The line that sticks out for me from my last post in re-reading it went something like this: “So, now I am in the uncomfortable position of being relatively sanguine about the near term but concerned about future trends.” I want to expand on that today and tell you why that makes me uncomfortable.

The known unknowns

I am going to start with one of my favorite media organizations, Axios. These snippets from an article on the pandemic and the economy yesterday is emblematic of the known unknowns gathering in the medium-term:

The weather is getting colder and the days are getting shorter — accelerating the economic and psychological damage of the coronavirus pandemic.

The big picture: During the summer, businesses took advantage of outdoor dining, exercise and shopping, and families and friends safely gathered outside and at a distance. As the season changes, much of what made the last several months bearable will vanish.

Businesses that have made it this far could start closing in droves.

[…]

Washington’s failure to deliver relief in the form of a stimulus package is hammering the economy.

[…]

The upcoming holiday season could trigger case spikes all over the country — or further devastate the hard-hit travel industry.

Most of these risks are known. The questions now go to when they crystallize and what impact they have. The Fall/Winter coronavirus wave is hitting both Europe and the US right now. We have seen a massive spike in cases. But because the delay to hospitalizations and deaths takes a while to occur, the jumps there have not yet hit. Moreover, we are much better in preventing deaths now than when the Covid-19 pandemic began. So we can hope that this wave is not as bad as the one from last Winter.

Coronavirus thoughts

Before I go into the economic side of this, I do want to talk about policy fatigue for a second because I haven’t mentioned Sweden in a long while. Sweden’s coronavirus response is not and has never been about herd immunity. It was a conscious effort to design policy for a sustainable new normal, rather than focussing assiduously on an absolute minimization of viral contagion and death (like New Zealand, for example).

The Swedes got it wrong in protecting their eldercare facilities. And that was one reason we saw tremendous loss of life there as the coronavirus swept the country. Moreover, a focus on a new normal – without mask-wearing and mandatory social distancing – guaranteed a worse outcome than we saw in other Nordic countries like Finland, Denmark and Norway. But the Swedes changes tack on this beginning in April and beyond. The result through the summer has been a decline in infection and a stable R-factor well under 1.0.

This is where policy fatigue comes into play. The sense I get is that the new normal in Europe and North America is unsustainable, meaning people are too used to freedom of movement to not chafe at the restrictions. And we crave more social contact. It doesn’t help that social distancing protocols have been politicized in the US either. But, irrespective, the fatigue has set in across the rich western Northern hemisphere countries. And that has driven infection rates higher.

So the musings from Axios about a deadly Fall and Winter make sense. Australia had a deadlier Winter too. So we know what’s coming. The question is whether the rich Northern Hemisphere countries of the west have as good a policy mix as the Australians have. I don’t think we do. And so, I tend to think outcomes for us will be worse. But that’s conjecture since I am not an epidemiologist.

I just thought I’d outline how I’m thinking about the virus since it is the all-consuming actor in all forward-looking thinking for at least the next several months. And I should add that the potential for coronavirus re-infection and the lack of efficacy of vaccines means that there may be no silver bullet. So, the new normal could drag on for quite some time.

Credit, defaults, and bankruptcies

I tend to look at all of this through a credit lens. That’s not just because I had experience in this part of the financial system. It’s also because credit tends to lead cycles. For example, I have explained the genesis of this site’s name, Credit Writedowns, as owing to the central role that writedowns were destined to play in the Great Financial Crisis.

When we suspended mark to market accounting for the troubled MBS sector in 2009, it took me a week to understand what that meant. It was only when Wells Fargo posted good numbers that I knew it was bullish. And back then, I didn’t think it was long-term bullish. I expected a short and difficult recovery. Instead, we got the slowest but longest economic expansion in modern US history.

So, looking forward, I still believe credit is key to understanding cyclical turns. But I am much more open to upside outcomes that emanate from policy interventions than I was in 2009. And by that I mean that governments can delay or ward off liquidity crises and shape outcomes that way by preventing liquidity crises from becoming solvency crises. We can’t just assume worst-case outcomes

When I think about the Axios predictions quoted at the top of this piece, I am worried. All of the near-term data make me perfectly sanguine about the runway I can see directly in front of me. Add to this some data I saw from Jim Bianco that California may be contributing to an artificially high initial jobless claim figure, and I see no reason this cyclical upturn couldn’t go on indefinitely… except the picture Axios paints.

In terms of causality it runs like this:

- In Summer, we went to a steady state from the initial V-shaped basing on the re-opening. That’s a decent-sized gap up in GDP based on closing the output gap. This is the so-called reverse radical recovery.

- The slope of the GDP growth line is directly related to the ability of policymakers to prevent liquidity problems from become solvency problems and destroying jobs before we can fully adjust to the pandemic new normal or get a ‘medical bailout’ via a vaccine.

- Right now, we are in a period where the new normal has become onerous enough that many have flouted the rules and Covid-19 positive cases have skyrocketed. The result is two-fold. One, consumer behavior becomes more cautious. Two, government policy adjusts by both tightening social distancing protocols and creating safety nets for those affected by policy changes.

- Going forward the questions, therefore, are threefold. One, how pronounced did the spike in cases and deaths become before protocols tightened. Two, how much does consumer behavior and government policy change in response to the spikes. And three, how effective are the protocols and safety net provisions in mitigating worst-case public health and economic outcomes.

What Axios is pointing to for the US is what I would classify as a reasonable worst case scenario where cases and deaths spike, consumer behavior changes markedly and the delay in policy response on both the public health and safety net sides are lacking.

From a credit perspective, this is pernicious. And as we have already seen a spike in lower-grade high yield downgrades, a jump in defaults in the lower grade credit spectrum have to be expected. The same is true for small business.

My View

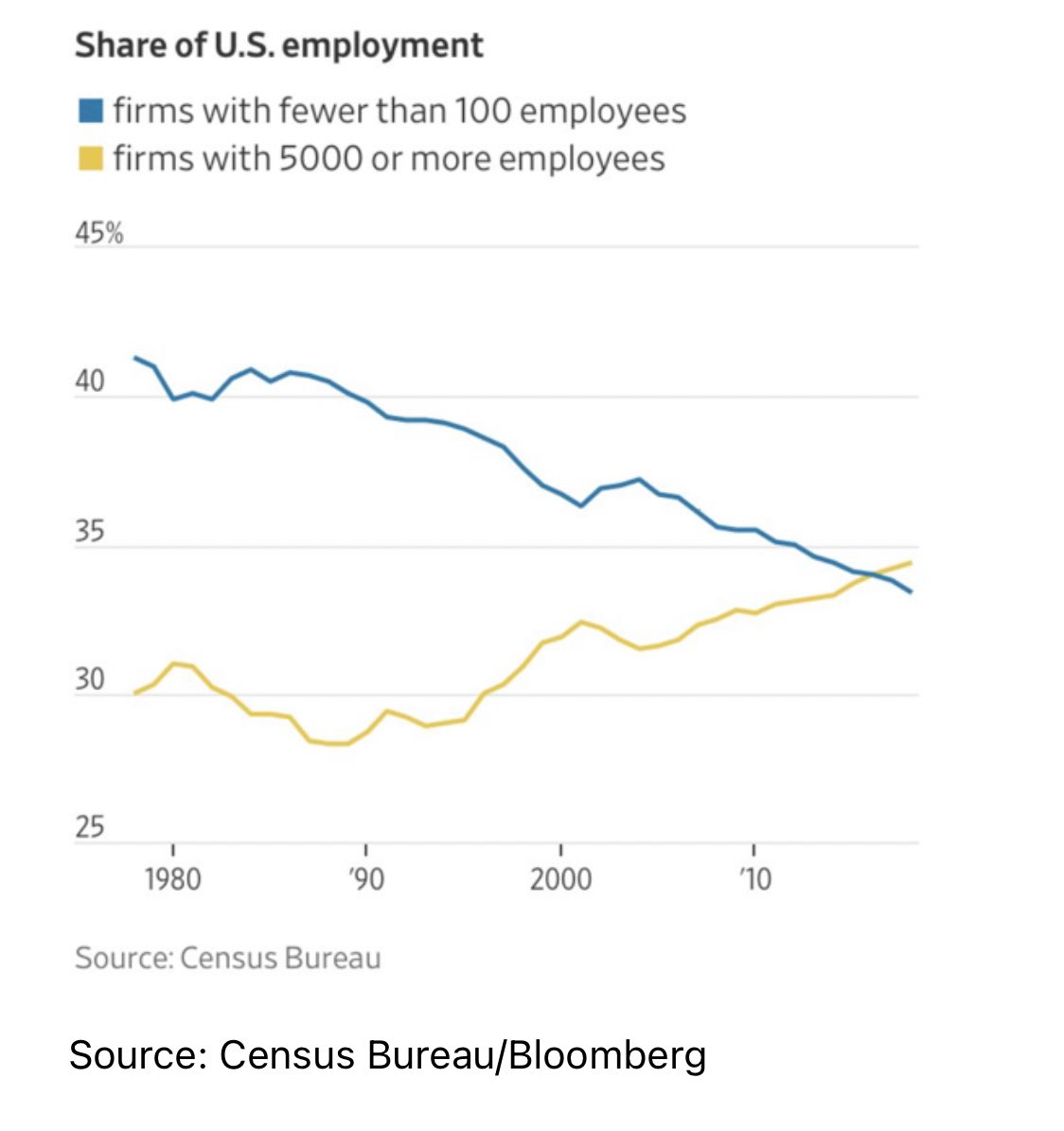

This morning, Carl Quintanilla tweeted a chart Paul Kedrosky pointed out showing the increasing market concentration across the US.

Since small business is the most endangered by Covid-19, worst case scenarios with policy responses with a porous safety net will increase market concentration as small businesses go bankrupt en masse. This is not not a good economic outcome. But it is not necessarily bad for the stock market since that’s where the largest firms are listed.

What we could see, then, is a botched public health and safety net policy response that slows GDP growth enough to get the federal government and the Fed to come in guns blazing before it all falls apart. This goes back to my comments regarding intervention in 2009 and not overestimating the likelihood of downside scenarios.

But, at this point all of this falls into the realm of known unknowns, meaning that the near-term still looks good but the longer-term time horizon is murkier with a range of outcomes. I think those outcomes go from modest upside to severe downside. So the risk remains weighted to the downside. And because the market seems to have priced in upside, that presents a risk, even to the most ‘pandemic-safe’ companies, who are trading at extremely high price-earnings multiples in any case.

All in all, it’s as soon as the credit situation begins to deteriorate that we will have a much read on where this is headed. In the meantime, focus will be on a blue wave in the US, likely massive deficit spending, and reflation for the US economy. That’s a bullish outcome. But, you can see that the risks are still there, lurking.

Comments are closed.