The macro crystal ball: macro framing and historical antecedents

Happy June!!

Listen, I want to start this month with a thought piece rather than a data piece. And this is going to be a pretty long post. But I think it’s important because I plan to build on it.

Now, I showed you some data last week on jobless claims, a series I have been following for some 20 years. And what was clear to me was that the nature of this recession and recovery is so different than previous cyclical troughs that we really have to go back to basics in understanding how the economy and markets will develop. And that requires a good macro framing first, followed by data from historical antecedents second because the historical comparisons will be limited in their applicability.

So I am going to tell you how I am thinking about this. And hopefully, we can turn to the data in due course. And note, while I would love to perform some linear regressions to show you robust correlations, I am going to flag that as more illustrative than determinative, especially given the unique nature of this downturn.

Three Main Macro Pillars

On the macro framing front, there’s the intersection of three main variables I am thinking of. Variable one is on business cycle internals and how production, employment, and wages interact to create cycle troughs and to bring economies out of recession. Variable two goes to both the orientation and efficacy and of government macroeconomic policy. And to me, this is the biggest variable because we are seeing a potentially seismic shift that can have far reaching implications. Lastly, there are the market internals in terms of profit margins, earnings growth and mean reversion. These are huge factors in determining risk tolerance, momentum and, therefore, valuation.

Let me take these one at a time. And having written about each in the past, I am going to borrow some ideas from past posts here at Credit Writedowns.

The Four Horsemen of the Economy

I first used the ‘four horsemen’ framing of business cycle internals in October 2008. Here’s a link to that post. The concept starts with the fact that the arbiter of US recessions, the National Bureau of Economic Research, relies on four data areas to date recessions: consumption, production, employment and wages. To classify a period as a recession, the NBER needs to see pervasive and long-lasting declines across these four areas. And usually they can only do so with many months of hindsight.

In this market cycle, they called the top as February 2020 really early because the lockdown sudden stop is unique in history. There was no mistaking the loss of GDP. The real question was whether the pause was long enough to qualify as a recession. To this, the NBER said in June 2020:

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

Here’s the thing. The NBER still hasn’t dated the recovery. I am not sure why they are holding out given the US lockdown ended a year ago. But, the fact that they are waiting should give one pause regarding how to think about the nature and durability of the upswing in Gross Domestic Product and Gross Domestic Income.

In my framing from 2008, there is a sequencing that I am looking for though. The sequence goes from consumers’ wages to consumption to industrial production to capital spending and corporate profits. That means wages should be key to the strength and durability of a recovery. While employment and capital spending are lagging indicators, rather than drivers of the business cycle.

So, I am looking for signs that we are seeing a durable and pervasive uptick in wage growth that can drive a sustainable pickup in consumer spending across a whole business cycle. Tis will in turn increase employment, production and capital spending durably.

The upshot of this framing is that, given the level of government transfer payments we have experienced to date, it is very hard to make a solid case for the durability of the business cycle at this time. Once we see pandemic unemployment assistance wane as a variable and schools re-open to allow for child care, we will have a better gauge of the way forward.

The paradigm shift in macroeconomic support

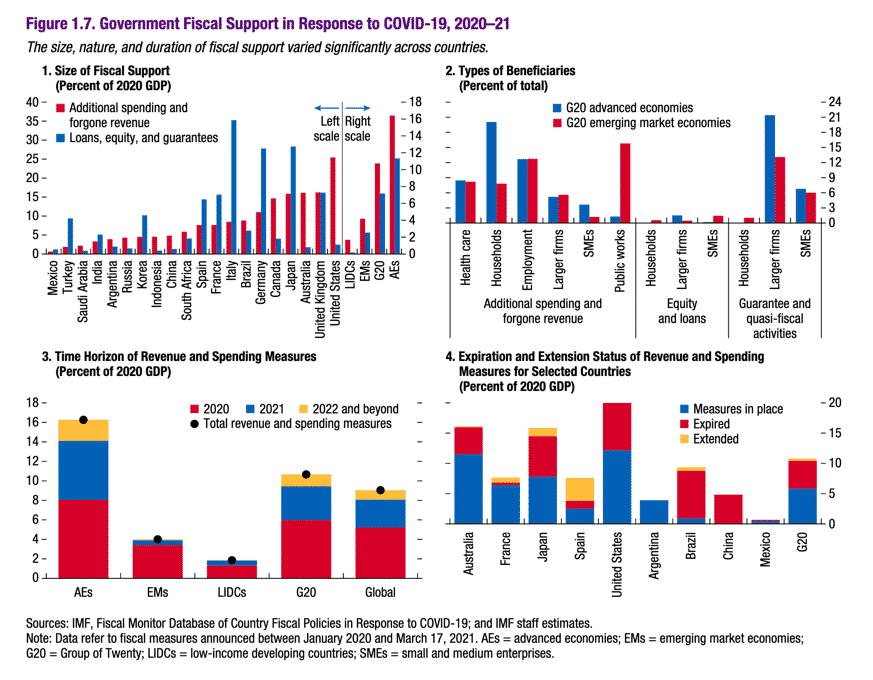

All of that seems relatively straightforward. But when you add macro policy into the mix, you have an additional variable that changes things. Moreover, given the massive support we have seen globally from policymakers on both the fiscal and monetary side and a regime shift in their willingness to provide that support, I would claim we are in a brave new world. Look at the scale of support. It’s unprecedented in peacetime.

Source: International Monetary Fund

The IMF is leading the way in the shift in thinking about adding fiscal support without thinking putting the deficit implications front and centre:

Policymakers need to balance the risks from large and growing public and private debt with the risks from premature withdrawal of fiscal support, which could slow the recovery. Credible medium-term fiscal frameworks are critical for attaining such balance, setting a path for rebuilding fiscal buffers at a pace contingent on the recovery. This effort could be supported by improving the design of fiscal rules or recalibrating their limits to ensure a credible path of adjustments or legislation such as “preapproving” future tax reforms. Improving fiscal transparency and governance practices can help economies reap the full benefits of fiscal support.

Translation: In our view, there is still an intertemporal government balance sheet constraint. But this pandemic is like a war. And so we need to deficit spend now, while recognizing the need to signal a return to fiscal probity once the coast is clear.

In the US, the Biden Administration is acting largely under this framing. They are not using an Modern Monetary Theory framing of the paradigm shift. For them, deficits matter but only in the medium to long-term.

The exact same debates are occurring everywhere in the G-20. Germany is certainly seeing a re-framing of the black zero thinking of yesteryear, for example (link here in German).

I would call this a move away from ‘monetary dominance’ where cutting interest rates at cycle troughs was the biggest macro policy variable to employ. This is in part out of necessity since rates have reached the zero lower bound and other emergency monetary policies are of questionable efficacy.

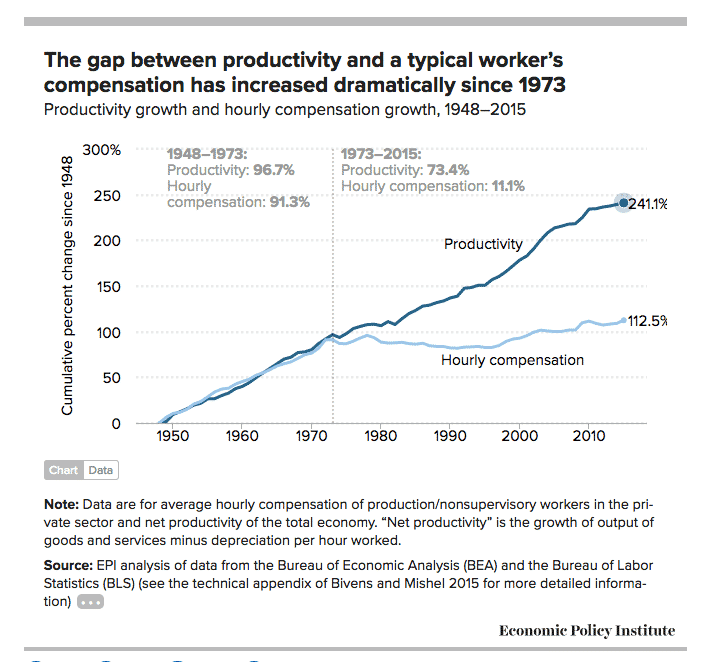

But it also a sea change in terms of the acceptance of actively using fiscal policy to ‘steer’ the economy. The old paradigm has coincided with a large increase in intra-nation income inequality while decreasing inter0nation inequality. That has caused intra-country resentments and political polarization to rise to dangerous levels. For that reason, I expect some kind of minimum global corporate tax regime to be agreed to in principle in the upcoming G-20 meeting.

Nevertheless, the question goes to the efficacy of policy on both the monetary and fiscal side. How effective are various policies in dealing with financial and political stability, closing gaps in income inequality within countries, in maintaining low levels of inflation over the medium term and in helping the economy close output gaps and reach full employment? We simply don’t know – especially in the aftermath of a pandemic when the new normal may be very different to the old normal.

The IMF, for their part, say:

The targeting of measures must be improved and tailored to countries’ administrative capacity so that fiscal support can be maintained for the duration of the crisis—considering an uncertain and uneven recovery. Given the low-interest environment, a synchronized green public investment push by countries with fiscal space can foster global growth.

One last note here: The Fed seems to have changed. When you listen to Fed Chairman Jay Powell, in the wake of the pandemic, he shows a lot of concern about lower income workers. It appears there is a shift in thinking at the Fed regarding income inequality and the Fed’s role in fostering it by snuffing out recoveries.

In the past four decades, the Fed has been quick to move preemptively against inflation when they saw signs of wage gains because the y believed that there was a floor on unemployment that would make inflation accelerate and spiral out of control. They no longer believe in this. Now, they want to wait until they see the whites of inflation’s eyes because employment has de facto moved to the Fed’s primary mandate, with inflation taking a back seat.

How long the Fed stays in this mode remains to be seen, however.

The four horsemen of this cyclical bull market rally

Now we get to the market part! About six years, I wrote a post I called “The four horsemen of this cyclical bull market rally“. And I was thinking about this as an analogue to the 2008 post I referenced above. I summed up the mental model this way:

- In the short-to-medium term profit margins can rise or fall due to factors like operating leverage or cost-cutting.

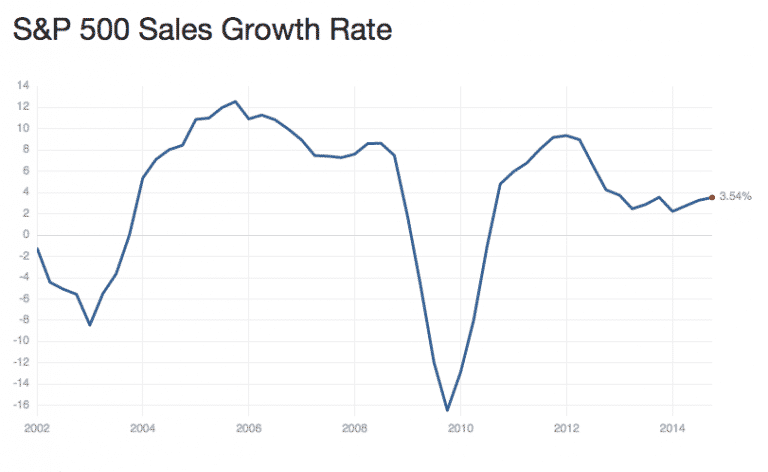

- However, over the long-term, profit margins are relatively stable and mean-reverting such that the driving force behind share performance is sales growth.

- In terms of share price, three other factors come into play that can boost prices over the short-to-medium term. One is the business cycle, which we can see from the ebb and flow of sales growth in the chart above. The other two factors are the other two horsemen I identified, share buybacks and multiple expansion.

- Over the long-term, the business cycle won’t matter. But share buybacks and multiple expansion can add to EPS growth and share price growth for far longer than one business cycle, as the last 35 years have demonstrated

How would I re-frame this now though?

I think the first point on the variability of profit margins stays the same. The second point is questionable though. I know Jeremy Grantham’s outfit GMO have done some work on this. But, without reading their work and having interviewed two of their deep thinkers, Matt Kadnar and Ben Inker, there are two variables I am thinking about here. One is the labor share of income. And that has diminished, seemingly durably.

That means fatter profit margins. The question is whether the policy paradigm shift toward fiscal and the Fed’s willingness to prioritize employment over inflation changes that. And we don’t know how corporate tax policy changes that either.

The second variable I have in mind when thinking about high margins not reverting to mean is the change in the nature of corporate balance sheets toward having more assets in intellectual property. I think IP is increasingly important in driving profitability and that means property, plants and equipment shrink as a percentage of balance sheets and labor shrinks as a percentage of revenue. All else equal, this should mean higher profitability. And so while profits may be mean reverting, they could be reverting to a higher mean because of the changed nature of how we buy and sell things and services.

On the third point, I had posted this image showing the cyclical nature of sales.

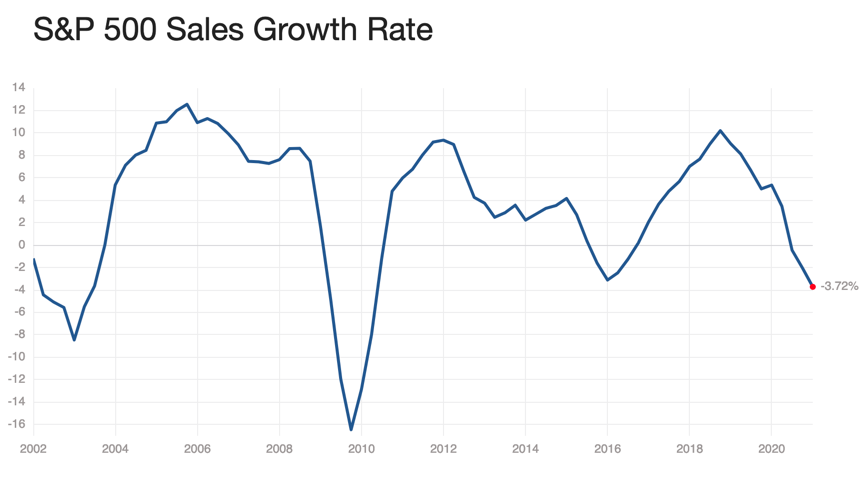

That time series looks like this through early 2020.

That time series looks like this through early 2020.

But the point of the third bullet was to marry markets to the first subject of this macro framework, the business cycle. There is bound to be variation across the business cycle in sales, in buybacks, and in ‘earnings visibility’. As we come down from cycle peaks into recessions that will affect profits and earnings multiples. But it should only be temporary. Right now, we simply don’t know how temporary temporary is, just like the debate over inflation.

The last point goes to what makes for secular bull markets. Share buybacks and earnings multiple expansions are hugely important there.

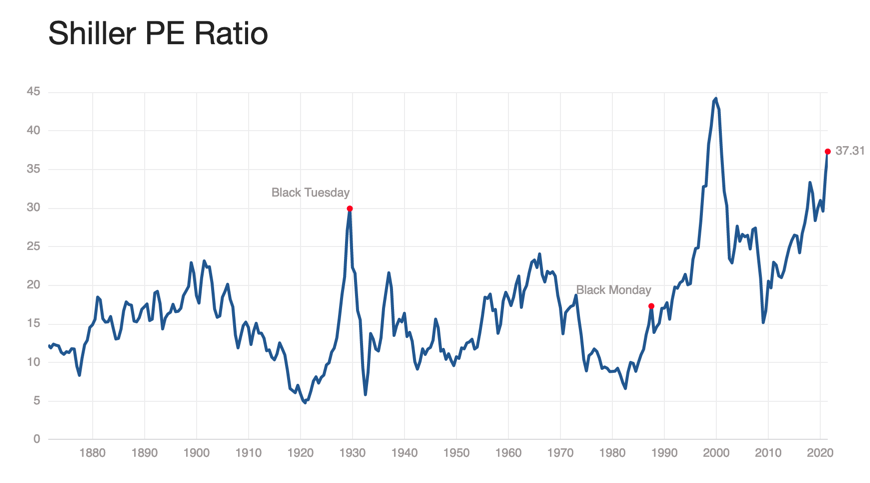

Source: Multpl.com

Right now, multiples are at their highest outside of the dotcom era. From a contrarian perspective, we should expect serious mean reversion here over the longer term. And that means underperformance for indexers and closet indexers

Putting it together

So, we have a lot of variables here and not a lot of visibility given the unprecedented nature of this cycle turn. To me, this speaks to why the NBER was able to date the cycle peak so quickly but has yet to call a cycle trough despite historic levels of GDI and GDP growth. I think they are waiting for more clarity on the sustainability of the uptick.

In the absence of clarity, we can use this framework to watch the most relevant data.

- On the econ side, I continue to believe that wage growth is the principle generator of durable consumption growth in the absence of debt accumulation. And so, we should look to post-September numbers as indicative of how good a new normal can be. Poor wage growth means less headroom for consumption, less secular growth in employment and business investment and a return to secular stagnation. Greater wage growth means higher nominal GDP growth and rising inflationary pressures

- On the policy side, the potential for inflationary pressures to rise is where we have to be most concentrated. Has the Fed really shifted its thinking? When will the willingness to accept deficit spending end? Neither of those questions has definitive answers at this juncture. And the historic nature of the change in policy means that these questions are important regarding the amplitude of the recovery uptick and cycle durability.

- Finally, we are starting this cyclical bull market with a massive surge in the midst of a historically high earnings multiple. To me, that speaks to a higher level of long-term downside risk for equities, junk bonds and other riskier asset classes. I find it hard to believe that multiples can go much higher and remain there for any extended period of time. I still see multiples as mean-reverting, even if that mean is higher than it was in the past.

Data-wise then, what’s to come is a drill down into what I am seeing on all these fronts, how it compares to past cycles, and what we can take away based on that data comparison. I’ve shown you jobless claims. Expect more in the coming weeks. But bear in mind the uniqueness of what we are living through. There’s only so much looking to the past that will help us unfog our crystal ball.

Comments are closed.