle the new normal?

The economy of the new normal

All of this speculation was precipitated by an article I read this morning about the upcoming GDP numbers out of Sweden. The title says it all: “Virus Hit to Sweden’s Economy Seen Among Least Bad in Europe“. Here’s the gist:

Data this week could confirm how Sweden’s contentious decision to avoid a full lockdown at the start of the coronavirus pandemic has spared its economy from the worst of the fallout.

On Wednesday, Sweden will publish a keenly anticipated flash indicator for second-quarter GDP, and economists surveyed by Bloomberg are expecting a 7% contraction, according to median estimates.

While that would mark an unprecedented drop for the Nordic region’s biggest economy, it’s considerably less than the recent hits suffered in the U.S. and the 19-member euro area.

As you may know, despite the death toll Sweden has sustained, I have some sympathy for their public health strategy. As I understand it, it has been designed for a sustainable new normal more than an absolute minimization of viral contagion and death. The thinking was that the coronavirus problem would be with us for months and years. And the country, therefore, needed a public health approach that it could maintain over the entire time period this pandemic was a threat.

It’s very debatable and highly contentious whether Sweden took the right approach initially when compared to its Nordic brethren since those countries have also been less scarred by the Covid-19 pandemic. But, what I believe most countries are looking to do is to get to a Swedish outcome as quickly as possible; we all want a new normal that is as minimally restrictive and safe as possible. For me, Sweden is the gold standard on that mark.

The second wave epidemic

I had wanted to write an update to last week’s post about the US economy and the fiscal cliff. But, having pored over the news flow, this morning, I felt I had to contextualize first, because a lot of it is based on where we are in the public health crisis. Looking out onto the empty streets this morning crystallized the context for me; It gave me a palpable sense that we are going through several serious, wide-ranging and long-lasting changes in how we live, work and use our leisure time. And there’s little I see that tells me this will change anytime soon.

Part of it is that the world we live in is unsustainable. The social distancing, travel, work and leisure changes are too abrupt and too restrictive to be maintained for the long haul. Just yesterday, my sister told me that my cousin’s nephew and a friend went to Las Vegas, taking on little in the way of social distancing precautions. When he returned home, he infected my cousin, who ended up in the hospital with Covid-19 and is now recovering at home. Was my cousin’s nephew reckless? Yes. Is his behavior to be expected from many people under the age of 30? Absolutely.

This is why we are seeing second waves pop up throughout the world, including in countries that were models during the first wave. Much of it is driven by the behavior of younger adults unable to properly social distance. And once it hits the under 30 set, it will eventually seep out and hit everyone else too. Japan has a big second wave problem. Australia has one too, with Victoria in lockdown now. Victoria is seeing jobs devastation as the state’s economy goes into deep freeze. In tourism-heavy Spain, the recent virus spike has been catastrophic for the leisure industry. The UK and France have warned off travellers.

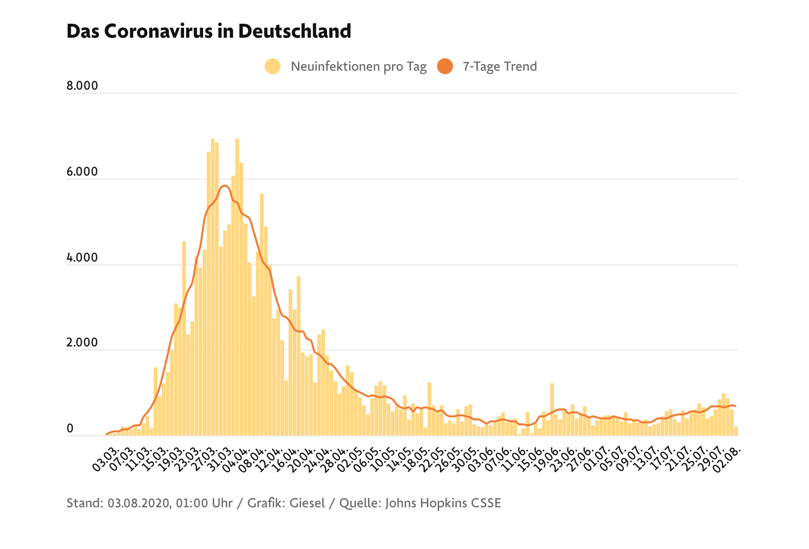

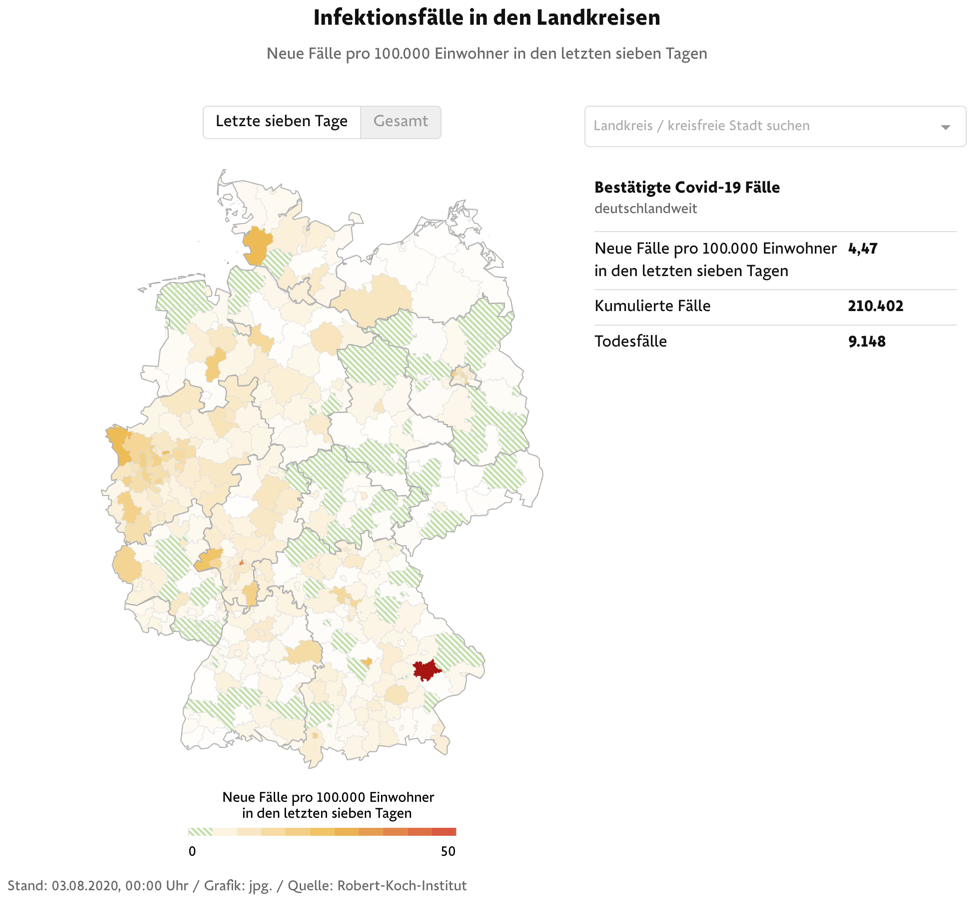

To give this some context, here are some charts from German newspaper FAZ. The first chart shows the number of new infections per day and the 7-day rolling average.

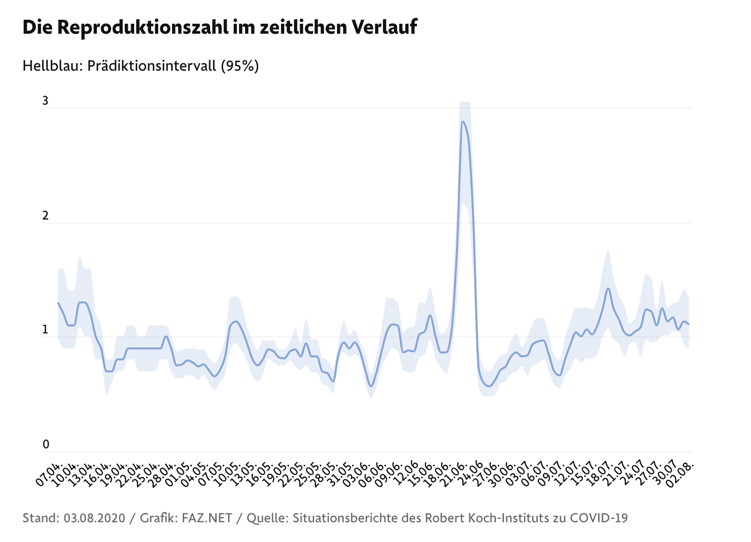

The numbers are up. So, even Germany is having a second wave. But the numbers in the second wave are not that high compared to the first wave. Even so, we wouldn’t know this based upon the viral reproduction rate, which is over 1.0 now, meaning each person with Covid infects more than one additional person.

The fact that the reproduction rate is over 1 but the case counts are down tells you that social distancing, testing and tracing protocols are largely working in Germany for the time being. Most of the cases are associated with outbreaks in cluster that are quarantined, minimizing the damage to everyone else.

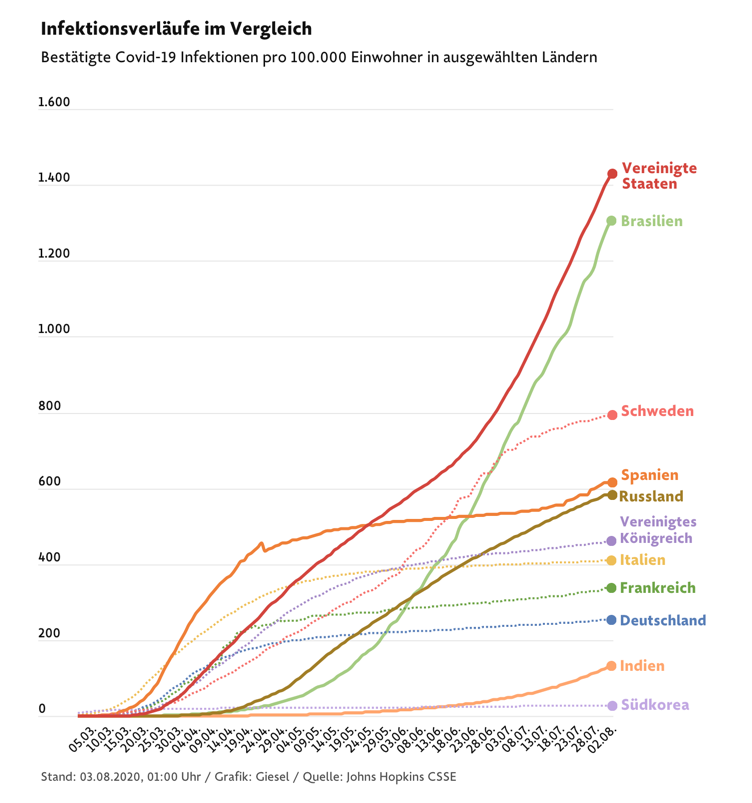

If you look at Germany in comparison to the US or Brazil, it has flattened the curve. Notice Sweden’s curve though – high but flattened. The US is the worst and the curve has also not flattened.

So, while the US is uniquely bad on the coronavirus front, in large part because of a very poor public health response, second waves are happening all across the world right now.

The economic consequences

This is trouble economically. It’s not the size of the wave that matters either. Let me explain this in two parts, using different articles from the Financial Times as macro lenses.

First, there’s Gavyn Davies’ piece “The anatomy of a very brief bear market“. I would sum up his view as one in which the equity price crash and rebound cannot be explained by monumental changes in the macro corporate earnings outlook. Instead, what seems to have happened is that equity risk premia went through the roof in February and March and then collapsed after the Fed intervened and provided a floor for risk assets.

My takeaway from this framing is that the February and March panic was a financial crisis, a liquidity crisis that threatened to wreak havoc on our financial system until the Fed intervened. And now that they have intervened, the chance of a second severe liquidity crisis is much diminished. And to the degree we don’t see a liquidity crisis, aggregate changes to share prices will be driven much more by changes to the earnings outlook.

In this earnings season, companies have generally outperformed. But that’s because earnings estimates were slashed. My strong suspicion is that this resilience will be tested in the months and quarters to come as the coronavirus stays with us.

A perfect example of why comes from Rana Foroohar’s piece on why “Tourism’s collapse could trigger next stage of the crisis“. I would sum up her view as one in which tourism has fundamentally changed from a global enterprise to a much more local one. And while one can envisage a future in which a more locally-based tourism is equally dynamic to the globalized version we used to have, the transition is going to be painful.

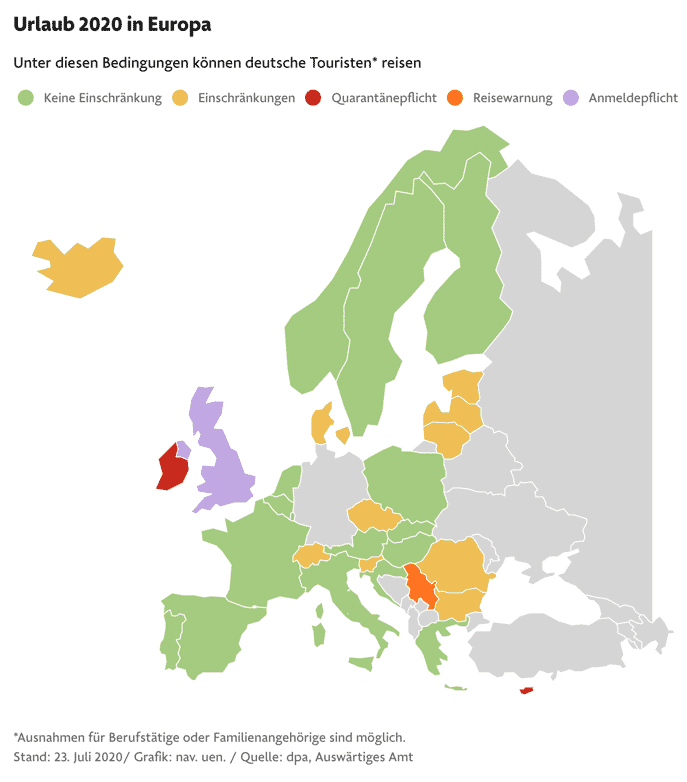

In the German newspaper FAZ, they are outlining where in Europe it is safe to travel.

And this concern is even within Germany.

Foroohar’s view:

Congress cannot agree on the next stimulus package, and viral cases are surging. Nearly 17m American jobs are at risk as a result of the tourism downturn alone. Countless companies may be threatened, too. Even with billions of dollars in government aid programmes, US commercial bankruptcies were up 43 per cent in June compared with the same month of 2019. It is hard to imagine what will happen when the bailouts stop coming.

Foroohar goes on to talk about travel from a commuting perspective, the idea I started this post with. The ‘ghost town’ motif outside my window is going to be absolutely devastating on commercial real estate, not just for offices but especially for retail.

The apparel industry has been hit particularly hard by the pandemic, prompting bankruptcy filings from retailers like the Neiman Marcus Group, J. Crew and J.C. Penney. Lord & Taylor, once a major presence in America’s department stores, and its owner Le Tote filed for bankruptcy several hours before Tailored Brands on Sunday. The owner of Ann Taylor and Lane Bryant, Ascena Retail, which just a few years ago was one of the country’s largest retailers for affordable professional clothing for women, sought Chapter 11 protection on July 23.

My take

Let me sum up at this point. The post-lockdown lifestyles we have chosen are not sustainable over the long haul. Maybe the mask-wearing can go on for a long time. But the social distancing is simply unsustainable; we are social creatures that cannot operate in tiny little social bubbles for years on end.

Everyone is hoping that a vaccine will bail us out. But if we don’t get a vaccine bailout, we are going to continue to see infection spikes for the foreseeable future. And that’s going to change behavior.

I think some behavioral changes are permanent or semi-permanent: less use of public transport, more remote work, less in-person retail use, less leisure in mass venues, and less long haul leisure travel. We have already seen a lot of bankruptcies in these arenas. But I believe many, many more are to come. In the US, the fiscal cliff will accelerate that coming.

Right now, Congress and the US president are at an impasse over how exactly to support the economy as the pandemic rages on. The proximate reasons are political. But, the real reason for the impasse is the same as elsewhere: US politicians were hoping the pandemic would pass more quickly. It hasn’t done. And as a result, Covid-19-associated benefits have run out just as the second wave is reaching its apogee.

I think this means the coming wave of bankruptcies will not just be accelerated but also more severe, even if Congress does get something passed in due course. The potential for a double dip has risen as a result.

Q2 2020 came in at -32.9% annualized. That’s a 9.5% drop in absolute terms. The expectation for Q3 is a bump of 17% in annualized GDP, with the Atlanta Fed GDPNow at 11.9%. How far below those numbers could GDP growth come in? Could Q3 or Q4 see a negative number? If the policy response is bungled enough during the election season, I think the answer is yes.

Whether this counts as one continuous recession or two, the message is clear: the US is going to go through a W-style downturn. How poor the second leg down turns out to be will depend on the public health and economic policy response. Both are severely lacking at the moment. So the risks in the US, much more than elsewhere in the advanced economies, are to the downside.

Comments are closed.