Wages might finally be beginning to rise

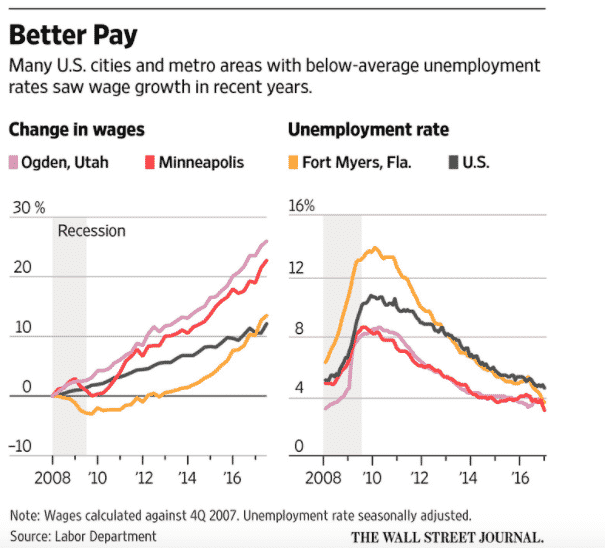

The Wall Street Journal has a piece out about wage rates in the tightest urban markets like Minneapolis. And what they found is that wages rates in these markets is beginning to rise. That doesn’t mean inflation will rise. However, it does put more pressure on the Fed.

We’re talking about regions with unemployment levels well below the national average 4.1%. Minneapolis, for example, has 2.3% unemployment and private-sector weekly wage rates there are increasing at a 4% clip, according to the Wall Street Journal.

The analysis from Moodys Analytics is what I suspect Fed officials will be thinking:

City-level data “show the relationship between wage growth and a tight labor market still holds,” said Adam Kamins, senior economist at Moody’s Analytics. “You’re seeing the first movers into full employment and past it, with the uptick in wage growth.”

If the Fed sees this data and this thinking reflects how the Fed sees the situation, we should expect the Fed to feel vindicated for raising interest rates. Moreover, the Fed would have less reason to deviate from its stated policy path, which includes 3 — or potentially 4 — rate hikes this calendar year.

Key takeaway: it’s not a foregone conclusion, even if wage rates rise more briskly, that this will translate into inflation. Moreover, the 2% inflation level is supposed to be a target, not a ceiling. Ostensibly the Fed could allow the economy to ‘run hot’ by accepting inflation rates above 2% with policy no tighter than with the equivalent inflation levels we have experienced below 2%. But all evidence is that these kinds of data will draw a further tightening from the Fed. Though Janet Yellen is no longer in the Fed chair set, she set the tone when she poo-pooed the concept of allowing the economy to run hot – something she actually had written about in October 2016.

These are exactly the kind of data the Fed is looking for to reinforce its view that very, very low unemployment leads to inflation and must be addressed pre-emptively.

Comments are closed.