Back in June, I wrote a post about worries that were beginning to surface regarding a speculative mania taking form in the equity markets. I want to update the thinking from that post now that we have had three months’ additional data. And I will use some of the comments Benn Eifert made to Joe Weisenthal and Tracy Alloway on Bloomberg’s Odd Lots podcast episode for the meat of the post.

My framing

Here’s how I’m thinking of it. In the absence of serious government regulation, it seems every generation has to have first hand experience in a speculative bubble. Tales of woe from the prior generation aren’t sufficient to keep a lid on these manias. Only real world experience proves chastening.

I’ll give you three examples. We had the Internet Bubble in the 1990s. And we also had the Nifty Fifty in the late 1960s and early 1970s. Most memorable, we had the roaring 20s bubble a century ago that presaged the Great Depression. In each case, speculators were badly burned. And in the case of the Great Depression, they were so scarred, the economy was so weakened and regulation so fierce afterwards, that it took perhaps two generations for speculative fervor to re-assert itself.

But these weren’t the only manias that came one generation after the next. Even in 19th century America, we saw the same pattern with panics happening without fail before twenty years was out: The Panics of 1819, 1837,1857,1873,1893 and 1907 all ended in tears.

I think we’re in another mania now.

The Options Market

The Odd Lots episode with Benn Eifert that Bloomberg released last night was instructive on this score. And so, I want to dig into the arguments Eifert made.

The first argument he made was that retail investment actions today are similar to what we saw in the late 1990s regarding investor appetite for options trading. My own experience in the 1990s and early 2000s bears out how the Internet Bubble sucked a new generation of investors into riskier and speculative forms of investment and position-sizing. The likes of Ameritrade and Etrade catered to this generation of traders by lowering costs of trading, allowing investprs to margin accounts and permitting investment into derivative markets, even for retail investors with little prior investment experience. The result was that many got burned when the Internet Bubble burst.

We see the same thing happening now with the likes of Robinhood offering ‘free’ financial transactions, incentivizing over-trading and short-term speculation.

Joe Weisenthal, who spoke to Eifert, tweeted a number of charts today that back this up.

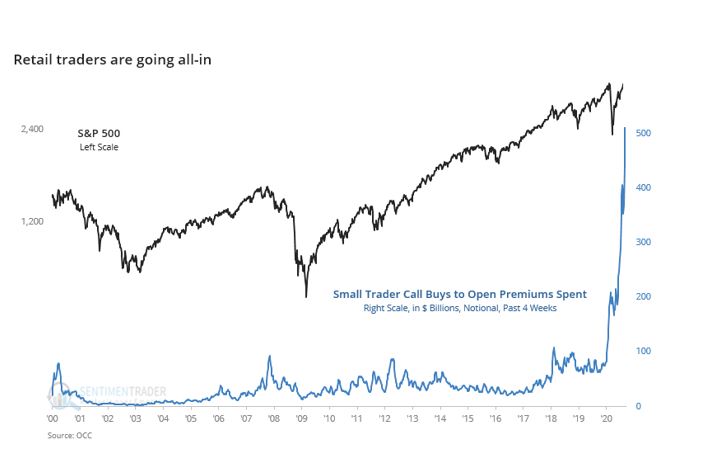

This first chart shows a parabolic increase in call option purchases this year.

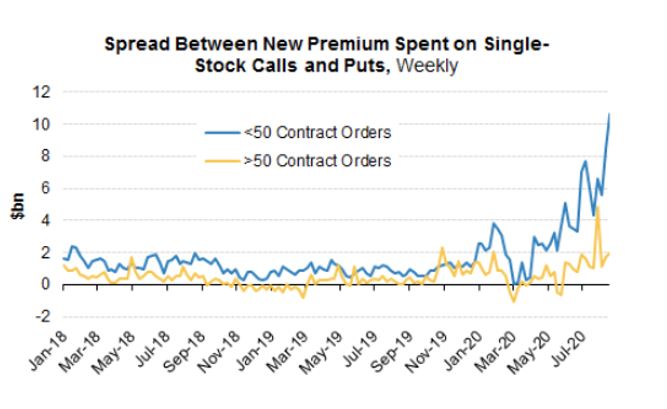

This next chart shows you that much of the activity is concentrated with smaller bullish retail investment purchases of call options.

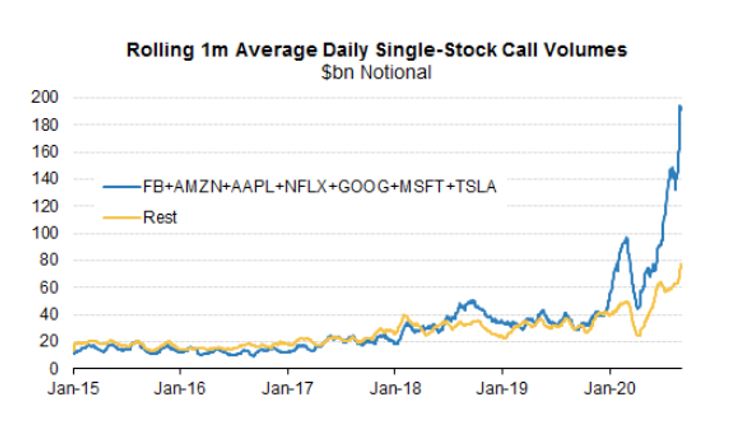

And most of the action is in large cap tech stocks.

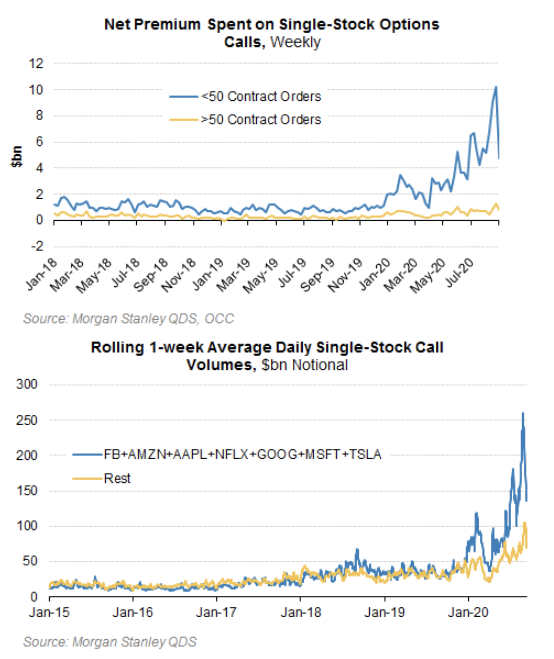

Volatility last week brought a brief chastening according to Eifert. Look at the plunge in call buying volume.

But I am sure we’ll be off to the races again this week.

SoftBank: The Options Whale?

Eifert’s analysis also convinced me that the short gamma market maker position amplifying moves in August had less to do with the large institutional buyer everyone spoke of a couple of weeks ago and more to do with retail investors.

Here’s how I explained what was happening on 2 September:

What’s happening is that the single-name large cap tech call buying has been so large that it has index-wide implications. And it has put the dealer community, which has to take the other side of these call positions and hedge them out, into a bind.

The link between an underlying stock or index price and its option price is not linear; it is curvilinear. That means as the price of the underlying stock or index moves, the ‘Delta’ – the percent change in the option price per discrete change in the underlying – moves. You don’t want that. So you hedge it out. And since they are effectively short the calls, having fulfilled their duty and supplied the institutional investor with flow, they have to buy tech stocks to keep their Delta hedged. They are effectively adding to upside momentum, creating massive multiple standard deviation moves in single names like Salesforce.com (CRM).

[…]

What you have to realize is that any buying forced by massive call buying will turn to selling when the market goes down. That means the move down could be violent…

SoftBank is the institutional investor reputed to have moved markets through its single name call buying. And Eifert told Bloomberg that this thesis doesn’t make sense because SoftBank’s equity replacement strategy was designed to be delta neutral — meaning it was designed to not cause massive market disruption. SoftBank was using options to replace its equity position and limit downside loss. And it was doing so with options that had much less convexity than the short-dated options that speculative retail investors have been using. And that means much less dealer delta hedging due to market moves.

So, it makes sense to think of the massive short-dated call buying by speculative retail investors collectively as the genesis of the dealer short gamma position that amplified moves in early September.

Reddit Options Buyers

Interestingly, Luke Kawa wrote about this back in February – before the pandemic – in a post titled “Reddit’s Profane, Greedy Traders Are Shaking Up the Stock Market“. His take:

Members of r/WSB believe they’ve discovered a kind of perpetual motion machine in the interplay of stocks with options contracts, which offer a cheap way to bet on whether shares will rise or fall without buying the stock itself. It goes like this: Members make bets that rely on market makers, the professional middlemen who sell you a “call” (a bet on shares rising) or a “put” (a wager on a decline). Market makers, like good bookies, don’t want to go out on a limb. When taking a bet, they lay off the risk. If someone buys a call, for instance, speculating on a rally, the dealer buys stock in the underlying company. If the stock rises, the dealer may have to pay out on the option—but that’s offset by the gain on the shares.

When shares keep rising, managing the hedge entails buying more stock. That’s where the Reddit set perceives a weakness. A favorite tactic on r/WSB is to swamp the market with call purchases early in the morning in an attempt to force dealers to keep buying stock. Up and up everything goes—supposedly. As the stock price rises, so does the value of the calls, often by far more.

In this worldview, the only constraint on success is the force of one’s own conviction and willingness to act upon it. An added attraction: It’s all relatively cheap in terms of an option’s simple dollar cost.

The Reddit community laughed at Kawa and carried on doing what they were doing. And after the pandemic hit, with many people at home, you had people with the ability to spend a lot more time trading. I know from my own circle of novice investors asking about oil ETF trading and bitcoin investing and buying Tesla shares. I didn’t hear any of this chatter last year. None

How does this end?

I think this ends like most manias – in tears.

But let’s suspend disbelief here and assume there is the possibility that markets can remain elevated long enough for fundamentals to catch up with them. Maybe market structure has changed so much with passive investments that ‘buy the dip’ mentality will help us power through.

We’ve had the worst economic event in modern global history and all we got was a brief blip in stock markets before they rallied to new record highs. I have looked at the recession and market data in the US. And this is unprecedented. So, we have two possibilities here; either the economic dip was foreshadowed by the bear market through 23 March and we are now in a sustained recovery or we will see more downside both economically and in markets.

We would also have to suspend disbelief on how parabolic rises in speculative volume resolve themselves. The charts showing call option buying are certain to presage a marked decline. Can markets continue to move upwards under that downward pressure?

My sense is no. As I told a friend last night, for me it is reminiscent of the housing bubble. I kept going back to the concept that a house I could rent for $1700, required $3800 for a 10% down mortgage. No amount of mental gymnastics about glide path rent-own alternative narrowing can overcome that math. There was destined to be a violent correction down in house prices. The same is true here. And many novice investors will get burned in the process.

Comments are closed.