I am back from the 4th of July weekend here in the US. I have a few new thoughts to share with you today. But, my overall macro view remains the same – namely that the US has recovered from recession but downside risks to the US economy and shares are elevated relative to in Europe.

Some random viral thoughts

I do about 250 kilometers a week on my bicycle. And one of my regular routes is on a reclaimed 7 mile railway line called the Capital Crescent Trail that goes from Bethesda to Georgetown. That’s the same path that made US national headlines because a cyclist assaulted some young kids back in June for putting up flyers in support of George Floyd.

The trail has been packed recently but the ends in Georgetown and Bethesda have been ghost towns because of the lockdown. A lot of times I go through Georgetown past the monuments in DC to Hains Point, an artificial island built up from Potomac dredging material from 1880 to 1892. Hains Point is big for cyclists looking to avoid cars. But, during the shutdown it’s been closed by DC Police.

Friday night, I rode down to Georgetown per my usual and was immediately struck by the mass of activity in Georgetown. There were cars and people everywhere. There were food trucks and evening gowns and celebrations just like any July 4th. And counter to norms I have seen for months, not a lot of people were wearing masks. My Spidey sense tells me this is trouble. To the degree the US is already moving toward a surge in viral contagion, with positive coronavirus cases now over 50,000 daily, July 4th is going to act as an accelerant.

The US economy

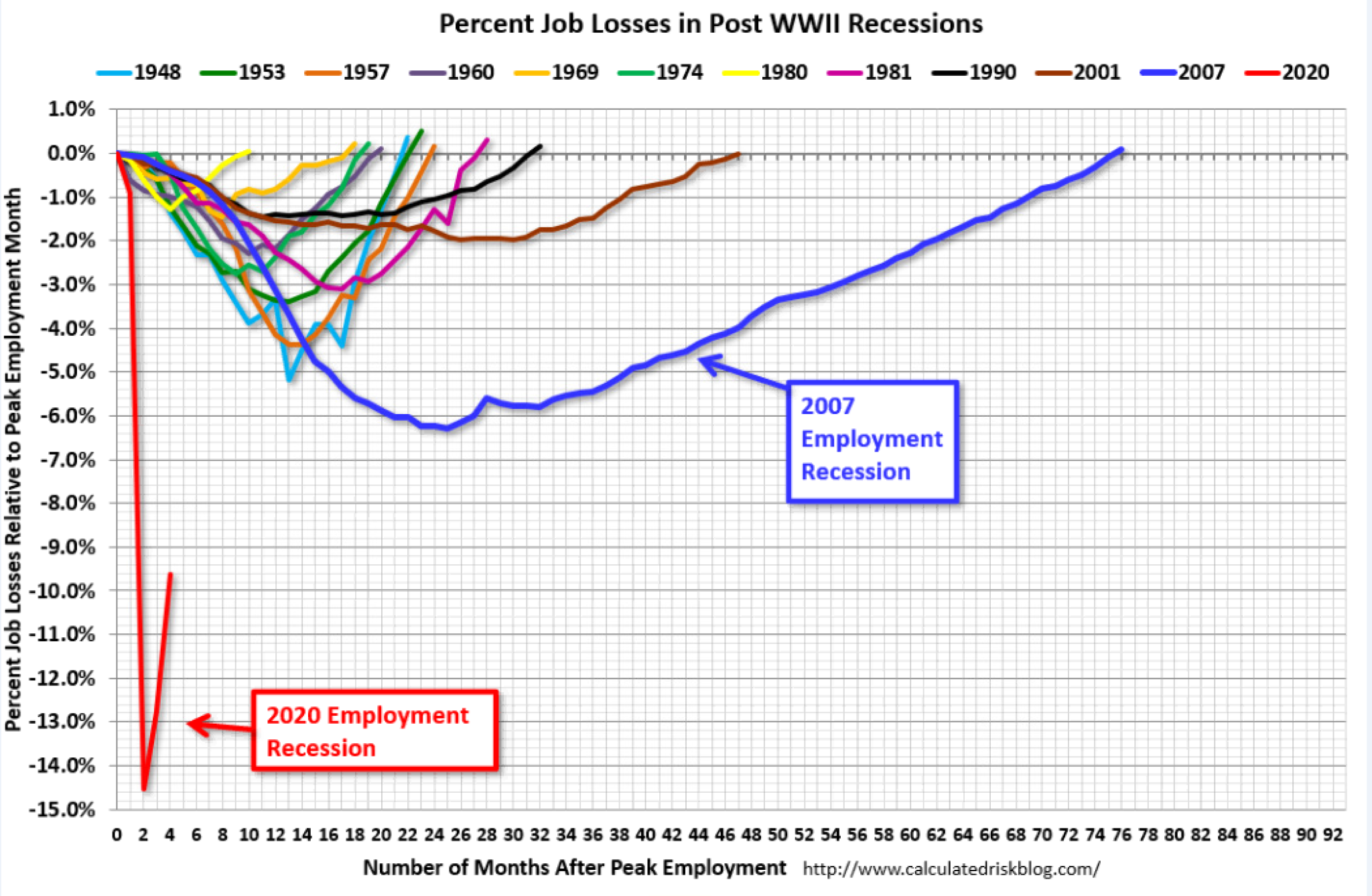

That’s where the downside risks are. Take a look at this chart.

I showed it to you two months ago before the rebound from re-opening. So it looked like a straight line down then. I also said then that “Bill McBride, who runs the Calculated Risk blog, has been producing this chart for at least a decade now. And what it shows is the loss of employment relative to recession employment peaks for each post World War 2 recession in the United States as well as the time it took to regain that peak.”

I showed it to you two months ago before the rebound from re-opening. So it looked like a straight line down then. I also said then that “Bill McBride, who runs the Calculated Risk blog, has been producing this chart for at least a decade now. And what it shows is the loss of employment relative to recession employment peaks for each post World War 2 recession in the United States as well as the time it took to regain that peak.”

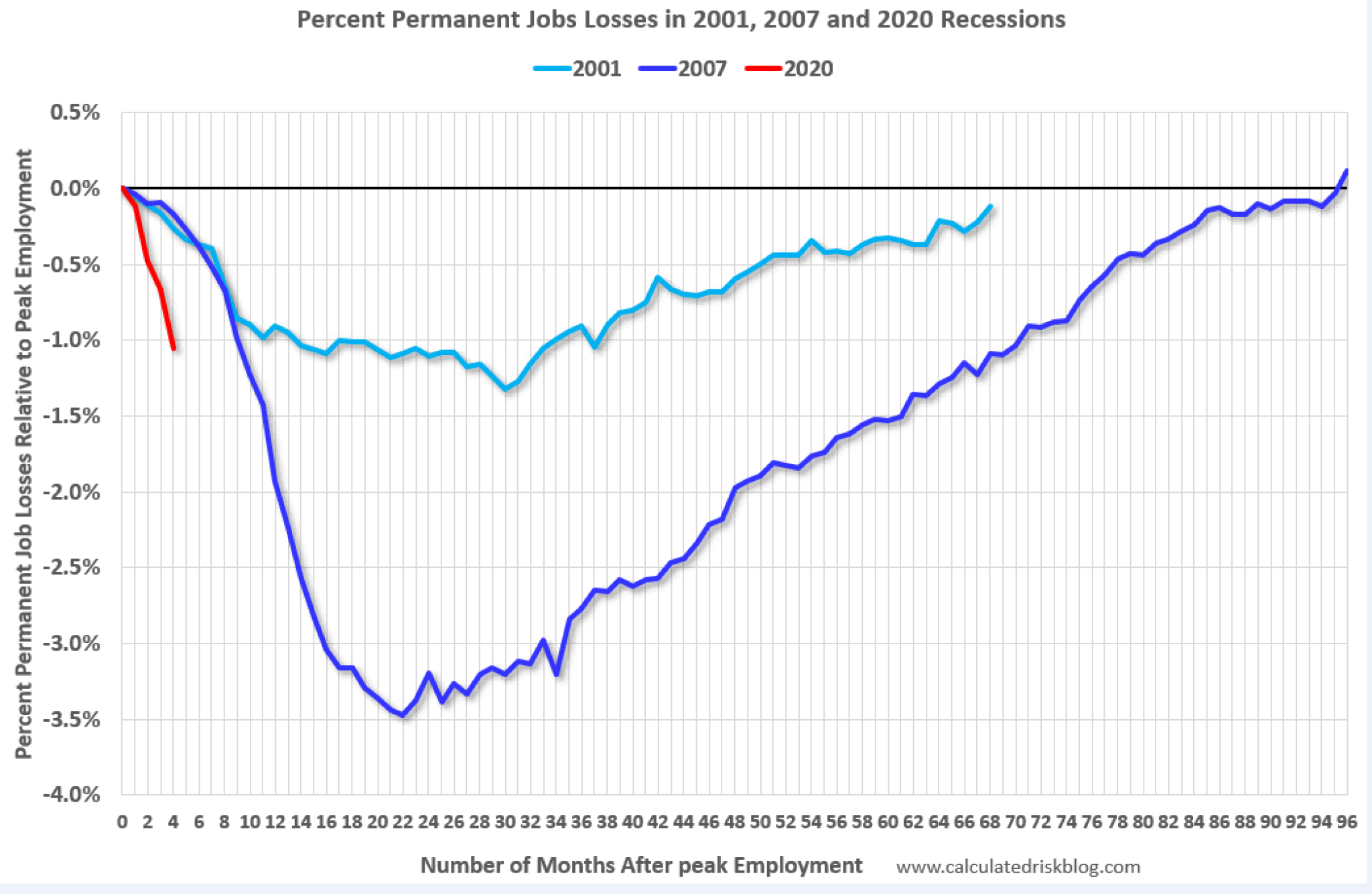

It’s an ugly chart. But Bloomberg’s Joe Weisenthal added a little twist today. In his morning note, he wrote “of course, most of the job losses in prior recessions weren’t initially characterized as temporary, so the comparison isn’t exactly apples to apples. So I asked him to make a version that looked just at permanent layoffs. And the chart at this point looks like this.”

Joe’s takeaway:

The glass half-full scenario here is that permanent job losses are still not nearly as deep as last time. So far in this crisis, we’ve lost just over 1% of jobs on a gone-for-good basis. On the other hand, these losses starting off way faster and way steeper. And in the meantime, the massive stimulus has already gone out the door, and we still haven’t gotten the virus under control.

This encapsulates where we are very well. If you want to be cautiously optimistic, then you could believe we can ride through this downturn with that red line bending upwards more quickly – and not approaching the permanent loss levels of the Great Financial Crisis.

But, the downside risk – especially with an accelerating re-closing in a lot of places – is that we see a massive new wave of permanent job loss. And this threat of the temporary becoming permanent is what should have us worried. Government stimulus is going to be key in easing those worries, of course.

Stimulus

I saw something chilling in the newspaper this morning.

A backlog of eviction cases is beginning to move through the court system as millions of Americans who had counted on federal aid and eviction moratoriums to stay in their homes now fear being thrown out.

A crisis among renters is expected to deepen this month as the enhanced unemployment benefits that have kept many afloat run out at the end of July and the $1,200-per-adult stimulus payment that had supported households earlier in the crisis becomes a distant memory.

Meanwhile, enforcement of federal moratoriums on some types of evictions is uneven, with experts warning that judges’ efforts to limit access to courtrooms or hold hearings online because of covid-19 could increasingly leave elderly or poor renters at a disadvantage.

Of the 110 million Americans living in rental households, 20 percent are at risk of eviction by Sept. 30, according to an analysis by the Covid-19 Eviction Defense Project, a Colorado-based community group. African American and Hispanic renters are expected to be hardest hit.

This is exactly what I worry about. The way I put it last week was this:

One thing to watch is evictions. Landlords who are receiving no rent due to COVID-19 deferrals may soon have a chance to get their money. But likely, many tenants will not have enough. And if allowed, landlords will begin evictions. For me, that will be the first visual sign that this crisis has escalated and the safety net of stimulus has broken irreparably. Consumers and markets will react – and negatively – if this does come to pass.

Evictions aren’t just a signpost of the crisis escalating though. They are a symbol of failure. When people are getting tossed out on the street en masse, with nowhere to go, in the middle of a viral epidemic, and likely with no healthcare insurance, you can’t have a more obvious sign of systemic failure. That’s as bad as it gets. And it’s happening right now – in the richest country in the world.

Focus on that a second. We can talk about specific stimulus measures or the fact that the US Congress has just started a two-week recess, making extending stimulus more problematic. And we can map out what level of support we need to keep the US economy growing. But, evictions are a more raw and obvious sign of extreme systemic dysfunction. It’s certainly not what you’re going to see in other rich developed countries over the next few months.

For me, this is the potent symbol of a W-style recession.

Markets

Meanwhile, markets are still in a bullish mindset. The re-opening data are still bullish and the institutional money is chasing returns after underperforming in Q2.

Nomura’s Charlie McElligott told me on the phone last week that as volatility winds down as the March liquidity crisis fades, money managers have more headroom for leverage. And so, many are employing leverage and chasing shares higher in order to make up for the re-opening rally underperformance. That will keep share prices elevated.

Bearish analysts are being forced to raise their price targets as the market moves higher. For example, JPMorgan analyst Ryan Brinkman was recently forced to raise his price target of Tesla from $275 to $295 because Tesla announced it beat vehicle delivery targets. Tesla is quoted at $1371.58 as I write this, with the average analyst target at $730 a share.

The same goes for the S&P500 as a whole, by the way. Citi bumped up its S&P 500 forecast to 2900 from 2700, because the market keeps going higher. The S&P closed yesterday at 3179.72. Their view?

“We envision volatility for equities as good news is being priced in and problems are being overlooked,” Levkovich said, laying out some risks he thinks investors are ignoring.

“A second wave of debilitating COVID-19 cases that causes either new shutdowns or slower economic recovery would be challenging, not to mention the U.S. elections, but these are not immediate threats, and investors appear to only have short-term time frames currently,” Levkovich and the team said. “We add that margin pressures from trade friction and weak year-over-year trends (despite better sequential activity) also matter.”

“Ultimately, earnings have to come back in a very meaningful way, and the market already is anticipating that likelihood over time,” said Levkovich, who notes that as businesses try to absorb fixed overhead costs during the pandemic, “a much higher level of activity is required to generate incremental margins.” And more job losses may prevent that expansion, he and the team said.

My View

I don’t think Citi’s wrong here. The market wants to go higher. And investors are only focused on the short term. Why? I think data that Dion Rabouin cited for Axios yesterday tells us why:

Despite cutting expectations for companies’ earnings by the most in history and revenue by the most since 2009, Wall Street analysts are getting increasingly bullish on the overall direction of the U.S. stock market.

[…]

Of note: Through Thursday, 185 S&P 500 companies had withdrawn or confirmed a previous withdrawal of annual EPS guidance for fiscal year 2020 or FY 2021 and just 49 have issued EPS guidance for Q2 2020.

- The number of companies issuing EPS guidance to date for Q2 2020 is less than half the 5-year average for a quarter of 106.

On the other hand: Price targets for the S&P have steadily risen in recent weeks with data now showing the average bottom-up, year-end target price is 3328.37 — 6% above the index’s current level, FactSet senior earnings analyst John Butters points out in note to clients.

[…]

- The S&P 500’s forward 12-month price-to-earnings ratio is 21.8, well above the index’s five-year average of 16.9 and 10-year average of 15.2.

It’s the lack of forward guidance that explains the disconnect for me. Companies are getting a free pass right now because the COVID-19 pandemic means no one has visibility into the future. So, corporates can pull guidance and wait.

Meanwhile, the data are coming out better than expected and analysts and investors are taking a wait and see approach to revising both individual and index earnings estimates until they get more EPS guidance. And with investors chasing shares higher on the back of leverage to catch up to their benchmarks, you get a lot of multiple expansion. And the market looks bullish.

I think that narrative plays out when the evictions play out. If and when people start losing their jobs permanently because of the re-closing and the evictions start up because of massive policy errors from government, that’s when the free pass for companies is over. I don’t think we get there until the end of summer and earnings season at the beginning of Q4.

The hope is that the second downdraft from this re-closing is muted and the policy errors are limited. The risk is that the downdraft is severe, and the policy errors are large. Share prices will move accordingly. That’s my bet.

Comments are closed.