Data show W-shaped recovery is taking hold

As I write this, I am waiting for the latest jobless claims data out of the US to be released. But, irrespective of what the data show, unfortunately we are seeing a W-shaped pattern to economic data. And that looks set to continue. Some brief comments below

The premature lifting of lockdown

I hate it when you see the likelihood of bad outcomes months before they happen, only to see those outcomes crystallize. But, what’s happening in the US right now was entirely foreseeable. Here’s how I started off my post on the premature lifting of lockdowns four months ago:

How many people will die because lockdowns are lifted prematurely? That’s the first question going through my head as I think about the logic of yesterday’s post on the coronavirus lockdown. No sooner had I written that post predicting that lockdowns would be lifted prematurely than a chorus of people yesterday – including US President Trump – began clamouring for exactly that outcome.

The whole thing makes me uncomfortable. I think it’s a mistake. I think many more people will get sick and be permanently scarred as a result. Many others will die. But I also think it’s going to happen.

The day before was the nadir of the liquidity crisis. And I had written about a 60% fall in equity prices as my new base case. But, the Fed swooped in just hours after I wrote that. And they stopped the financial crisis dead in its tracks. Now we are back to record or near-record levels on equity market indices in the US. That’s due in large part to the Fed’s well-timed intervention. We can argue about its being too aggressive now and its distortionary impact; but it was necessary. I still believe we would have seen a 60% decline in shares and a large financial crisis had the Fed not intervened. So I applaud their March actions.

But, during a pandemic, the real economy is much more dependent on the actions of economic and, particularly, public health policy. And this is where the predictable failure has been in the US. What I was saying in March is that “we will see lockdowns lifted prematurely and then we’ll have to live with the consequences of that decision”. And the consequences of that decision are a stalling of the recovery – and – in a worst case outcome – another recession.

Axios on the data

Here’s how Dion Rabouin put it yesterday:

Given the reporting lag for most traditional economic indicators, investors have turned to real-time data to assess the U.S. economy. Almost all of which shows business activity stalling or declining.

What’s happening: Economists at Jefferies write in a note to clients that their in-house economic activity index has “flat-lined” and “has now been moving sideways for the past three weeks.”

- “The loss of momentum is broad-based, spanning small business activity, discretionary footfall, restaurant bookings, traffic congestion, and web traffic to state unemployment portals.”

- “Regional data show particular weakness in virus-hit states, where V-shaped recoveries are morphing into Ws.”

- “Given the timing of the hit, official June data are likely to be spared, but there is clear downside for July data.”

He’s confirming what I’ve been telling you about the W-shaped recovery, that it’s coming for the areas of the United States where the lockdowns were lifted prematurely. That doesn’t necessarily mean the US as a whole will see a W-shaped outcome or that the US is about to slip into a second recession. But, those are reasonably high probability outcomes.

On the epidemiological basis, the train goes from premature lockdown to increasing viral spread to increased hospitalization to increased death. On the economic basis, it goes from rising COVID-19 cases, hospitalizations and death to increased localized consumer fear, business shutdowns and government re-opening rollbacks to negative US-wide economic implications to a renewed rout in asset prices.

There can be breaks or weak links anywhere in those two chains that give us a reprieve. That’s where we see a mild W-shaped pattern at the national level. At the same time, those chains could also both be very solid. And that’s where recession comes into play.

Hope for the best and prepare for the worst.

The novel coronavirus

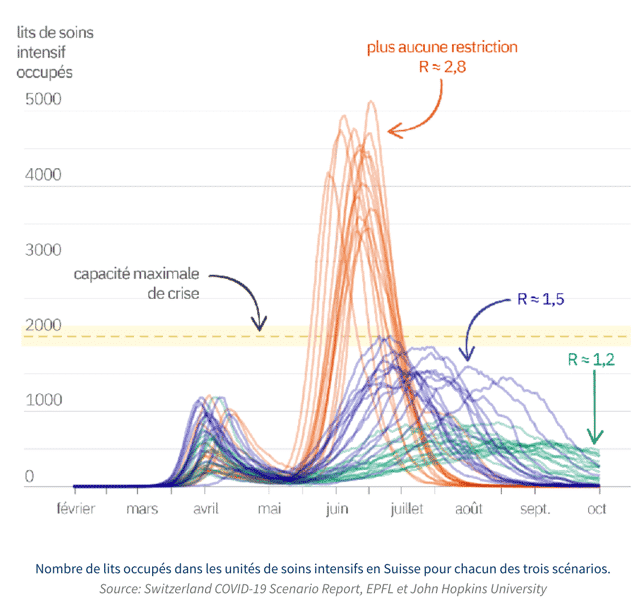

On the epidemiological front, what I’ve been telling you is that my hope is that the younger skew of viral infections and our better overall knowledge of treatment would lead to a less severe second spike in deaths. But the ‘Le Figaro chart‘ is still in the back of mind.

The hope has always been that the hot summer weather and people’s being outdoors would stop community transmission of the coronavirus. And as we got higher case counts, the hope then became that the younger demographic would limit the hospital overload and deaths. These hopes are now being dashed.

The risk was always that the second spike in infections and deaths would be large. The case counts are certainly larger – record numbers nationally – due to increased testing. But, the percentage of positive cases points to widespread community transmission in multiple hotspots too. And, despite the younger skew of patients, that is now leading to more deaths.

Yesterday was a record in Texas for coronavirus deaths. It was also a record for deaths in Arizona too. And most ominously, in Florida, cases skew older ahead of a test surge. This is turning into a perfect storm.

I think we should now contemplate worst-case outcomes where Texas, Florida and Arizona become the new New York, New Jersey and Connecticut. That means rampant community spread – eventually to the most vulnerable as well, as we see in Florida already. That means hospital overload, high death counts, and localized lockdowns.

Outcomes

When you get total lockdowns, you get catastrophically bad economic outcomes too. And given the size of the economies in Texas, Florida and Arizona, we should be concerned this leads to a double dip recession in the US.

Note that I haven’t mentioned the potential for community spread to infect other jurisdictions in the US. But, I believe that possibility exists. What I saw in DC on the Friday evening, July 3rd makes me think it is entirely possible – especially with federal government workers now being forced to go back to work. It could get a lot worse.

The thing that worries me is that policy responses, particularly from the Trump Administration, are frustratingly bad. One example is schools. Children need structure, especially small children. And distance learning doesn’t give them that. It’s been a catastrophe in the US. I know it from my own personal experience. So, getting kids back to school is a first priority.

In Denmark, where schools opened first, the policy response made sense because they had a lockdown that stopped community transmission. They knew school re-opening had to come first to give parents the opportunity to work. So, they then put protocols in place to limit contamination from the schools – even knowing that children were less severely affected by coronavirus. The result was that the rest of the economy was able to open in phases. And Denmark is now in a good place in terms of its economy and public health situation.

In the US, the Trump Administration is pushing to get schools re-opened even as community spread is rising exponentially. That makes no sense. The risk of family to family community spread increases exponentially that way. It turns schools from a vehicle for freeing people up from childcare so they can work into a vehicle for debilitating entire swathes of the population, sickened by school- and daycare-hosted community viral transmission.

I am flagging this now as a really big policy error. Not only is there no help from the federal government on the massive expenditure necessary for coronavirus safety protocols for school systems whose governments are strapped by huge revenue shortfalls, the Trump administration is threatening schools on federal funding if they don’t re-open. This is the height of folly. And it will backfire. It will aid community transmission. And that means increased hospitalization and increased deaths too.

The Le Figaro chart could actually come to pass in the US simply because of grave, grave policy errors.

My View

I would be lying to you if I said I was cautiously optimistic at this point. My worst fears about a premature lifting of lockdown are already coming true. And more policy errors are set to pile on top of that, with the re-opening of US schools in vulnerable states. We have to be prepared for these policy errors to occur. And the outcome will be negative for public health and the economy.

As I wrote this, initial jobless claims came out at 1.3 million. And while claims levels lag after cyclical turns, they don’t lag at 1.3 million. This is a level that should concern us as a coincident indicator, as an indicator of continued economic stress at such a high level that it jeopardizes the re-opening recovery.

My expectation is for the re-opening rollbacks to start infecting data releases that we see in August and September. And only then will the setbacks become apparent. To the degree initial claims rise again, we should see this as a double dip warning. And to the degree we double dip, asset prices will fall, especially since much of their recent rise was built on earnings multiple expansion. You don’t get expanding multiples in a double dip. You get contracting multiples, like we saw in 1982.

How much can the Fed do here? How much will they do? That’s the big question for investors. For me, the W-shaped recession outcome is clear. How violently downward-sloped the second dip is remains to be seen. But, September and October remain my timeframe bogeys for when the uncertainty gets resolved for both the economy and asset prices.

Comments are closed.