Rotation toward value, Covid-19 spikes and electoral disputes

I have been trying to find a coherent thread to write about on what’s happening in the economy and in financial markets. But it’s been challenging. Yesterday, for example, I did a segment for Real Vision with my colleague Ash Bennington. And I wanted to write a newsletter post as a thought piece to discuss. I got halfway through and realized it wasn’t up to snuff. So I canned it. So today’s post is an attempt to follow on from there, especially with jobless claims having come out.

I have a segment with Jack Farley, the up and coming presenter for Real Vision, today. So I will use this as fodder for that conversation. Let me say that, given the election and recent vaccine news, the narrow focus in the markets is on the composition of the Senate and durability of the rotation out of large cap tech. I will discuss that but have some other thoughts as well.

The narrow focus

A couple of weeks ago, the markets were telling us that the spiraling load of coronavirus cases, hospitalizations and deaths in Europe was serious. Lockdowns were occurring all across the continent and the result, in my view, was going to be a double dip recession there. Given the size of Europe’s economy, we could even consider that a double dip globally. Markets sold off in a big way, with little in the way of downside protection from bonds to mitigate the losses.

But with the US election last week and positive vaccine news this week, markets have moved up substantially, with bonds also selling off. And there’s been a rotation out of the ‘stay at home’ theme companies to those names in travel, leisure, and hospitality that were beaten down by the pandemic.

In a narrow view, it tells us that the pandemic ‘new normal’ is not completely normal at all – that a ‘reversion to mean’ is clearly expected and desired. People will go back to restaurants, hotels and airplane travel in due course. Perhaps there will be some residual impacts. But the narrative emerging from the recent trading tells you that the lifestyles we’re experiencing now are completely unsustainable culturally and nowhere near what post-pandemic daily life will be like.

Overall, I expect the rotation to have some legs. But, in addition to the rotation, I would also expect less precautionary savings in a post-vaccine world. And that’s largely bullish. Still we have to get through this second and third wave first. And there may be lasting economic repercussions once this wave is finished.

The election

The election trade is less clear to me. Is divided government good? It’s not good if it means questioning the very legitimacy of how government is formed. Only when the Confederacy seceded from the United States did we see such a wide-scale disavowal of the legitimacy of a President or President-elect.

And even though shares were up just after the election, the uncertainty and the disavowal is not bullish to me. Having fired the defense secretary and some of the top people below him, President Trump is now inserting loyalists – as if to threaten he’s willing to use the military to back his belief in the illegitimacy of the recent election.

Back in 2018, after the midterms I questioned how far Trump was willing to go. And in July I wrote the following:

President Trump might act as a lame duck if the polls move against him and he thinks he can’t win in November. He will have nothing to lose in not compromising with the Congressional Democrats. And that might mean US policy that’s even less than sub-optimal and more like a scorched earth policy that ends us in a Depression. Not a base case, but certainly imminently possible

Now that we are beyond the election, this same logic holds, but not just with the economy but everything under Trump’s remit. These are very dangerous times – as his party is giving him the green light to go to the mat. And it simply is not clear how far Trump will go and what his goals are. A Swedish professor of political science was even quoted in one of the two big daily newspapers there saying this is what a coup d’etat looks like (link here in Swedish).

Again – not bullish – at least for the next month. So, forget about the composition of the Senate for the time being.

In the end, then, we have vaccine news and a reversion to mean behavior as bullish for shares and bearish for bonds. And then we have post-election volatility as bearish for shares and bullish for bonds. The first factor is probably more enduring than second. However, if Trump can manufacture a 1876-style victory, all bets are off.

The data

Let’s put all of that in the back of our mind and focus on what the economic data are telling us. Today, we saw initial jobless claims in the US fall by 48,000 to the lowest level since March. The level, at 708,000 is still quite high relative to levels in every other downturn. However, it’s the direction of the data and the magnitude of the direction that matter most in terms of growth. If we have a sharply falling unemployment level and a sharply falling initial claims level, that will ensure personal income growth continues forward.

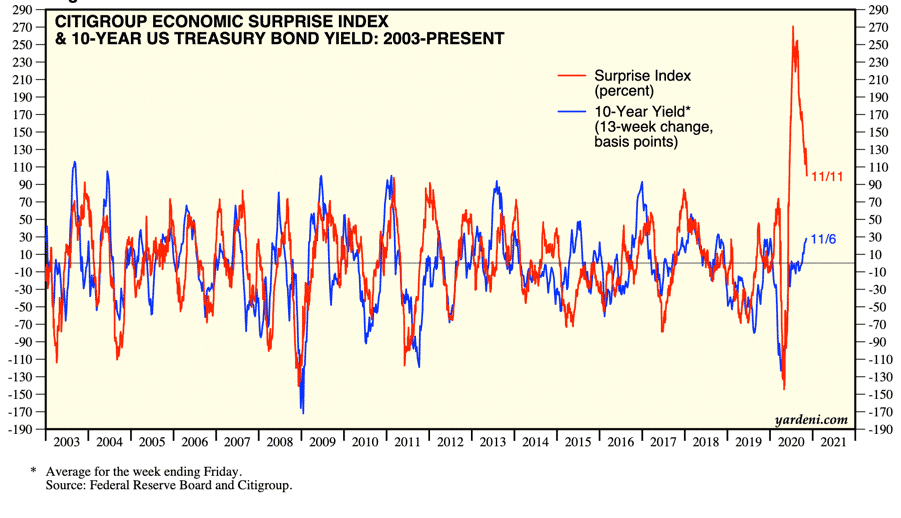

If I had to characterize the data of late, without looking at the Citigroup Economic Surprise Index, I would say we are still not mean-reverting to a point where the data undershoot expectations. And that is bullish.

Now, let’s look at the chart.

Source: Yardeni.com

There has been some mean reversion. But the index is nowhere near undershooting. In fact, it is still above peak levels in other cycles. That provides a tailwind if it continues.

The virus

The biggest caveat here is viral case counts, which are at epidemic levels globally and rising substantially in the US. We already know that Europe is going into various forms of lockdown to arrest the spread of the virus. And that’s going to kill GDP growth there. The question for the US is what happens with growth there.

Here are some potential cause – effect points to inform the answer.

- In the US, there is increased testing, which means increased case counts. So, it’s not clear how much of the rise in case counts is representative of a true rise in infectiousness. But when looking to see if the virus is spreading faster, positivity rates are important. And they are rising across the United States. See here for California, for example. See here for New York City.

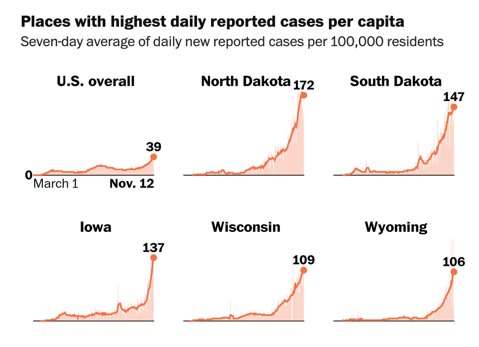

- All else equal, case counts rising means that hospitalizations will rise. But, all else is not equal. It depends on who gets infected, how healthy they are, how virulent the virus is and a number of other factors. We know that the infections are infecting a younger, healthier sample group of people. And that would lead us to believe that hospitalization rates will rise less abruptly than case counts. But cases have risen so much that hospitalizations are still at record levels in many parts of the US, especially the upper Midwest.

- All else equal, rising hospitalization rates mean deaths will rise too. But again, all else is not equal. It depends on who gets infected, how healthy they are, how virulent the virus is, and how capable our medical professionals are in mitigating the impact of the disease. Hospital death rates have declined considerably. But even so, unfortunately hospitalizations have risen so much that deaths are at record levels in many parts of the US, especially the upper Midwest.

Overall, the data flow suggests to me that, while case counts will overstate the impact in sickness, hospitalization and death, the rise in case loads is so high that we will reach prior peaks and have wide-scale overload of the US healthcare system before this wave ends. The 14-day change in cases is 69% and the change in deaths is 36%. If that death rate increase remains in place, we will reach 2,000 deaths a day by Thanksgiving.

The viral economy

2,000 deaths a day is a level representative of healthcare system overload. And while patients can be shuttled from one place where the system is overloaded to another where it has yet to reach capacity, the longer this continues, the fewer places there will be that aren’t overloaded.

As I wrote on Oct 31 regarding Europe:

The health care system overload happens when healthcare personnel are tapped out and overloaded. When the number of people who are infected and in need of medical attention is more than the medical professionals can handle, that’s when the system breaks down, chaos happens and things move toward a total shutdown.

Europe reached that level and shutdown. The US will also reach that level based on the data I have seen. And that means, wide-scale local and state shutdowns are likely. That’s my expectation.

Here in the DC area, when I have driven at night, I have noticed a drop-off in nighttime car traffic. It seems as if people are already starting to curtail the ‘most infecting activities’ as the case counts rise. And this is even before a government mandate. As in February and March, it may be that consumers act first and government mandates follow. And if so, we should expect the rise in case counts to continue for some time after shutdowns i.e. through the holiday season.

The Upper Midwest is the first place to look for all of these signs as that is where the epidemic is most severe in the US.

These states are more Republican in governance and, thus, less likely to mandate shutdowns. So they represent a good test case of how government mandates, viral spread and consumer behavior interact. Watch these areas closely for any signs of shutdown. If there are, we can assume the consumer moves first thesis is intact. And that says the negative economic impact of viral contagion will occur even if government officials resist shutdowns.

Asymptomatic nurses are being permitted to work in North Dakota. That tells you we are at healthcare system overload there already. And to me, this news is already a signal that shutdowns have begun:

North Dakota, as of Monday, is now facing “high-risk” levels of COVID-19 infections, prompting recommendations that restaurants, bars and venues limit their capacity to 25 percent.

I believe it will get much worse both healthcare-wise and economically.

My Take

Overall then, if I looked at US data alone, I would green light this as a durable recovery where a rotation into value over growth due to vaccine news was warranted. But, the third US Covid-19 spike is so severe that it is likely to lead to healthcare system overload and lockdowns as it has done in Europe already. Preliminary evidence in the upper Midwest suggests that overload has already happened. And this is starting to require restrictions that will crimp growth.

My view continues to be that you cannot benefit the economy by resisting the virus and staying open. This simply leads to viral contagion, system overload and shutdown. That’s a worse outcome than taking more appropriate precautionary measures. But the jury is still out on this. Let’s see how the Upper Midwest fares.

Since I expect shutdowns across the US in due course, I think it may be too early to pile into the ‘vaccine trade’. This fall and winter will be horrific. And markets are likely to reflect that.

Comments are closed.