Chinese regulation, the top of the market and investing in the future

I was talking to my colleague Jack Farley about the financial news flow earlier today. (We’re recording a Real Vision Daily Briefing at 4:30PM EDT). He and I agreed that crypto seemed to dominate the headlines. But he and I are also sick of talking about cryptocurrencies all the time. So we have been looking for other threads of importance to contextualize. What you’re about to read is the outcome.

I have three broad themes – and it terms out crypto is part of it. As the title says, I want to share some thoughts with you about Chinese regulation, about markets that seem ‘toppy’ and about ways to keep the economy going strong. Fortunately, they also happen to all be interrelated. So, here goes.

The Chinese are all about financial stability now

Let’s start here, with excerpts of this Bloomberg article that came out yesterday:

Another trying workday was ending for Wang Zhanfeng, corporate chairman, Chinese Communist Party functionary—and, less happily, replacement for a man who very recently had been executed.

[…]

Welcome to the headquarters of China Huarong Asset Management Co., the troubled state-owned ‘bad bank’ that has set teeth on edge around the financial world.

For months now Wang and others have been trying to clean up the mess here at Huarong, an institution that sits—quite literally—at the center of China’s financial power structure…

[…]

The bigger issue is what all this might portend for the nation’s financial system and efforts by China’s leader, Xi Jinping, to centralize control, rein in years of risky borrowing and set the nation’s financial house in order.

The article is highly recommended reading for the insight it gives us into China’s political economy. The picture that emerges is one where, with the pandemic and its economic effects contained, financial stability has moved to centre stage.

Essentially, Xi Jinping is now prioritizing stable growth over high growth as China’s overall growth rate has declined. And so, now, rather than pump money into export- and infrastructure-led projects which have created a mountain of debt, China is concentrating on deepening its consumer base while cleaning up the debt problems years of heady growth have left behind. Huarong might be the poster child for this effort. But I believe the cryptocurrency market will soon be as well.

Over the past week, China has sent two shots across the crypto bow by reiterating stances on the dangers of crypto investing and by upping the ante to discourage and reduce cryptocurrency mining activity in China. And the result has been a lot of volatility in the crypto world, with Bitcoin getting cut in half at one point. As I write this Bitcoin is still some 40+% down from all time highs. And I believe regulatory pressure will only increase – both from China and elsewhere.

And this crackdown comes at exactly the wrong time for the crypto market because it was already under pressure from mixed messages Tesla CEO Elon Musk has been sending about the investment space, and under pressure from US regulators looking to reinforce their message that capital gains in the space for US nationals must be taxed.

So, is this the top of the market?

It doesn’t take a great leap of faith to thinking we’re seeing the top of the market for cryptocurrencies. I’ve talked about this before.

Make no mistake, there is a bubble happening in the cryptocurrency realm. And despite all of the HODLers telling you this is a normal correction right now, we do have to consider that it is a bubble popping, with massive losses all around.

But I am looking at crypto as less a unique island mania and more a manifestation of a larger speculative fervor. And so then the question becomes: what are the signs of a top and why should we think the top of the market is upon us.

On crypto, it’s the 50% drawdown that is exhibit number one. Exhibit number two is the 30% plus losses in the most speculative equities in the US like Tesla. And like the Ark Invest funds. But the there are other signs too.

Lance Roberts, who presciently warned of a bubble in stocks before the March 2020 crash, says shares are at their highest level EVER relative to their 3-year moving average. Roberts also highlights other signs of toppiness including:

- His firm RIA’s Fear/Greed Index, presently registering “extreme greed”

- Extreme levels of bullishness among professional money managers

- Margin debt near highs, with inflows into long leveraged ETFs relative to short leveraged ETFs at extremes

Coincidentally, Bloomberg’s John Authers showed an interesting chart today in his morning note along the same lines.

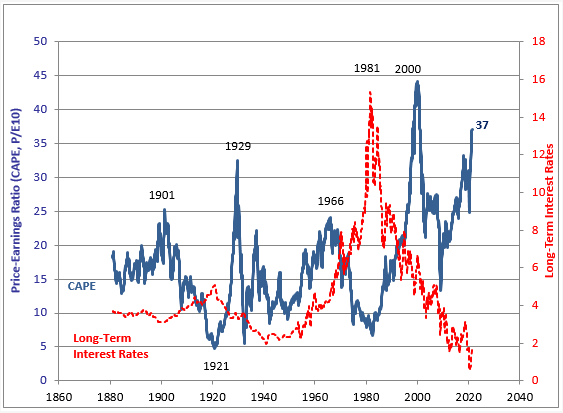

This is showing you that cycically-adjusted price-earnings ratios are at the highest levels ever outside of a few months during the Dotcom bubble. And while you can justify some multiple expansion because of the fall in interest rates, that justification doesn’t close the gap. We are at extremes.

And markets like this just don’t go sideways, they crash down. As Jeremy Grantham puts it:

…it is statistically simple to identity a two-sigma price move [when prices move two standard deviations out from their historical pattern] . . . and all of them went back to where they came from, all of them, every one”

Avoiding a crash

So how do we prove Grantham wrong? How do we justify the extremes by maybe going sideways? I’ll tell you why I’m thinking about this. Joe Weisenthal retweeted this earlier today:

Just got off a call with a builder in Iowa. Prices are comically different than where I am in CA, but the story is the same. He said he had to offload a family house and priced it at $115,000. It sold in 2 days with 25 offers for $175,000.#housingwows

— Ali Wolf (@AliWolfEcon) May 24, 2021

And my first thought was that I was starting to get a bit worried by this house price inflation. Housing has been a big part of the up-move in the US economy. And the last thing we want is another popped housing bubble. How do we get this thing to cool off by moving sideways?

And that’s where this post by Alex Williams came into play. Here’s the part I want to focus on:

If we can be sure that the final consumer demand will be there to validate new investments,…we should welcome the discovery of bottlenecks. They let the economy know where to make investments.

Williams posits with great effectiveness that the crap recovery we had from the Great Financial Crisis

created an environment of low demand that slowed investment, hiring and wage growth for at least a decade. Firms have adapted to this environment, and when faced with a sudden spike in demand, do not remember how to quickly add capacity.

That’s secular stagnation right there. And the way to defeat it, Williams says, is to allow wage growth to accelerate in order to sustainably boost demand. Remember back when Henry Ford doubled wages and demand went up? That was way back in 1914 so you probably don’t remember. But you may have heard about this from history books. This is exactly what we’re talking about happening here.

My View

And so, maybe if we ‘let the economy run hot’ as the US Federal Reserve would say, we can get out of the low growth, low investment trap. aka secular stagnation. And that would allow us to grow into valuations and maybe allow for house prices to pause as affordability caught up.

The alternative is pernicious, especially when you look at housing because houses are leveraged investments that are widely owned. Any decline in house prices means credit problems. And that’s the last thing we need since the US has only recently reduced household debt levels.

I am less concerned about stocks declining though that too could be destabilizing. And I am even less concerned about crypto since that space isn’t yet big enough to be destabilizing. Or maybe it is.

In any event, if I had to hazard a guess, I would say between the heady rise in crypto, stock prices and house prices and the overvaluation of US equities, some or all of these markets will correct downward violently. In fact, crypto already has. But because it is smaller, it doesn’t have to lead to a recession. What we want to avoid is the broader market and housing market crashing. And we can best do that by supporting the real economy in a way that promotes both wages and capital investment. The result would be inflation, of course. But I’d prefer that to a market crash and recession… or worse.

Comments are closed.