Bullish thoughts about Europe’s recovery

It’s easy to get pessimistic, looking at the economic outlook from the US, which has been a laggard during the coronavirus pandemic. The United States has a ways to go before a semblance of economic normalcy returns.

But I have been looking at a lot of European data and news flow the past several days. And what’s clear is that while the US is still hunkering down, Europe is now slowly emerging from lockdown. I think this presents the potential for better growth. So I want to outline what I’m seeing.

Some coronavirus data

A lot of this comes from the data, which show that Europe has flattened the curve. I have looked at data from a number of countries and they all show a retreat in the virus, even in Italy and Spain.

For example, writing this on Sunday, in Spain, the number of additional deaths due to coronavirus was 288 yesterday, the lowest count in 37 days. A total of 207,634 Covid-19 cases have been recorded in Spain thus far. But, the number of new cases was 1,729, while 3,024 people were marked as recovered today.

The outlier is Sweden, which has been more relaxed about its lockdown. Swiss public news service SRF has some good charts for Switzerland.

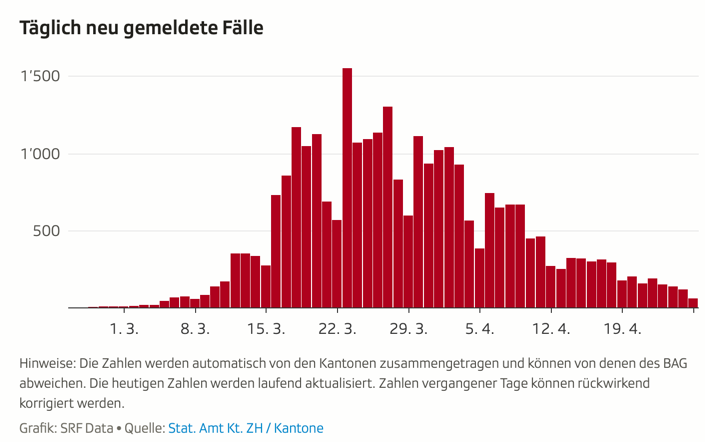

In terms of new infections, they peaked a month ago in Switzerland, and have fallen precipitously.

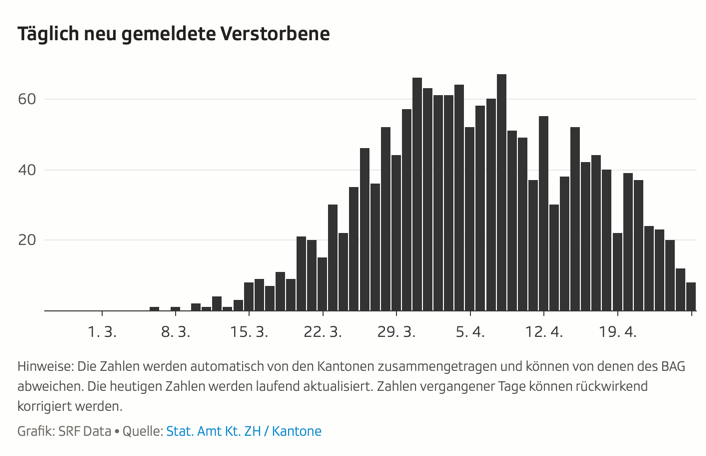

The chart of coronavirus deaths looks similar with a two-week lag.

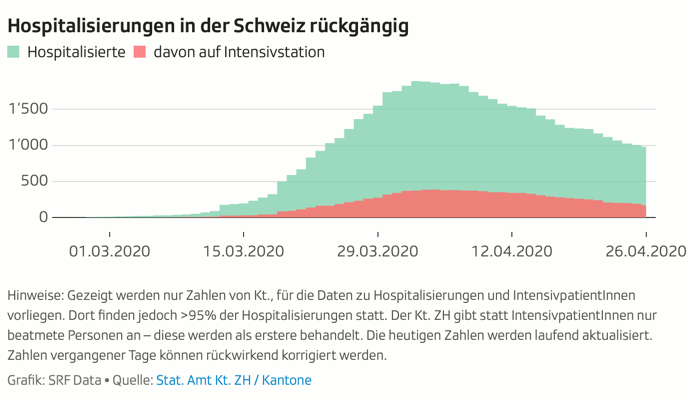

Hospitalizations and intensive care cases peaked about the same time as the death due to the virus. But the numbers are still high, showing how a large increase in cases could saturate a health care system.

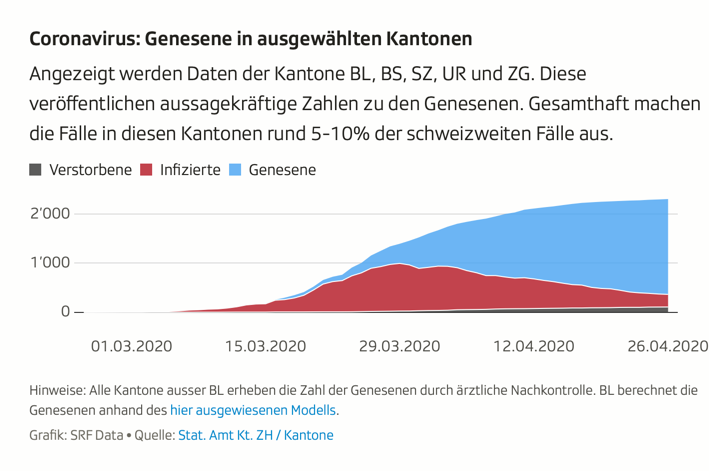

In the end, the overwhelming majority of coronavirus cases in Switzerland can now be counted as ‘recovered’

This is the picture that has caused European politicians to green light relaxation of lockdowns.

Relaxation of lockdowns

My daughter, who is studying in Germany, told me she went Schaufensterbummeln (window shopping) in Cologne yesterday because Germany has allowed stores under a certain size to re-open. She wore a mask, didn’t enter any stores, and said the streets were moderately full during good weather. Her conclusion was that neither she nor most other people were prepared to return to stores yet. But she was wading in cautiously.

As Europe tries to restart businesses, it will be similar everywhere. We have already seen this in Wuhan. German public news service ZDF has a good compilation of where we are seeing lockdowns lessened and how. Here are businesses now open or opening shortly, according to ZDF.

Switzerland: Building and garden supply stores, hairdressers, veterinarians, dentists, cosmetic studios and tattoo parlours

Croatia: most stores, libraries and museums plus public transport

Czech Republic: business visitors from within the EU with proof of a negative Covid-19 test in the last 4 days can stay for up to 72 hours. Libraries, zoos, restaurants and cafes are re-opening.

Norway: nurseries and primary schools

Belgium: only on 11 May will the first shops open. A week later some classrooms will open. Restaurants won’t come back until the beginning of June at the earliest

France: Also looking at 11 May. But renovation of Notre Dame will re-commence Monday

We know about Danish schools re-opening as well.

Again, Sweden is a bit of an outlier here in that they have travel restrictions in place through mid- June and seem more likely to increase lockdown than to decrease it. On Friday, I said that I had been looking at this mid-June date as a bogey for a resumption of normality. That would give us 7 weeks to ramp up in Europe. I think that’s optimistic but doable.

Even after the lockdown restrictions start lifting, people will be hesitant. Some behavior will be sticky and things may never go back to normal for years. But, we could see Q2 in Europe better than expected if this relaxation of lockdowns comes together quickly.

The contrast to the US

The United States is both a laggard and a worst case for Covid-19 infections. The worst cases in Europe like Spain, Italy, the UK and France are not opening up yet. They have weeks of economic pain still to come. In Spain, for example, only now are children allowed to leave their house. And only once a day for an hour and within a 1 kilometer radius, at that. Starting on 2 May, Spaniards can go for walks and do exercise outdoors.

So, we should expect the US to either risk a second wave of infections or be forced to wait another few weeks before rules start relaxing.

The biggest favourable contrast for Europe to the US in restarting the economy is the lack of economic disruption because of the social safety net. I was looking for the link yesterday to a story in a Swiss paper I read, but I couldn’t find it. It outlined why they felt blessed to still have 2.9% unemployment because of Kurzarbeit, where worker hours are cut, the employer pays workers for hours worked, and the government picks up the tab for difference. Universal healthcare means this doesn’t enter the picture in terms of employer-employee relationships.

That’s going to mean that, as long as your company is still in business, you can return as if nothing happened. In the US, many of the mass of unemployed people will need to look for employment elsewhere. And finding another job will take time, adding a long on-ramp to the recovery once business even opens.

Numbers and changes

Again, post-lockdown, consumption behaviors will have changed. Absolute consumption levels will be lower, but the consumption mix will change. We know that people have been using online and delivery services more often during the lockdowns. This will continue to benefit the likes of Amazon ($AMZN). Media consumption benefits the likes of Netflix ($NFLX). But, a lot of this is priced in as these companies have outperformed on the stock market.

In German magazine Focus, they talk about more Germans paying with cards (link here in German). The same at German daily Die Welt, (link in German), where they say that now 60 percent of Germans are not using cash at all. That’s quite a contrast from days of old since Germany has been a laggard in accepting credit and debt card transactions. Winners: Euronet ($EEFT), Mastercard ($MA) and Visa ($V).

My View

While researching this, I found gathering all the data across Europe in one place time-consuming and incomplete. This goes to the Achilles heel of Europe in terms of its balkanized consumer market vis-a-vis the US. Even so, as I look forward, I am more upbeat about the near term prospects of European economic recovery than I am about a US recovery.

Within Europe, there will be laggards though. Swiss daily Tagesanzeiger talked of there being a tussle and discounting war as Swiss companies fight over domestic tourists (link in German). For me, the obvious implication is that many tourists will go on holiday in their home country. And so, big losers are the likes of Greece.

SRF has a good article on Greece’s struggle with tourism (link in German). And it highlights that Greece is still in a Great Depression, having now been hit by three economic traumas back-to-back-to-back. As much as we have to be concerned about what a ‘peacetime’ Italy looks like, we have to also worry about what a post-crisis Greece looks like. I am not convinced the aversion to deficits and debts is over. And these will become an issue again for both of these countries.

The overall message here is hopeful though. Europe has been less aggressive with its stimulus measures than the US. But that’s in part because it hasn’t had to be as aggressive given how well the social safety net is performing. And the PMIs show a worse present economic situation than in the US. Most of this has been fully discounted by asset markets though.

I actually expect Europe to outperform the US over the short- to medium term as it exits lockdown in better shape. It’s over the longer-term and in transfer payments to help those hit hardest by the crisis like Spain and Italy where the worries are.

Expect more on this contrast in the coming days and weeks.

Comments are closed.