No catalysts for global recession as Brexit gets long extension

The overall macro message I have been making the past several months is that the global economy has cooled to perhaps its slowest growth since the financial crisis. Yet, when we look for signs of imminent recession in the US or for catalysts for a global recession, there are none. A no-deal Brexit was perhaps the only potential catalyst I could see. And that has now been taken off the table.

My December Brexit call has been validated

Before I get into the global economy, now that Brexit has been taken off the table as a catalyst for recession, let’s unpack where we’ve come from in Brexit – and where we’re headed. Back on 10 December, after British Prime Minister Theresa May delayed the Brexit vote in the House of Commons, here’s what I was saying about likely outcomes:

I think Theresa May’s days are numbered. The only reason she remains in power now is that there are no obvious successors. And fear of Corbyn is too great to take a risk on changing leader while the Brexit process is ongoing. This calculus changes considerably if Brexit can be delayed or Article 50 revoked unilaterally, as the European Court of Justice confirmed is possible today.

From a purely political perspective, this makes delaying Brexit past 29 Mar 2019 the obvious priority for the majority of MPs within the Conservative Party who are not committed to a no-deal Brexit. And if that delay cannot be achieved, due to EU recalcitrance, Parliament will be forced to consider revoking Article 50 altogether, simply to stop the clock ticking.

Theresa May may not survive until then, of course. But, as soon as either of these two outcomes occurs, Theresa May’s utility will cease to exist. And the Conservative Party will find a new leader it can sell to the electorate as someone capable of negotiating a better Brexit.

The issue of a second referendum will continue to loom in the background as this occurs.

Politics don’t get more complicated than this.

On the first paragraph, the pro-Brexit crowd tried to unseat May in a party no-confidence vote immediately after I wrote that piece. They failed. And so, May is protected through the end of the Brexit extension.

On the second paragraph, this has proved the right view. A no-deal Brexit proved a step too far for the British parliament. And so, we now have a delay. In my last post, I wrote that Theresa May finally tipped her hand on revocation too, hinting in her “Chequers couch” video at Article 50 revocation as preferable to no deal. So, going forward, we can pretty much forget about a no-deal Brexit as long as Theresa May remains Prime Minister. The only way we get a no-deal Brexit now is if we have a general election that puts a new eurosceptic pro-Brexit Conservative Prime Minister like Boris Johnson into 10 Downing Street. And I have serious doubts that could ever happen.

On the third paragraph, Theresa May has survived, simply because her Conservative party enemies mis-timed their challenge, acting too precipitously. Moreover, even though we have a delay, it is still not long enough to unseat her. So, my previous statement is wrong; Theresa May’s utility has not ceased to exist. She can limp on as PM for quite some time. I don’t think she will find a way through the Brexit impasse in cross-party negotiations. And so I predict a second referendum looks increasingly likely to solve the logjam, which is what I pointed to in the fourth paragraph.

Of course, it is still a very complicated situation. But, I think parliament has proven that there is no way out of this through them. They cannot agree a solution. Maybe, May will keep bringing votes forward in parliament until she gets a majority on one of them. But House Speaker Bercow has already ruled that she cannot do this if the legislation does not change substantially from one vote to the next. So I think this green lights a second referendum. There are only six months though. So, it’s far from a certain outcome.

The Conservative party is in big trouble here though. Not only are they split, but they are about to lose a lot of seats in the upcoming local elections. Moreover, having not delivered on Brexit, they have now created the impetus for a resurgence in UKIP, from whom they took votes at the last General Election in 2017. If we were to contest another General Election, UKIP would take votes from the Conservatives. Other pro-Brexit voters would protest and stay home. And given the first past the post system, that would end up helping Labour win. And Jeremy Corbyn would become Prime Minister.

So that’s my view on Britain for now

The IMF sees global deceleration

On the global front, I want to focus on the IMF here. Via Quartz:

In all corners of the globe, warning signs are flashing about the state of the economy. The IMF recently downgraded its forecast for global economic growth for the fourth time in nine months. We are now in a “significantly weakened global expansion,” according to IMF chief economist Gita Gopinath.

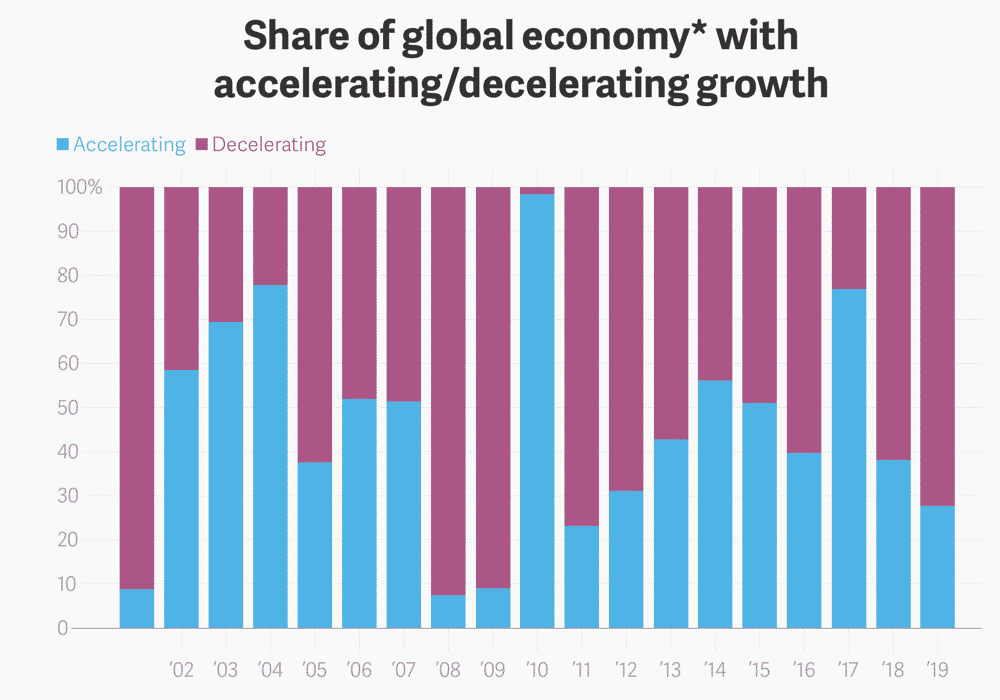

Some 70% of the global economy (as measured by GDP) will experience a slowdown this year, the IMF forecasts. That would make it the most extensive synchronized slowdown since 2011.

How forward-looking is this outlook though? Yes they say that growth is forecast to decelerate further. But, they could be wrong. Moreover, it’s the pace of that deceleration that matters – because if the economic deceleration is itself deceleration, there is going to be no global recession.

My point is that everyone is pessimistic now. Everyone has bought into a narrative of continued global deceleration. And, to me, it says that outcome is priced in – which means there is the potential for an upside surprise, both globally and in the US. That doesn’t mean everything will be just fine. It just means the data could come out better than expected. For the US, that means, not just no recession but re-acceleration. From an investing standpoint, in the US, that means outperformance for cyclicals like banks.It would also mean curve steepening i.e. rising long rates relative to short rates.

I see this outcome as still very much in doubt. But, for me, there is simply no catalyst for global recession on the horizon. That’s good news for risk assets and bad news for safe assets.

Comments are closed.