Selling the good news does not a bull market make

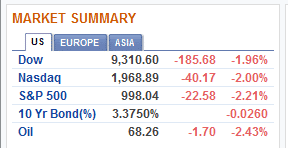

So we started September in an ugly way. With the markets down 2% across the board, and oil and bond yields also falling. Forgive me for thinking this is a bad sign, but selling on good news doesn’t sound very bullish.

So we started September in an ugly way. With the markets down 2% across the board, and oil and bond yields also falling. Forgive me for thinking this is a bad sign, but selling on good news doesn’t sound very bullish.

And the ISM data definitely was bullish. Production 61.9 – Yay! New orders 64.9 – Hurrah! What’s not to like? But the Dow was down 185 points – Boo! What gives?

And the ISM data definitely was bullish. Production 61.9 – Yay! New orders 64.9 – Hurrah! What’s not to like? But the Dow was down 185 points – Boo! What gives?

Well, for one, bank shares were decimated (see the sea of red in the chart to the right?). But, there’s more to it than that; Wal-mart was the only stock to rise in the Dow. For the S&P, we had breadth of 16-1 for decliners to advancers. This was a broad-based selloff – and one that took place with the backdrop of positive economic data from manufacturing and housing.

To me, that is a very worrying sign. Now, obviously I expect a market correction (see posts here and here). But, I neither expect nor want a crash (I do think this is a possibility, however, given how far stocks have run without a correction).

It is now September, the month of market jitters, and the financial services industry is headed back from their long slumber. Things get serious in September. Let’s hope they don’t get too serious or Paul Tudor Jones is looking like a financial prophet yet again.

Comments are closed.