Data setback for the economic bears

The US economy has been growing for a record 129 months now. And the data that’s been coming out of the US recently indicate that’s unlikely to change anytime soon. Could the economic effects of the coronavirus outbreak upset this trend? Absolutely. However, the threat is much more about financial conditions and medium-term economic risk than anything regarding near-term recession in the US.

The Data

Before I get into the data, let me say that I am thinking of this in stock and flow terms. By that I mean that we have an existing data set that describes the US or global economy at any one time – the stock. And depending on what those data say about the economy, we are at a point that’s either vulnerable or largely impervious to incoming data and event risk. From what I can see, right now, the US economy is still in the ‘impervious’ state. And the incoming data seem to suggest it is becoming more impervious to data shocks rather than less.

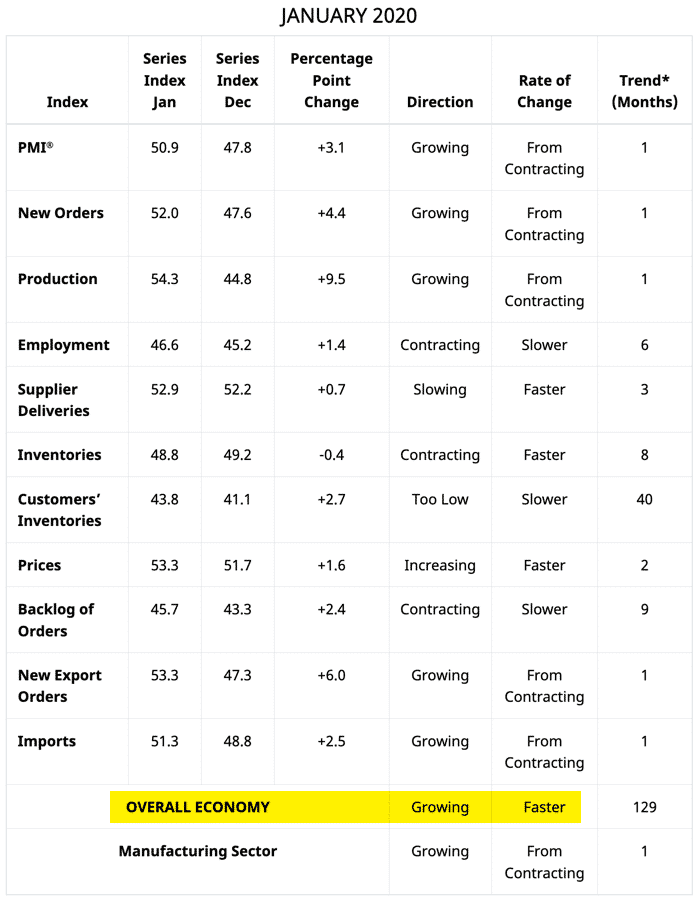

For example, if you look at yesterday’s ISM print, the worry there was that the ISM manufacturing data set would deteriorate further. ISM has shown the US manufacturing sector in recession while the Markit PMI data has already shown a bounce. Back in October, Markit’s Chris Williamson tried to explain why the datasets were diverging. And at that time, I wrote that we could be bottoming – but warned “if we aren’t, policy makers are well warned that this could be a pre-cursor to recession – unless they take additional steps to prevent that.”

Well, the ISM data are finally corroborating a bottom, alongside the Markit numbers.

Source: Institute for Supply Management

ISM even says that their PMI data is consistent with an economy growing at 2.4%. That’s not stall speed, folks. That’s well above stall speed.

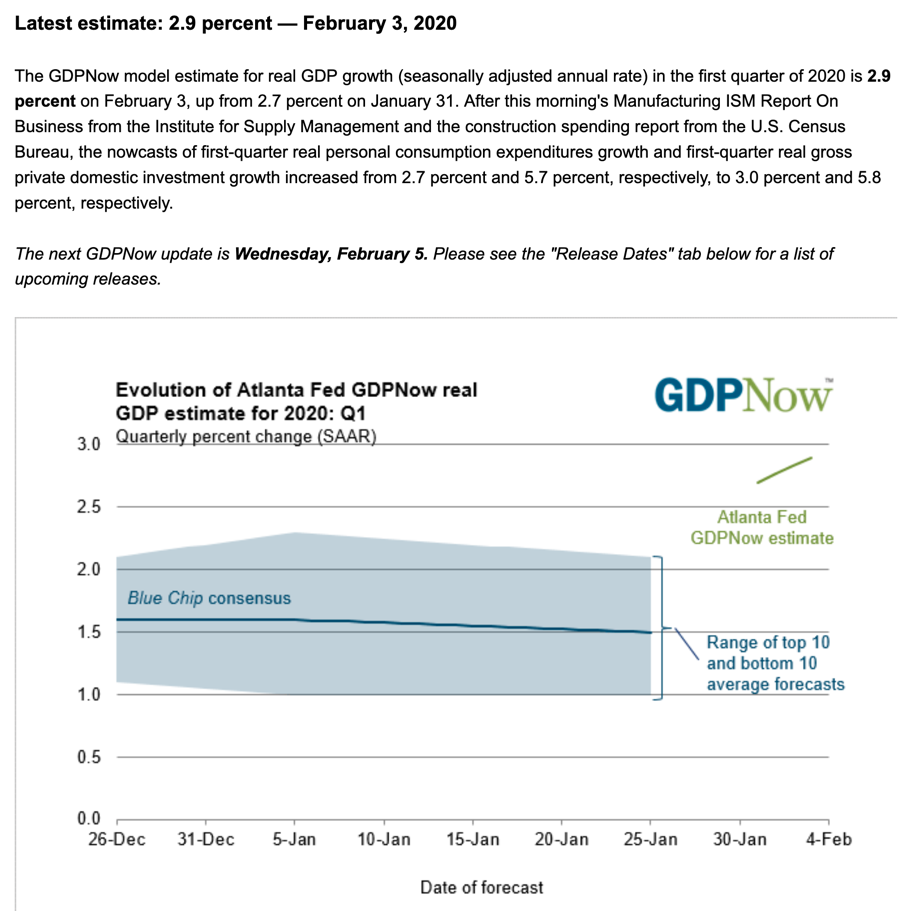

And now, the Atlanta Fed nowcast has moved up to 2.9% for Q1 2020 on the back of the ISM data set.

Again, well above stall speed

Rolling 12-month real GDP growth is 2.32% through the end of Q4 2019. And that’s up from 2.07% after Q3. Add to that the fact that the Atlanta Fed is presently nowcasting 2.9% for Q1 2020 and the obvious conclusion is that – on the eve of the coronavirus outbreak – the US economy was re-accelerating.

The Coronavirus

The latest stat I saw out of China was that China’s car sales are predicted to plummet 25% to 30% in the first two months of 2020, the largest drop on record. And Macau is now preparing to shut down its casinos, which – depending on what source you look at – are 6 to 9 times as big as the Las Vegas Strip.

So, the uncertainty surrounding the coronavirus – and whether it eventually will become a pandemic – is very large. We simply don’t know how severe an impact it will have on the Chinese economy, on global trade flows, on the oil and commodity sectors, and on global growth.

My take

But, the pre-conditions in the US are pretty good. And so, the coronavirus has to have massive and long-lasting impact, and the policy response has to be completely misguided to overcome that in the near-term.

The medium-term – say beyond six months – is another story. We clearly have a slowing in job growth in the US. JOLTS data show job openings declining. And the jobless claims data show companies are on the cusp of sacking more workers. All of that is going to slow income and consumption growth, irrespective of the bounce in PMI data.

For me, right now, my biggest worry on the coronavirus is the policy response. There are multiple signs that financial conditions are tightening, most importantly from the inverted US yield curve. And the lag between that signal and a potential recession could be as short as six months. If the coronavirus outbreak gets worse and policymakers get it wrong, asset markets have a long way to fall. And any recession is going to be that much deeper as a result.

My view: in the worst case outcomes of this virus, policy choices in the coming days will have resonance for weeks and months to come.

Comments are closed.