The US economy is doing fine and the jobs picture is good

The US jobs report released just earlier this morning showed the US economy adding 136,000 jobs to payrolls in September, with the unemployment rate declining to a 50-year low of 3.5%. This is the latest in a batch of economic data showing the US economy doing just fine, with little chance of recession in 2019. So, let’s go through some of the numbers and what I believe they are telling us.

The jobs picture

Headline Figures:

- Nonfarm payroll employment up +136K vs +140K expected, with +45K in revisions

- Unemployment rate: 3.5% vs. 3.7% prior and 3.7% expected

- U-6 unemployment rate: 6.9% vs. 7.2% prior

- Average hourly earnings steady, but up 2.9% y-o-y, down from 3.2%

- Labor force participation steady at 63.2%

These are good figures. The +136,000 payroll number released today was bolstered by upward revisions of +45,000 to July and August data. So, not only is the real headline add number in essence +181,000, handily beating estimates for +140,000, we also got upward revisions for the first time in 6 months. This is a very positive sign.

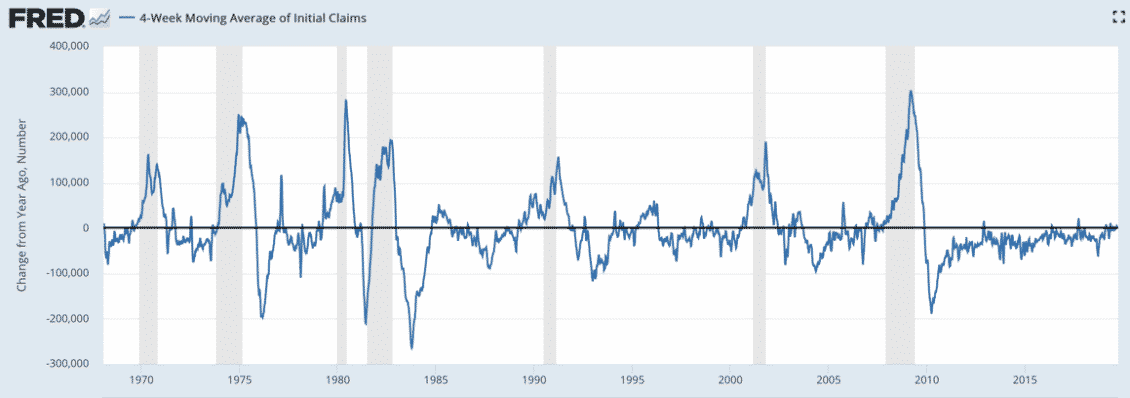

But I tend to look at rate of change data more for directionality. And the only headline number of that ilk was soft, with wage growth coming in below 3%. In addition, the rate of change on the employment figures are showing signs of weakness as well.

Notice that the y-o-y unemployment rate change is basically a push right now. And that’s a level consistent with mid-cycle slowdowns and recessions. This means that we either see the unemployment rate fall further from here or we are at risk of a recession in 2020.

The same is true if you look at the rate of change of initial jobless claims, though I would caution that this cycle’s data shows a very different pattern, with a near flatline rate of change.

So, overall, I would say the jobs picture looks good right now. But, going forward, we should watch the rate of change numbers to confirm whether we are exiting the mid-cycle slowdown or moving into a recession. In my view, the data could go either way, depending, at the margin, on the policy mix and the policy response to incoming data.

Other Macro Data Points

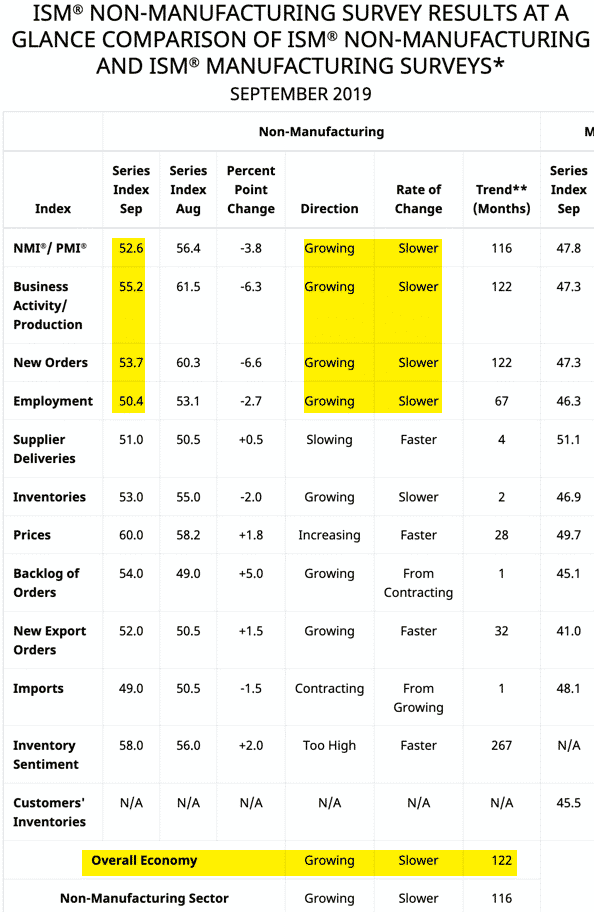

There are few other macro data points of note from this past week’s data set. The first I would point out is the Services ISM because it highlights the mid-cycle slowdown aspect, while also confirming the uS is not in a recession.

The picture it paints is of a fairly rapid deceleration in service sector growth from August to September. And while most of those numbers are well above 50%, the contraction cut off, the magnitude of deceleration almost invites a strong policy response on the fiscal and/or monetary side, simply to prevent downside risk from materializing.

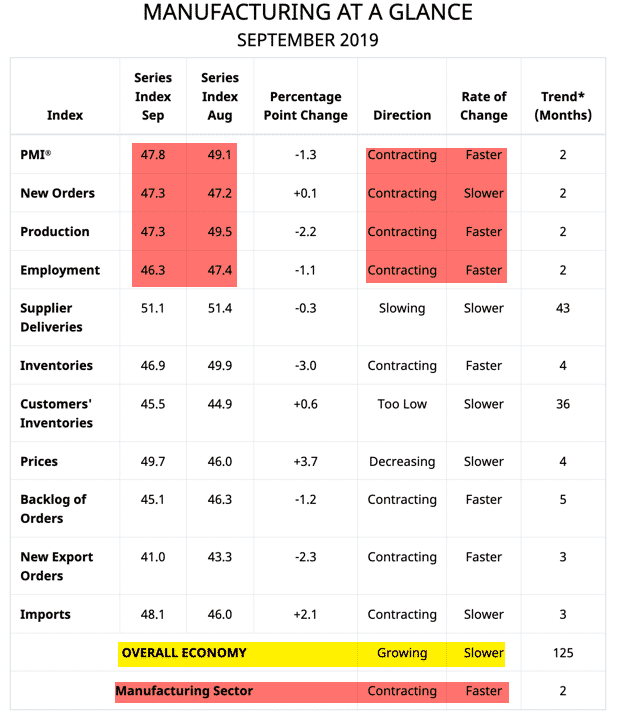

The most recent manufacturing PMI levels are worse, of course. The bits highlighted in red below show contraction, while the yellow shows a growth deceleration.

That’s ISM only, though. Interestingly, Markit PMI data say the manufacturing sector has bottomed. The IHS Markit Manufacturing PMI hit a five-month high in September of 51.1, putting it above the 50% level, even as the ISM showed continued deterioration. Markit put out a whole piece on why there’s a divergence. You can read it here. For me, the bottom line is that we could be bottoming. But, if we aren’t, policy makers are well warned that this could be a pre-cursor to recession – unless they take additional steps to prevent that.

My Macro View

As I have said for a number of months now, despite angst about a recession, nothing in the macro data says the US is in jeopardy of falling into a recession in 2019. In fact, if you used market data — like the spread between 2- and 10-year bonds or default rates in the high yield market to make a recession forecast — you would be hard-pressed to make the case for a recession in 2020 as well. The US is doing remarkably well economically, even as other major economies are faltering.

But, the data, although generally improved relative to expectations, do show signs of weakness that, if not contained, could lead to a recession next year. My biggest concerns are the rate of change numbers in the labor market and in the ISM Services figures as those represent economy-wide leading indicators.

So, my macro view is we are not in a recession now and that recession is still not a foregone conclusion over the medium term. The case for a 2020 recession relies mostly on policy errors exacerbating downside risk, not on the trajectory of growth given the macro outlook.

I expect no policy support on the fiscal side given the partisan nature of impeachment hearings. But let’s see what the Fed says and does.

Comments are closed.