The US labor market is deteriorating

Today’s US jobless claims report makes clear that the boost from re-opening is now fading. And a second wave of job loss is upon us. As a result, while the US unemployment rate declined more than expected in the last jobs report, I expect the rate to tick up going forward.

Pandemic Unemployment Assistance

In the recent past, I have mostly steered clear of ‘stock’ data in the labor market and concentrated on the flow. And that’s because I am trying to get a read on economic directionality. I want to know in which direction the labor market is pushing GDP growth. And so, I have focused a lot on initial jobless claims because that’s the best real-time labor market flow data we have.

But, increasingly, I am becoming alarmed at the number of people now relying on Pandemic Unemployment Insurance, both because of the political stand-off in Washington DC and because of the size of that market.

The Massachusetts government website says:

Pandemic Unemployment Assistance (PUA) provides up to 46 weeks of unemployment benefits to individuals who are unable to work because of a COVID-19-related reason but are not eligible for regular or extended unemployment benefits.

You can see similar language at other state websites like New York and California.

The crux is that this pandemic has so severely impacted labor markets that normal unemployment insurance benefits are not enough to cover all of those missing work. Many households, regardless of employment situation, received a $1200 check from the Federal government. Weekly unemployment benefits were supplemented by $600 extra per week through the end of August and Pandemic Unemployment Insurance is provided for up to 46 weeks as a catch-all given the number of people who are now self-employed, in the gig economy, or otherwise not eligible for unemployment insurance benefits.

However, these benefits are all rolling off even as joblessness remains high and many more workers continue to lose their jobs. The $1200 check was a one-time event. The $600 per week supplement rolled off at the end of August because Congress could not agree to a fiscal package. And PUA benefits will expire at the end of 2020, unless Congress acts.

Stock and flow job variables

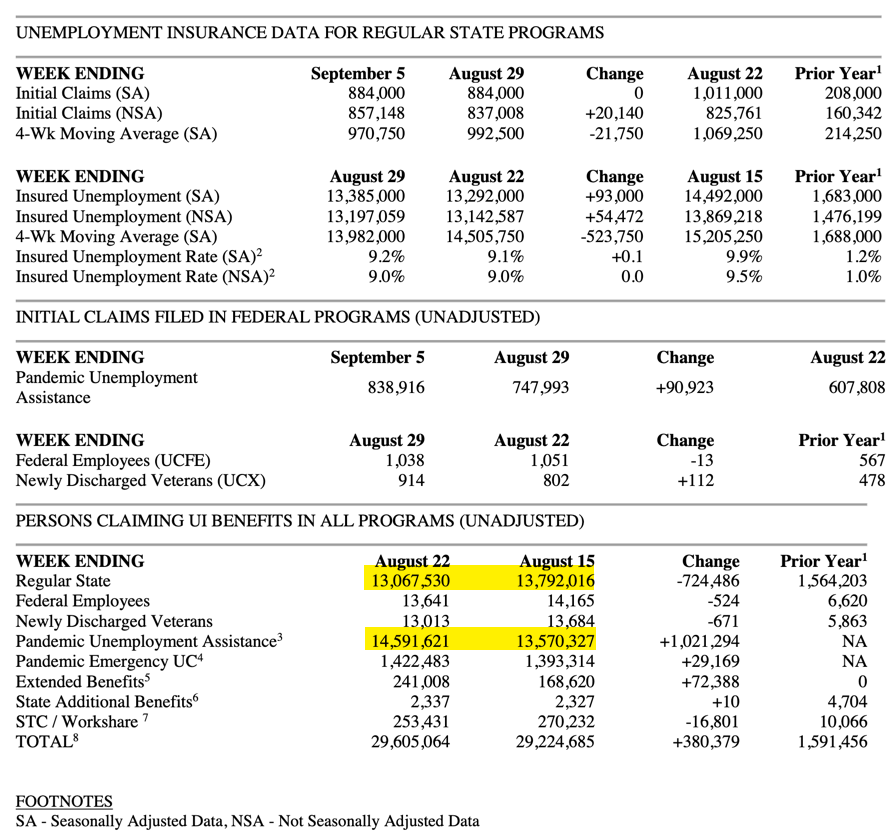

To give yourself a sense of the magnitude of the problem, look at the data from today’s jobless claims release.

There are two things I want to point out, one on stock and the other on flow:

- Flow is elevated. The seasonally-adjusted number of initial claims is still almost 900,000 for both this week and last week. This is 6 months after the first pandemic-affected number in the week ended on 21 Mar 2020. And it is some 4 months after the re-opening of the US economy after a brief lockdown. By comparison, in the last cycle, initial claims first hit 400,000 in July 2008, cresting above 600,000 in the first half of 2009 before making a slow grinding descent back below 400,000 in February 2011.

- Stock is elevated. Look at the number of people receiving PUA benefits. For the first time that I have seen, we now have more people on that program than those receiving traditional unemployment insurance benefits. And the total receiving benefits went up another 400,000 to 29.6 million

The US labor market is a disaster

The thinking has been that the re-opening would solve all of these problems. And the unemployment rate has retreated as the US economy has re-opened. Nevertheless, I see this latest jobless claims report as alarming.

It is clear that we still have major problems with both stock and flow. The number of people receiving benefits is almost 30 million. And the flow of newly unemployed is almost 900,000, a level 50% higher than the highest levels during the last economic downturn.

Philippa Dunne and Doug Henwood write the subscription Newsletter TLRwire. And in yesterday’s edition they noted the following about hiring:

Hires were down a significant, and ugly, 1.0% and, like openings, only needed 0.2%. The only significant positive was Federal government and yes, one of those Census workers stopped by Philippa’s house to clarify a few points. Hires in accommodations & food services were down 6.2%, needing only 0.5%, but were flat in arts and entertainment. Construction hires were down 1.4%, manufacturing down 1.0%, with durables down 1.4%, and other services, which include all the personal care work, down 2.9%. Decreases were significant in all four regions, and largest in the Midwest.

My View

So, what we see here, then, is a situation where the number of job losses remains elevated. And because the number of new hires is weak, the stock of unemployed workers will grow.

It’s simply not credible to believe that the re-opening means we can muscle our way through this, especially with the overhang of fiscal gridlock in Washington. There is a very real possibility that we could see some 15 or 20 million people lose PUA benefits at the end of the year.

Is this an outlier scenario? Maybe. Most analysts thought Congress would get a fiscal package passed before the $600 supplement expired. It didn’t happen. Now, we face the fiscal cliff at the end of the month. And then we will face PUA expiry at the end of the year. Those are two further fiscal deadlines that could have meaningfully negative impacts on the US economy.

My baseline assumption, given the continued flow of joblessness and the likelihood of many more bankruptcies and job losses to come in the future, is that the unemployment rate rises from here. The Fed has a bogey ay 9.3% at year end I believe. And the thinking now is that the Fed has been too pessimistic since the last unemployment number was 8.4%. But, I anticipate that this number will rise.

The question is what this means for GDP growth in Q4 2020 and Q1 2021. For me, there is considerable downside risk here, even before the election in November and the expiry of PUA benefits at year end. A negative GDP print in the next couple of quarters is still a reasonable worst case outcome. It’s hard to believe shares can remain elevated with this economic backdrop. But time will tell.

Comments are closed.