Economic downshift sinking in?

I want to run something by you here. It’s entirely speculative but there are multiple threads hanging off of it that give me reason to speculate. It’s about the trajectory of the US (and global economy) and signs that growth is slowing.

What precipitated this post was the realization that copper and oil prices were plummeting today. And while it’s just one day, and importantly, the first day of the month, it does bear watching what these commodity price movements are signalling.

Framing

Here’s how I am thinking of it at a macro level. I am going to go all the way back to the beginning of the year to set the scene.

The coronavirus pandemic was an exogenous economic shock that hit the global economy just as the US was leading us out of a mid-cycle slowdown in early 2020. Had we not been hit by the pandemic, there is ample reason to believe this cycle could have powered through without a recession. But we did have a pandemic — and a global shutdown to boot. The result was the worst economic contraction since the Great Depression.

When the shutdown was over, it was off to the races, with economic data showing the hockey stick-style increases emblematic of a V-shaped recovery. And while no credible macro analyst promised us that level of growth would continue for long, there was still a large degree of uncertainty about how long it would continue. In fact, economic surprises to the upside were just as big in the re-opening as they were to the downside during the shutdown.

So now, as the fall begins we are reassessing where we are and where the economy is likely headed over the short- and medium-term. The Federal Reserve, for example, has recently been more upbeat about the US economy, even going so far as to say their initial read of 9.3% unemployment at year end was too pessimistic. But are they ‘overshooting’ in their newfound optimism? I fear the answer could be yes. And that’s why the price action today in commodities got my attention.

Commodity Prices

My expectation going forward is that we will see a marked downshift in growth in Q4 from Q3, with some of that downshift having already begun in September. But, that is nothing to worry about. Where we should worry is where the downshift is exacerbated by policy mistakes like the lack of US fiscal support for households hit by the pandemic.

And this is where commodity prices come in. To the degree that the economic downshift is greater than anticipated it should be reflected in commodity prices as demand growth wanes. For example, as the coronavirus turned into a pandemic, copper prices started to buckle well before share prices did.

Source: Investing.com

So, any selloff in commodities – especially copper – has to be seen as a potential early warning signal of future economic demand growth weakness. And the fact that crude oil was down 4% and copper down 5% as I wrote this got me thinking.

My Real Vision colleague Roger Hirst told me that you have to be careful in extrapolating anything from commodities on three specific days: quarter end, quarter begin, and options expiry because so much volume occurs at those times. Large moves on those days are often simply the result of market positioning and have nothing to do with fundamentals. Today, as the beginning of Q4, is one such day. So, let’s not extrapolate.

ADP, Initial Claims and ISM

Having said that, let’s look at the economic data released in the US recently. Yesterday, we got the best upside surprise on the jobs front I have seen in a few weeks in the US. The September ADP private payrolls print was better than expected at 749k vs. 649k estimated and 481k in the previous month.

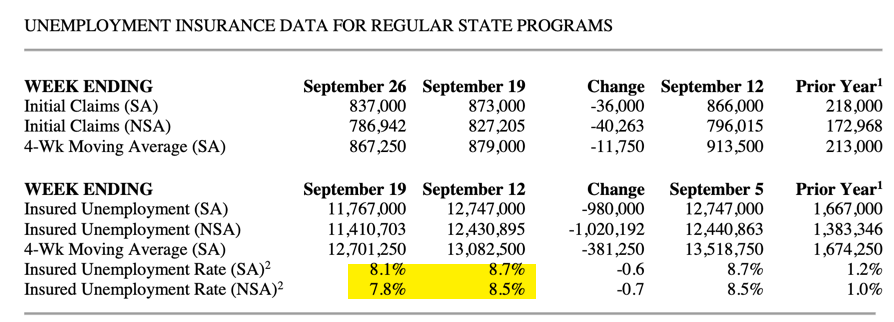

The jobless claims numbers that came out this morning were mildly encouraging, supporting the ADP numbers to a degree as both initial and continuing claims fell. The percentage of workers receiving traditional unemployment insurance benefits also fell below the rate of unemployment.

Those two data points were good. But the ISM numbers that came out this morning were weak. They showed the overall growth levels in manufacturing declining more than anticipated to 55.4 versus 56.4 expected, with production and new orders also declining.

The Markit Manufacturing PMI was also marginally lower than expected at 53.2 vs an anticipated 53.5.

The data show a slowing then, but are inconclusive as to whether that slowing is faster than anticipated. Tomorrow, we get the jobs number. Consensus is for an 850,000 add to payrolls and a drop in the unemployment rate from 8.4 to 8.2%.

My view

I am not going to make anything out of the moves in copper or oil until I see follow through. As a point of reference, WTI at $38 a barrel doesn’t concern me. That’s where we are now. It’s getting into the lower 30s that would be a big problem.

And the economic data are just good enough in my view to take a ‘steady as she goes’ view of the situation. Nevertheless, the movement in commodities still could be telling us we could be on the cusp of a sentiment shift. It is as if the disastrous Trump-Biden debate on Tuesday night told people: “hang on here; the US is a banana republic where gridlock is the norm and where a contested election will mean downside risk is more elevated than you thought.” That’s not my view of what the prevailing narrative around the US economy is. But I am attuned to its becoming the narrative.

So ends my speculation for the day.

Comments are closed.