Double dip is now the base case for the US as well as the global economy

The incoming data in the US make clear that the US is now also in jeopardy of recording a double dip recession because of the latest Covid-19 wave, just as Europe before it. Moreover, the data also make clear that there is no healthcare – economy trade-off. During this pandemic, the two are inextricably linked. Comments follow below

Pandemics are different

There is so much to say that I don’t know where to start. So let me start with how I’m thinking about why the pandemic matters so much to the economy.

In a normal situation, there is a trade-off between protecting some aspect of the economy or society by erecting economic restrictions and the performance of the economy. Tariffs are a perfect example. Economics would tell you that erecting trade restrictions leads to worse outcomes economically irrespective.

As Michael Pettis wrote this morning, “We’ve experimented for decades with tariffs, quotas and purchase commitments – always keeping capital mobility sacrosanct – and have done almost nothing during all this time to change global trade imbalances.” But, even there, capital market restrictions might come at a cost too.

With a pandemic, this trade-off may not be there because, without pandemic-specific safeguards and protocols, societies will eventually reach healthcare system overload and shut down economically. We know this already from the Great Influenza a century ago.

Early implementation of certain interventions, including closure of schools, churches, and theaters, was associated with lower peak death rates, but no single intervention showed an association with improved aggregate outcomes for the 1918 phase of the pandemic. These findings support the hypothesis that rapid implementation of multiple NPIs can significantly reduce influenza transmission, but that viral spread will be renewed upon relaxation of such measures.

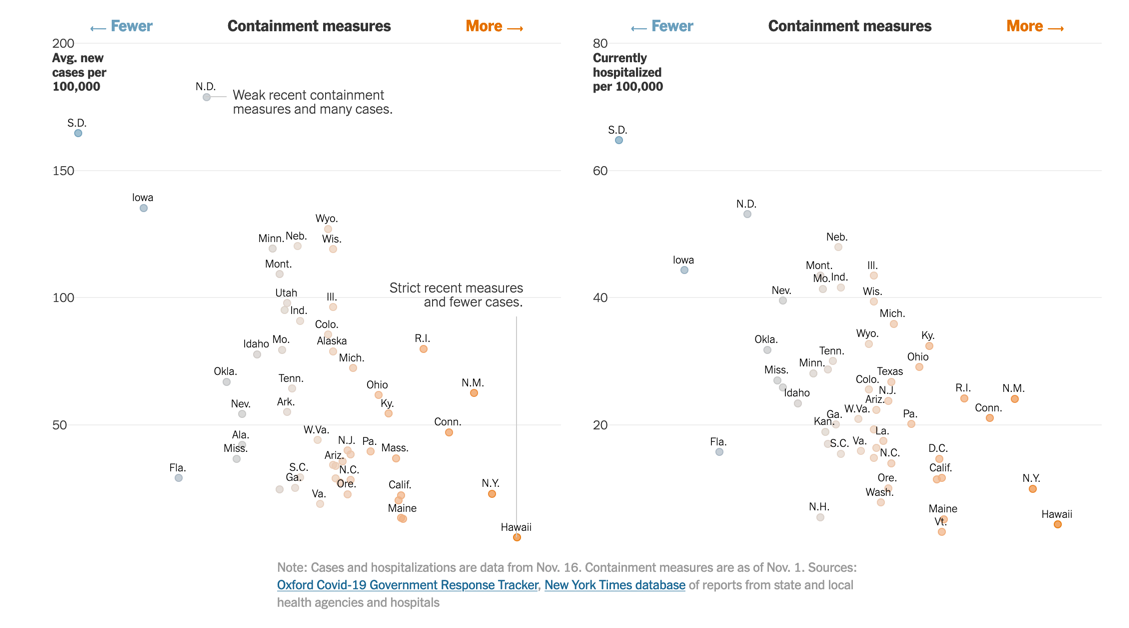

We are seeing confirmation of these 1918 data points in the US today where the federal system allows for significant variance in responses to the pandemic. And states that imposed few restrictions now have the worst outbreaks.

Source: NY Times

So, fewer restrictions mean higher mortality. The question has always been about what that does to the economy. My view has been that a pandemic is defined by an infectiousness and deadliness that is much greater than even seasonal influenza outbreaks – to the point that healthcare systems break down unless contagion is arrested. Putting too few healthcare protocols in place guarantees healthcare system overload. And I believe that guarantees a more abrupt, longer and wide-reaching lockdown for which people are unprepared.

Therefore, in terms of causality the sequence I postulate is this: fewer restrictions leads to greater healthcare overload which leads to a more aggressive shutdown which leads to greater eventual economic disruption.

North Dakota showing us what’s to come

In my last post a week ago, I told you that: “Preliminary evidence in the upper Midwest suggests that overload has already happened. And this is starting to require restrictions that will crimp growth.” A week later this observation seems justified. North Dakota, which now has the world’s highest COVID-19 mortality rate, has enacted a statewide mask mandate and put up restrictions on businesses.

Will the economy in North Dakota underperform the economy in New York, that has had more nonpharmaceutical interventions (NPIs) in place, for example? I hypothesize yes, but we don’t know. At a minimum we do know that the state was eventually forced to curb activity once the healthcare system was overloaded. And that means economic growth will decline. The economy might even contract outright.

We’ve seen this in Europe already. I have been saying that the US will eventually follow Europe. More specifically, my claim in the last post a week ago was as follows:

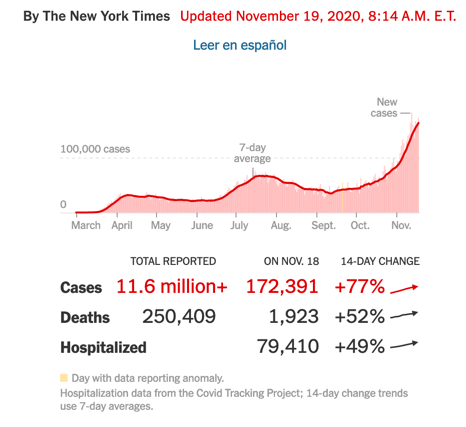

Overall, the data flow suggests to me that, while case counts will overstate the impact in sickness, hospitalization and death, the rise in case loads is so high that we will reach prior peaks and have wide-scale overload of the US healthcare system before this wave ends. The 14-day change in cases is 69% and the change in deaths is 36%. If that death rate increase remains in place, we will reach 2,000 deaths a day by Thanksgiving.

The latest data show the situation is actually worse than that.

Source: NY Times

Case counts and deaths are increasing at a faster rate nationally in the US than they were a week ago. We are already at near the 2,000 deaths a day level I told you I expected to reach by Thanksgiving. And given that the infection growth line continues to slope upwards, we should expect the situation to deteriorate further still before NPIs arrest the falls.

My expectation, after the Thanksgiving holiday, is that we will see numbers higher than in the first wave, forcing significant lockdowns given the existing overload, and causing GDP in the US to contract outright. That’s my base case now, a double dip recession.

The coincident data and the political situation

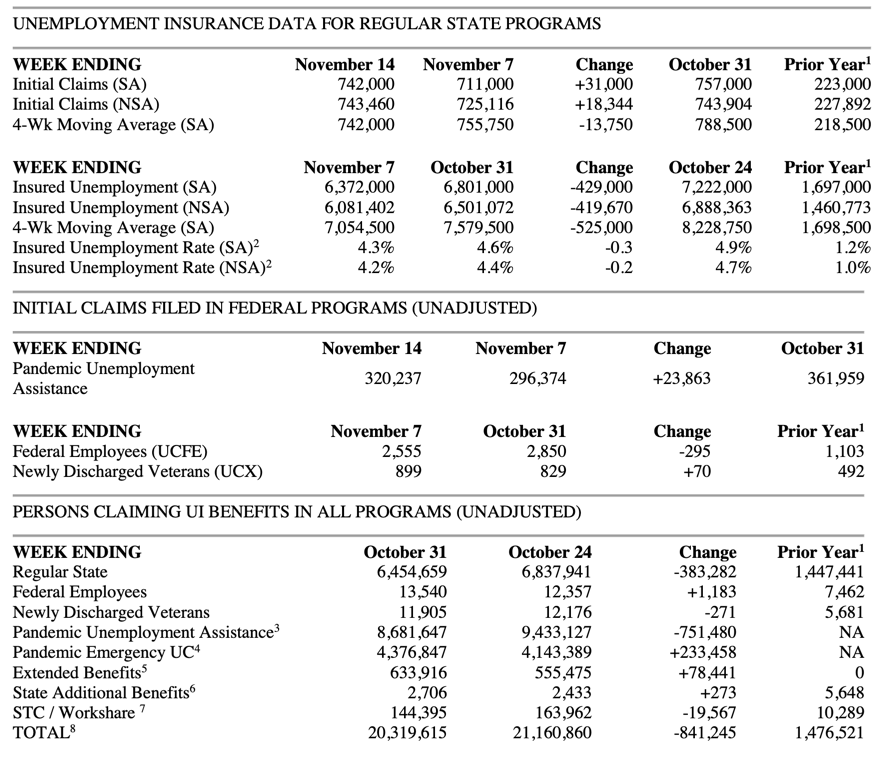

I like the jobless claims data set because it is coincident to leading, if you look at the change in claims as opposed to the level. In the post from last week, I told you the levels had decreased materially. And that, along with the decline in the headline unemployment rate was a good thing. My fear, of course, is that this is not reflective of what’s to come. Why? The pandemic.

As I put it right after the election:

Eventually though, we will get a read on whether the Covid-19 situation has dented employment prospects. I think it will. And I expect to see this show up in jobless claims data by early December. Until then, I am still expecting the economic outlook in Europe to deteriorate into recession. The US is hanging on by a thread. From the early hours after election night, it seems as if the political situation won’t make it better.

The claims data that came out today are directionally of that ilk.

Source: US Department of Labor

Again, I expect these numbers to rise as the shutdown takes hold. And, as with the death counts, it may well be that my anticipated scenario is happening before I said it would. My bogey was the beginning of December. And the last week’s data could mean the rise in initial claims has already happened. Let’s see next week.

To make matters worse, we have a fiscal cliff staring us in the face, even as the US presidential election remains disputed. The election dispute may make the cliff harder to manage, resulting in a lapsing of government support similar to how political gridlock at the end of the summer did.

I know markets seem to like divided government. But political dysfunction has negative consequences. Two points here:

-

If Congress doesn’t act, 12 million Americans could lose unemployment aid after Christmas: “According to the report from unemployment researchers Andrew Stettner and Elizabeth Pancotti, those Americans will lose their unemployment benefits the day after Christmas — more than half of the 21.1 million people currently on the benefits — due to deadlines Congress chose when it passed the Cares Act in March amid optimism the pandemic would be short-lived.”

-

White House chief of staff ‘can’t guarantee’ U.S. government will avert December shutdown: “Congress and the White House have until Dec. 11 to approve new spending legislation to prevent the federal government from shutting down in the middle of a pandemic and amid a surge in coronavirus cases. Meadows said he was hopeful an agreement would be reached but did not rule out that an impasse. There has already been two government shutdowns during President Trump’s four years in office, one lasting more than a month.”

Merry Christmas and a happy new year to you too!

My take

As with the political impasses at the end of the summer, it behooves us to take this dysfunction seriously.

First, not only have we already reached a breakdown in many US hospitals already. But, with cases and deaths rising and hospitalizations at a record, it will get a lot worse on the healthcare front right across the entire United States.

Second, a lot of people have a fatalistic view about this. When talking about his father’s death, a North Carolina man told the Washington Post, “we’re more of the faith that the Lord predestined him. He was going to pass at this age and for this reason, and we don’t question why it happened.” Rugged individualism will rule the day. And that means flouting mask protocols and social gathering limitations and accepting the consequences. I expect this to increase the healthcare system’s overload in the US because of the Thanksgiving holiday.

Third, these events will lead to economic shutdowns via both consumer behavior and government mandates. And that will be occurring just as existing government support will run out for many. If the impasse over the Presidential election is any gauge of the climate in the DC area where I am, I think the potential to fall right over the cliff is higher than people assume or markets are pricing in.

The global double dip recession I spoke of because of Europe’s lockdown will be made considerably worse with the US in recession as well. I know this is not uplifting to read. But, we need to be prepared for what’s coming.

Comments are closed.