The dollar liquidity squeeze and Germany’s weak real economy

Real quick here on Europe as I promised yesterday to add some thoughts on Germany after my trip to Cologne

US base rates are too high

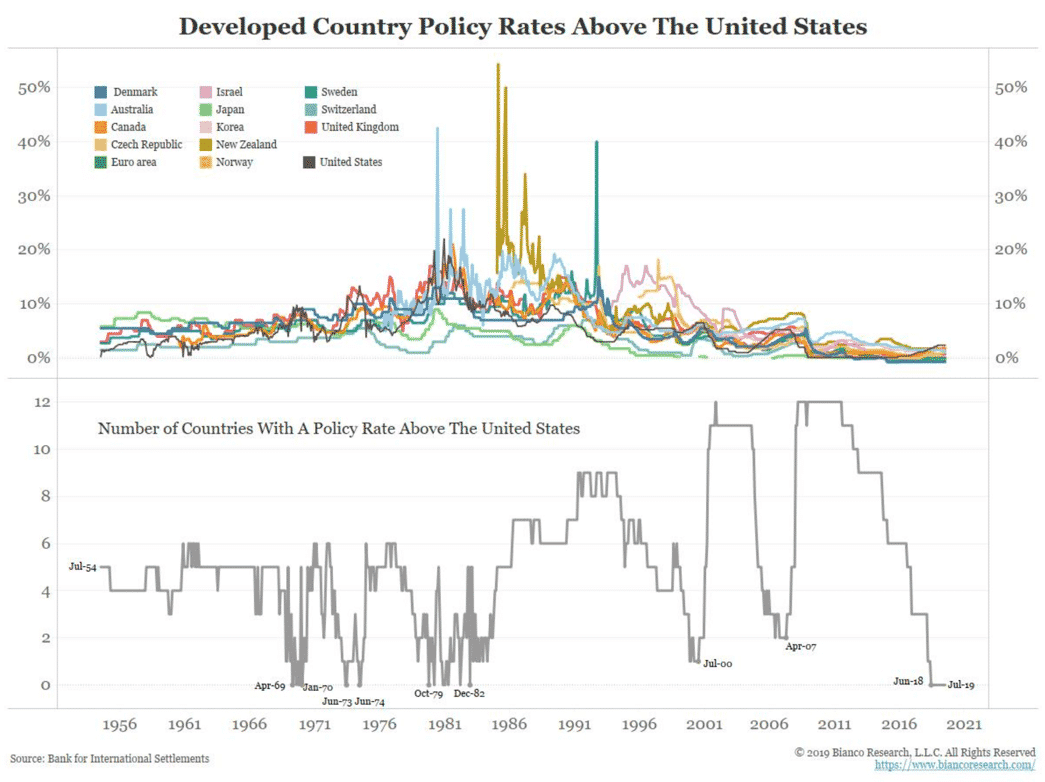

Take a look at this chart from Bianco Research.

Jim Bianco describes this as showing the US having the highest policy rate among developed economies for 13 months on the trot. He says that’s the longest streak for some 65 years and the first time since December 1982 that the US has had the highest rate.

This is a big problem.

Traditionally, one could think of this as a problem for emerging markets, where companies and countries issue debt in US dollars but have most all revenue sources in local currency. High US base rates engender inflows that buoy the US dollar. And a rising USD puts EM balance sheets upside down and threatens their ability to repay dollar denominated debts.

But today, we should think of the US dollar as a global funding currency, even in Europe. In fact, there has been a lot of talk about the plumbing of the global financial system being stressed by a lack of US dollar liquidity abroad. And this seems to be getting more and more acute because of the issuance of a huge amount of post-debt ceiling standoff US Treasury liabilities that are soaking up all the USD liquidity.

The New York Fed says that it had $872 million in foreign exchange swaps with foreign central banks last week, a sign that some foreign bank needed USD liquidity and this was provided via its central bank which then went out and utilized fx swap lines with the Fed. In this case, allegedly, the central bank in question was the European Central Bank. And that tells you that some European bank is experiencing severe liquidity problems.

If the US Federal Reserve doesn’t lower rates soon, we are going to have an accident.

Fed policy

It’s strange to lead a piece about Europe with two sections about the US dollar and Fed policy. But this is important given the weakness of the European banking system.

This chart of the Stoxx 600 banks gives you a sense of how weak they are.

Source: Gregoire Dupont

We are now below levels from the last mid-cycle slowdown and near the levels of the European sovereign debt crisis, when the European banking system was very close to collapsing if the wrong policy response was chosen instead of Draghi’s “whatever it takes”.

In this world, where dollar liquidity is short, Fed policy makes a difference. And here’s what the Fed is thinking. I’ll outsource to Tim Duy in his latest missive titled “Smaller Odds Of a Big Cut“:

As of this moment, CME reports odds of 95.8% that the Fed cuts rate 25bp while a 4.2% chance that they hold steady. Earlier in the week the choice was cut 25bp or 50bp but flipped on today’s data. It is reasonable to believe that a solid employment report with upward revisions to August further raises the odds of no cut this month.

I believe the Fed will cut 25bp even if the employment picture remains bright. The risks to the outlook remain, business investment has not yet rebounded, upcoming revisions to employment data indicate the economy had less momentum than believed, market participants anticipate further easing, and another rate cut would help address the yield curve inversion. Still, ongoing upside surprises to the data would encourage the Fed to take a more hawkish stance beyond this next meeting.

Translation: The Fed will remain the tightest of the developed economy central banks. A financial accident due to poor eurodollar liquidity should not be discounted

The German Economy

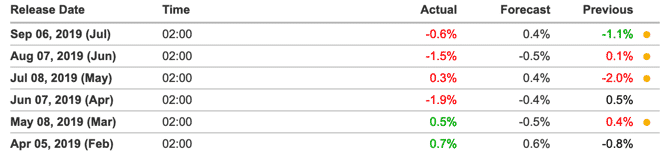

I want to concentrate on Germany here, since it’s the so-called motor of the euro area real economy and the largest economy in Europe. The data out this morning highlights the problem with Germany’s external demand-driven economic model because industrial production for July was down 0.6% after a 1.1% fall in the previous month. For four months now, the IP data out of Germany has disappointed. In fact, Germany’s manufacturing PMI for August came in on Monday at 43.5, well below the 50.0 dividing line for recession.

So large is the manufacturing component, the country as a whole is likely in a recession. And it doesn’t look any better going forward because German factory orders came in down 2.7% in July.

The incoming ECB head Christine Lagarde is asking for more fiscal stimulus – because the ECB is at the end of the line with its negative interest rate tax on euro area banks. That policy is a failure as it hurts already weak banks.

What’s on offer?

Not at a lot, frankly:

“If there ever was a time for the government to spend more, this would be now,” said Dirk Schumacher, head of European economics at Natixis . “This would benefit not just Germany but the eurozone as a whole. Everybody is asking for it.”

Faced with this, the finance ministry has been working on proposals worth about €50 billion ($55 billion) and almost entirely financed by debt, according to two senior officials.

The bulk of the stimulus would come from not raising taxes to finance the higher welfare spending and falling corporate tax revenues that will occur automatically as profits fall and workers lose their jobs, which would allow the budget deficit to grow.

Incentives to buy electric cars or insulate homes and special rules allowing companies to write down investment faster are also in the cards, as are special-purpose investment vehicles, which thanks to an accounting quirk aren’t subject to the country’s strict fiscal rules.

Such a package would be projected to boost GDP initially by about 1.5% but faces questions about its potential effectiveness.

My view

The Germans are not going to deviate from the existing economic orthodoxy which is based on low inflation and prudent fiscal management. Only in a crisis should we expect to see the Germans do anything that would jeopardize the euro area’s debt and deficit hurdles.

I think that means continued domestic consumption weakness that, combined with external demand weakness and demographic decline, means continued economic weakness.

Meanwhile the US just added another 130,000 jobs. And that’s enough to keep the Fed at 25 basis points later this month. Expect the dollar liquidity problems to continue. And only if there is a financial accident will we get an outsized response.

Comments are closed.