More negative signals, this time from the economy

At the end of May, I started a post on very negative market signals saying “[t]he economic data out of the US and elsewhere still point to continued economic expansion over the near term. But, what we’re seeing in financial markets right now suggests markets are discounting serious economic problems down the line”. Two weeks later, this is no longer.

What we’re seeing now is a convergence to the downside for economic and market data, with the real economy catching up to the negative market signals. Some brief thoughts below

Gary Shilling thinks we’re in a recession now

Let me just say, I am interviewing economist Gary Shilling today for Real Vision. And on Thursday, I will be talking to Gluskin Sheff Chief Economist David Rosenberg who I believe also sees a recession.

But Gary is talking about a recession already happening. His latest 29-page insight for June starts “A U.S. recession probably started in the current quarter”. And this is predicated on downshifts in consumer spending and labour markets, with Gary saying the likely outcome is a garden-variety recession that ends sometime in 2020.

I’m not there yet. But I thought I would give you that view because it’s saying we’re in recession already. And I’ve been saying we’re simply on recession watch.

However, since I wrote the recession watch piece two weeks ago, the data flow has been negative, culminating in two particularly negative pieces of data over the past couple of business days.

Negative Data Flow

The first piece of dat comes from business sentiment. Here’s CNBC:

Key Points

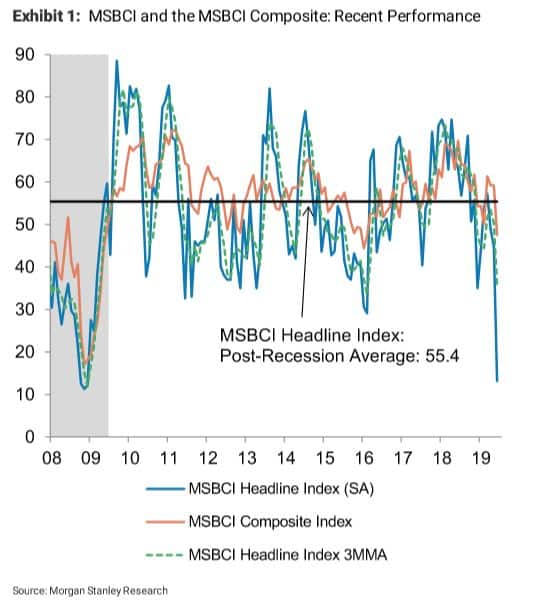

- The Morgan Stanley Business Conditions Index fell by 32 points in June, to a level of 13 from a level of 45 in May. This drop is the largest one-month decline on record.

- “The decline shows a sharp deterioration in sentiment this month that was broad-based across sectors,” economist Ellen Zentner said in a note to clients on Thursday.

- Every subindex of the Business Conditions Composite fell in June, except for the credit condition category, which “is consistent with the recent easing in broad financial conditions,” Zentner said.

And here’s the chart.

First, the rapidity of the decline doesn’t concern me per se, because that might be related to the Trump tariff scare and simply a one-time event. But, in the context of weak employment numbers it does concern me because it could be the beginning of a trend.

Look at the NY Fed’s Empire State Manufacturing Survey in that context. Here’s the chart.

And again the deterioration was rapid:

Business activity took a sharp turn downward in New York State, according to firms responding to the June 2019 Empire State Manufacturing Survey. The headline general business conditions index plummeted twenty-six points, its largest monthly decline on record, to -8.6. New orders receded, while shipments increased modestly. Unfilled orders fell, and delivery times and inventories moved slightly lower. Labor market indicators pointed to small declines in employment and hours worked.

Interpretation

The way I am looking at these data is not as a confirmation that recession began this quarter as Gary Shilling does. I have looked at the consumer spending data he cites. And while the downshift is rapid on a quarter to quarter basis, it is not anomalous.

Instead, I see the data as a confirmation that Trump policy moves are exacerbating near-term economic weakness. And the fragility of the US and global economy right now makes it vulnerable to an exogenous shock. The tariffs and the tension with are Iran are both flash points that could legitimately tip this into recession.

The yield curve remains inverted from 3 months to 30 years, which is a big worry because it is only a persistent inversion that matters regarding a recession indicator. The depth of inversion has lessened though because the 3-month to 3-year inversion is now from 2.221% to 1.750%, which is only 47 basis points, down from over 50 a couple of weeks ago. But 3 basis points are not a lot to hang your hat on. And 47 basis point of inversion is pretty massive.

Ultimately, while I am not in Shilling’s camp, calling recession right now, I do think we are edging closer. And the Fed does have a role to play here. It will be interesting to see how they respond with their policy and policy statement tomorrow.

Comments are closed.