Europe: Don’t call it a comeback

I have four things on my mind today: Bullish PMIs in Europe, the electric Ford F-150 launch, non-payment on bond by Unicredit, and the Biden Administration’s non-embrace of MMT. Let’s take each of these in turn

European economic data

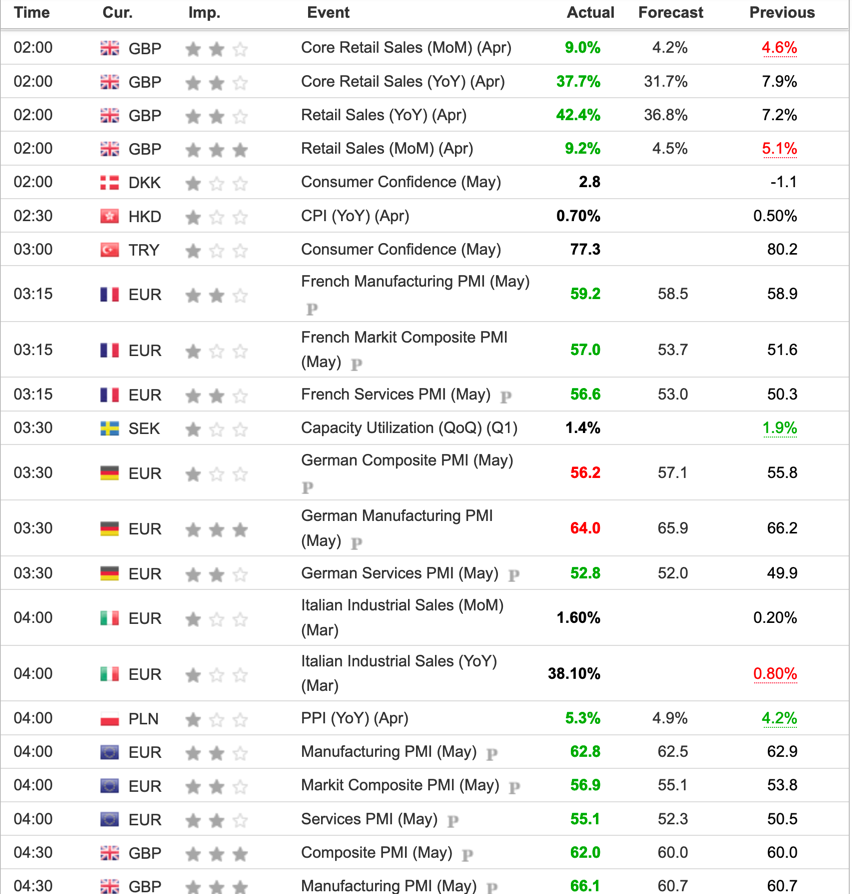

Look at the data prints from overnight in Europe. They are really good.

Source: Investing.com

The only real miss was German manufacturing, which also caused the German Composite PMI to miss. But all the green you see shows not just great numbers but numbers ahead of expectations.

How do you play this at a time when the coronavirus is absolutely raging? A lot of Americans forget during the US full re-opening that the Covid-19 crisis is at near its most acute globally right now. And Europe has been worse than the US after nailing the initial re-opening in 2020.

But Europe is coming back. These data points tell you that. And what it’s telling you is that European growth is going to play catch up to the US and perhaps even outperform. I anticipate more green in the weeks to come where I see downside risk in the US due to the roll off of the initial stimulus packages of the year.

So that has me thinking about my April 26 post where I basically said that the political headwinds to more stimulus in the US were mounting but that European re-opening was going to be bullish for Europe.

…the fiscal picture affecting the medium-term outlook in the US. It’s accommodative but not as accommodative as it has been. And against a massive uptick in shares, it may not be enough to sustain momentum in the market.

…I think the odds of the US outperforming Europe as Europe reopens from midyear are lower than at any time since the lockdowns and 2nd wave in the US last year. And the relative gap this time is much larger, meaning the downside performance risk in the US is greater.

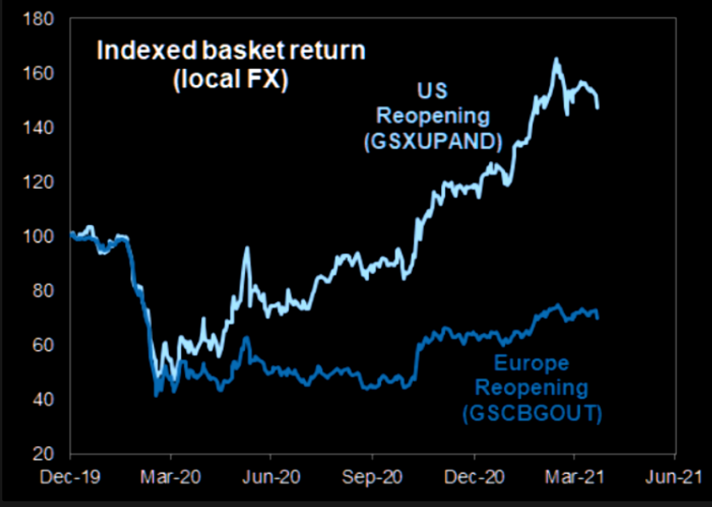

Here’s the chart from Goldman I posted that had me make that last point about European outperformance.

There’s a lot more upside in Europe available. And while the US has seen a pullback since I wrote this piece, I still think the US markets are vulnerable to more slippage, due to risk on both growth and inflation. *Note that as I wrote this thee Markit US Composite PMI came in off the charts good at 68.1 vs 63.5 in the previous month. So we still have upside in the US.

Tesla as the poster child

Even so, let’s use Tesla as a lesson here. The stock peaked at just about $900 a share, near a trillion dollar market cap during the heady days of the reflation trade in late January and early February. It’s been downhill ever since with a third of the value of shares having been cut from Tesla.

Let’s forget about momentum for a second. The way I am looking at this is true the lens of optionality:

Now, if you think of all of this from a derivatives market perspective, with low earning or long duration momentum stocks, you’re effectively buying a long-dated call option with huge amounts of implied volatility. The premium is huge because of the huge optionality.

That’s a quote from my Aug 12 post. Go there for the full framing. The upshot is that when I shared this framing with GMO’s Ben Inker he told me to think of a company maturing and volatility — and therefore optionality — diminishing. After the interview, I wrote in September:

In the real world, that simply means that what seems like limitless possibilities in a company’s growth today will become much more limited five years down the line. And the share price will decline as a result.

That’s exactly where the F-150 Lightning announcement comes in. They absolutely nailed that intro. It was Apple-like press conference perfection. And Ford are absolutely running up the pre-orders now. Deliveries are a year from now.

This is option-negative for Tesla. If you think about the limitless blue-sky possibilities of Tesla from the reflation trade days, in my view, the F-150 lightning reality shows there are a more narrow set of outcomes with Tesla upside capped. This is just as Inker said.

And remember, we have the likes of Volkswagen competing directly with existing Tesla product rolling out vehicles.

This is what’s happening all around for the US market. If you think of the US reopening play as one of embedded optionality, we are now seeing option value capped as reality reveals a more limited set of outcomes. And that’s negative for share prices. Europe is looking forward with greater optionality simply because their prices have yet to run up and they are not as far along in the re-opening. Upside scenarios will be at their max over the next several weeks as a result.

Unicredit as the poster child

But then there’s this odd Unicredit announcement I caughton Bloomberg News.

UniCredit SpA’s Chief Executive Officer Andrea Orcel shocked investors with a decision to skip a coupon payment on $3.6 billion of hybrid bonds due later this month, an abrupt u-turn that risks eroding confidence in the bank just weeks after he got the role.

The Milan-based lender won’t pay a quarterly coupon of around 30 million euros ($36.7 million) due May 25 because it reported a net loss for last year, one of the conditions under which it can miss obligations on the 2.98 billion-euros of notes, according to a statement emailed to Bloomberg.

Why would a company do this? I understand it has the legal option for non-payment. But the signalling effect is horrible. Investors are even saying so. In the same Bloomberg article it quotes one investor:

“The fact they are not paying is crazy,” said Jerome Legras, a managing partner and head of research at Axiom Alternative Investments, which holds some of the notes. “Why would we trust them on AT1 bonds?”

So, let’s just remember that optionality means a range of outcomes to the downside and to the upside. There are downside risks for Europe too. And this highlights one of them: the undercapitalized European banking sector.

I still think the fact that Europe is re-opening now and its re-opening shares haven’t run as much as the US makes you want to overweight Europe relative to the US for the time being.

Biden and MMT

Let me come back to the US to finish this post off. A lot of people are talking about Modern Monetary Theory these days. And to be honest with you, a lot of what I hear is absolute nonsense. It’s people who don’t understand MMT shoehorning their own political and ideological biases into a policy debate. And that bias pernicious especially to the degree you’re looking to make predictions.

So, it was interesting for me to hear Jared Bernstein, an important economic advisor to Joe Biden, on the Odd Lots podcast with Tracy Alloway and Joe Weisenthal. He basically said “Joe Biden is not doing MMT”. He didn’t use those words but he did say that Joe Biden wants to ‘pay for stuff’ over the medium term rather than run up the deficit. And I think this important.

From a political perspective, what we have is a Congress sharply but evenly divided on political lines with the Democrats having razor-thin majorities. Republicans have said their goal is to block everything Biden wants to do. On top of that, you have a Democratic leadership that is old. Both in the House and the Senate as well as in the White House, you have a New Democrat leader – someone who sees the fiscal probity of the Bill Clinton years as a defining element for electoral and economic success. And you are constrained by moderate Democrats like Joe Manchin and Kyrsten Sinema, something I wrote about in April.

What that’s telling you is the Democrats are going to close the fiscal gap. They might take progressive moves on policy. But they are going to do pay fors by raising taxes. And they are unlikely to go big. Bigness was a pandemic make-good, a relief remedy. Bigness is not going to happen in terms of fiscal stimulus.

This all means the US economy is vulnerable to downside risk. Once the impact of the existing ‘stimmy checks’ and the demand boost from re-opening fade, you have downside risk.

My View

I look at all of this and I see a US equity market that is challenged. I also see a US bond market with upside. One thing to remember about yields is that the yield curve is at its most convex, its most non-linear at levels below where we are now. So to the degree downside US economic risk crystallizes, we could see a massive rally in bonds supported by two factors: convexity forcing insurance and pension companies to buy to keep their portfolio duration constant and a massive short position in Treasuries forcing short covering.

On the US equities side of things, a rally in bonds puts a floor under prices. But the loss of upside earnings optionality will be acting in opposition to that. So its anyone’s guess how that would play out. I prefer to think of it as a relative value play versus Europe where there is more optionality as opposed to a US directional play.

I am going to leave it there with this positive thought: light is at the end of the tunnel. The US is on the other side now. Everyone will eventually follow. We simply need to maintain caution so as to prevent deadly mutations and we can all get there sooner than later.

Comments are closed.