The convergence to zero trade is back

Let me follow up this morning’s general post with some longer term thoughts here via the Patreon platform. And while I want to make some geopolitical comments, let me look at this mostly from a markets perspective.

I am once again thinking a lot about the long Anglo-Saxon bonds relative value trade that I recommended back in 2015 when we were in the last global economic scare. That’s because of disinflation and deflation. From a US investors perspective, I am also thinking about this as potentially long US domestic equities and short the S&P 500 as nationalism comes to the fore.

Here’s the setup.

Overtightening

The 2015 episode was a mid-cycle slowdown. We know that now. but there was real angst it could have been the end of this global expansion. As 2015 began and I was talking about pivoting to Anglo-Saxon bonds, we were at the high point economically for the US. Year-over year real GDP growth peaked at 3.8% in Q1 2015. It bottomed at 1.3% in Q2 2016.

Initially yields went up as Q1 2015 played out. But, as growth came crashing down, so did yields. US yields troughed at 1.3% in July 2016 as US GDP growth began to rise. I see the same happening again now. But this time, bond yields are way ahead of the curve because the 10-year peaked around 3.25% way back in October. I think there’s more room to fall. And that’s simply because I think the global growth slowdown has legs.

I am calling this the global economy’s Scylla and Charybdis passage. And by that I mean that the aim has been to tighten monetary policy enough to give monetary officials ammunition but not so much that it wrecks the economy. All of the Anglo-Saxon central banks have been out in front on this, largely because their monetary (and, therefore, fiscal) sovereignty has given them more license to expand. The result is that the Anglo-Saxon economies are the world’s external debtors, while the emerging markets and the eurozone have been the world’s external creditors during this up phase.

But, the tightening of policy may have been over-tightening, particularly in the US. And all of the Anglo-Saxon economies are faltering, which means there external positions will falter. And that means the global economy will slow. In Australia and Canada, this is particularly problematic given the housing bubbles in each of those countries. If we have a true recession, not just a mid-cycle slowing, expect those bubbles to pop, creating financial crises.

Nationalism

But, China is slowing too. And in today’s environment of increased nationalism, there are a number of fault lines through which this can play out. First, the question is how much the Chinese will allow this slowing to progress in an environment in which it is in a trade war with the US. My sense is that China is done with outsized stimulus that leaves deadweight costs on the financial system in the form of debt. And that means that, although the Chinese will work against excessive slowing, the slowing will continue.

The first order effect outside China will be in emerging Asia. They are slowing to near recession levels already right now according to recent PMI data. Further slowing in China will mean recession.

The second order effect will be in Europe, which is increasingly taking the German tack of suppressing domestic demand because of fiscal rectitude and filling that demand externally. This play won’t work and Europe is and will continue to feel pain from the Chinese slowdown.

But beyond that there are a lot of variables in terms of the trade war, a potential currency war, capital flight and political maneuvering. Retaliation against US firms is a real possibility. But that is just a possible outcome. So I am not modeling it.

What I would say, though, is that nationalism will play out in unpredictable ways that reduces globalization and even regionalization, breaking supply chains and hurting those most dependent on trade for growth. This, of course, is especially negative for Europe.

Deflation

All of this is deflationary — meaning we should expect inflation to fall. And indeed, inflation expectations are falling globally. This is the main reason behind the fall in yields.

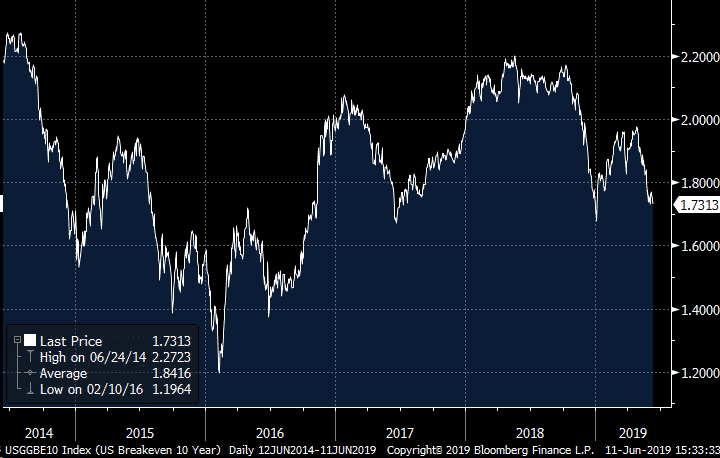

Look at the US 10-year breakevens, for example. We’ve seen a fall of about 50 basis points since the peaks in 2018. That explains 40% of the fall in 10-year yields. Just as the rise in breakevens explained the rise in yields through October.

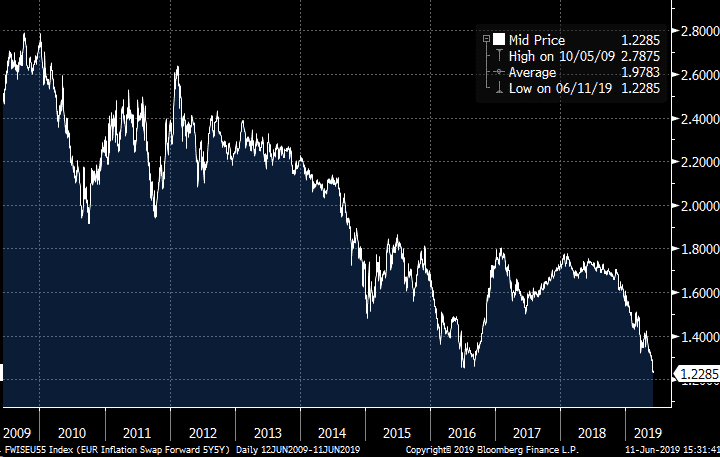

Look at Europe. It’s even worse there. Inflation expectations have fallen off a cliff since the Great Financial Crisis. And for good reason given the dynamics I highlighted in the last post.

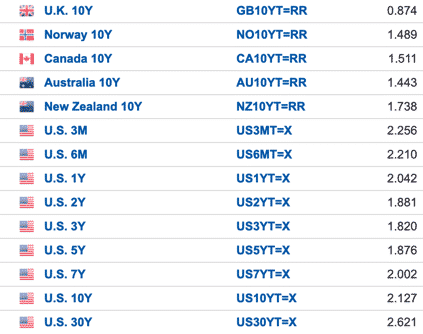

But, with European yields pinned at zero plus a penalty rate on deposits at the ECB. There’s not much further these yields can go. The convergence to zero as global growth slows tells you that the highest yielding long-term bonds are the area of best relative value.

Last thoughts

We are in big trouble here -economically and politically. This episode is more finely balanced than it was in 2015. The fault lines are more stark. And that makes the potential for crisis greater. Personally, I don’t think we can avoid a political or economic crisis at the tail end of this global growth slowdown. But I remain open to the soft landing view. In the meantime, it makes sense to play the deflation play and load up on US, Kiwi, Canadian and Australian government bonds. The convergence to zero trade is back.

Comments are closed.