Before I get into the markets, let me point out two nice data points released this morning.

The data

The first is Q3 GDP for the US, which came in at 33.1% on an annualized basis and ahead of expectations for 31.0%. That’s 7.4% growth in one quarter. While it doesn’t make up for the contractions in Q1 and Q2, it does highlight the V-shaped recovery through most of Q3.

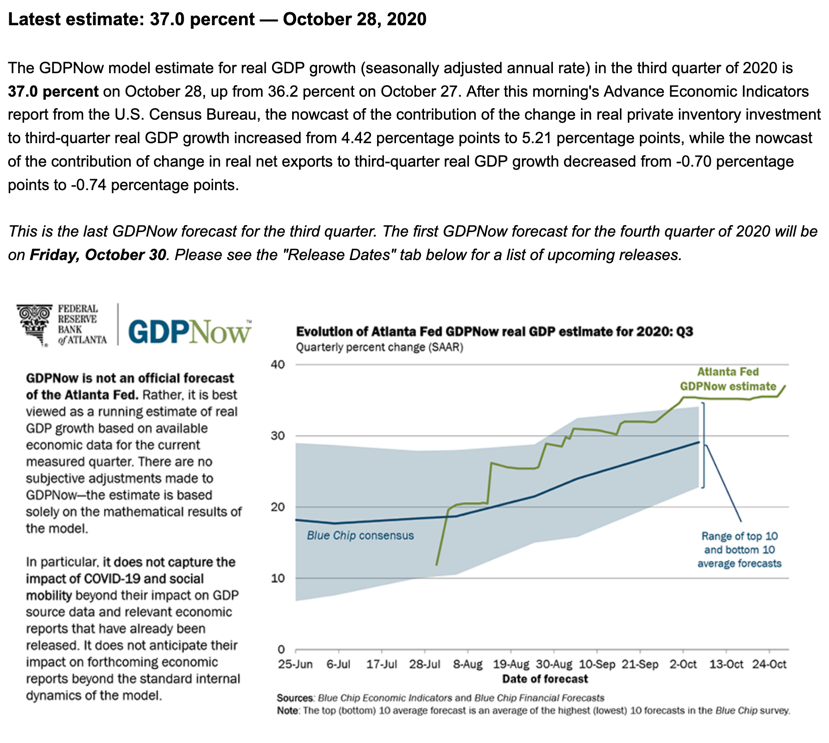

In fact, if you look at the blue chip consensus estimates and the Atlanta Fed’s GDPNow forecasts, there was a consistent ratcheting up of numbers over the past three months, suggesting most analysts underestimated the acceleration off the bottom we saw in Q3.

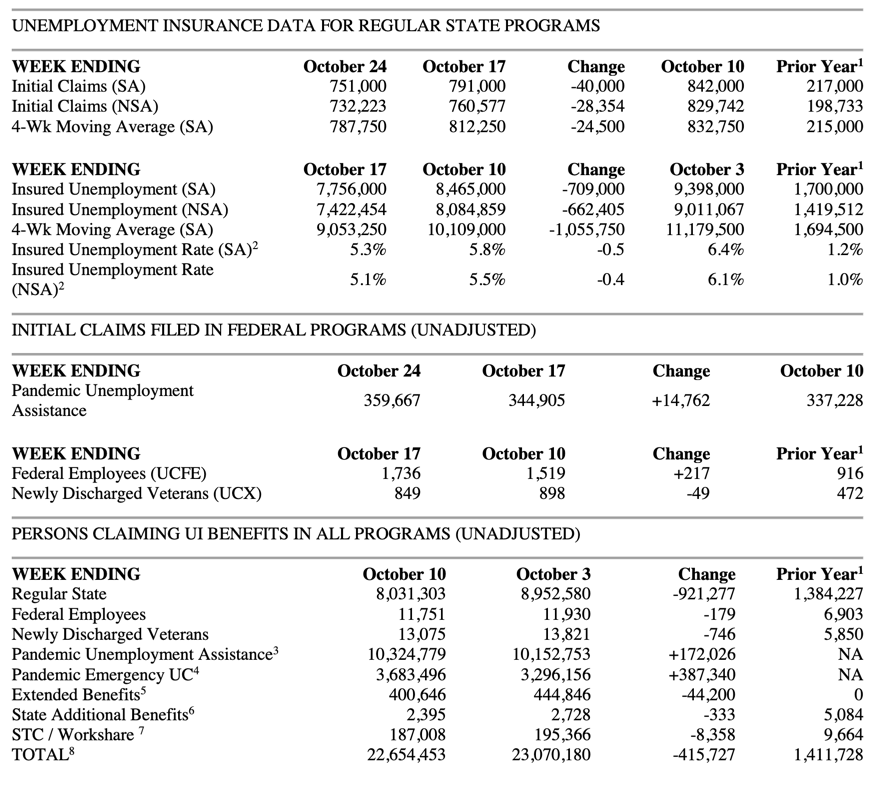

The second data point comes on the jobs front, where initial jobless claims fell from 791,000 to 751,000. That’s ahead of expectations for 775,000 and puts us well out of the 900,000 realm, where we had stalled in September. The 4-week average claims number has fallen 50,000 in two weeks.

I lead with the data because that’s what drives earnings and markets over the long term. And these backward to coincident data points tell us that the recovery should have legs. If this September and October period of volatility was simply about determining where the economy is headed and had nothing to do with coronavirus, we would be in the clear. But, unfortunately the virus is the big issue again now.

A brief note on the recession

And I say again for a specific reason. At the weekend, I finished the Bob Woodward, “Rage”. And what struck me was the degree to which President Trump blamed his woes on China. In his view, everything was going so well until the virus wrecked it. And he blames China for that.

Two things here. One, I was calling an economic turn from a mid-cycle slowdown early in the year. We were at historic lows for unemployment – and that includes Black Americans too. So I think the President is right; we were on a sustainable growth trajectory that the virus wrecked.

Two, from the book, even Dr. Fauci and the CDC’s Redwood admit the Chinese were hiding the ball. They did delay in reporting the severity of the outbreak. They didn’t work with the US. And that cost lives. Potentially, that delay was the biggest factor in the size of the first wave outside China. The Chinese run an authoritarian regime where they can institute draconian lockdowns to snuff things out. But, in western-style democracies, you can’t use the iron fist that way. So, the Chinese were able to get on top of the virus while other states were not.

Eventually, east Asia got on top of the virus too. Taiwan, for example, has a population of nearly 24 million. And they haven’t had a domestically-transmitted case of the novel coronavirus since April 12. That’s 200 days. They did it through border patrol, mask distribution, contact tracing, quarantines, and learned behavior from SARS. The west was at a distinct disadvantage there. And we see the outcome now.

Whether China is to blame is another question altogether. George H.W. Bush could blame the Fed and Oil and Carter could blame Volcker and Iran for their plights. It doesn’t matter. Politics don’t work that way.

Credit markets

With all of that as backdrop, it’s notable to look at what’s happening in credit markets. Moody’s recorded just 11 defaults in August and September for U.S. corporate debtors. And the Wall Street Journal reported just recently that this trend seems to be holding.

At the end of September, the trailing 12-month default rate for U.S. corporate issuers of speculative-grade bonds and loans was 8.5%, according to Moody’s Investors Service. That was below the 11.2% rate that Moody’s had forecast in early April and a decline from the previous month’s rate of 8.7%.

How backward-looking is this though? If we have a third wave in the US and consumers take fright, how likely is this to hold without stimulus and bailouts. I don’t think it will. David Rosenberg wrote this morning that high yield spreads widened out 17 basis points to 509 basis points yesterday. That’s the highest spread in a month. And since high yield is the canary in the coalmine for credit markets, this could be significant.

Let’s assume for the purposes of this piece that we do see a spike in hospitalizations and Covid-19 deaths that causes consumers to pull back. Then, we should expect defaults in high yield, particularly in oil, leisure, and travel.

What is clear is that covenant-lite deals will come home to roost then.

Three cents. Two cents. Even a mere 0.125 cents on the dollar.

More and more, these are the kinds of scraps that bondholders are fighting over as companies go belly up.

Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies — if that.

While few could have foreseen the pandemic’s toll on the economy, the depth of investors’ pain from corporate distress was all too predictable. Desperate to generate higher returns during a decade of rock-bottom interest rates, money managers bargained away legal protections, accepted ever-widening loopholes, and turned a blind eye to questionable earnings projections. Corporations, for their part, took full advantage and gorged on astronomical amounts of debt that many now cannot repay or refinance.

It’s a stark reminder of the long-lasting repercussions of the Federal Reserve’s unprecedented easy-money policies. Ultralow rates helped risky companies sell bonds with fewer safeguards, which creditors seeking higher returns were happy to accept. Now, amid a new bout of economic pain, the effects of those policies are coming to bear.

The takeaway: If the third wave is negative for credit, it will be a bloodbath. Credit losses will be severe. Liquidation – as opposed to Chapter 11 workouts – will be more common. And that will hurt credit supply, GDP growth, capital formation, jobs, and investor returns.

If we can get through this wave without a hit to the credit market, the economic trajectory I hinted at when I started this post could carry us toward a longer sustained recovery.

Growth vs. Value

If we see a spike in hospitalizations and Covid-19 deaths and consumers pull back, in retrospect, we could see the period before those early September jitters as a top of a bear market rally.

We got a September 2nd peak, followed by a correction in the Nasdaq, followed by a secondary lower peak on October 12th before the selloff resumed, with levels now approaching correction territory.

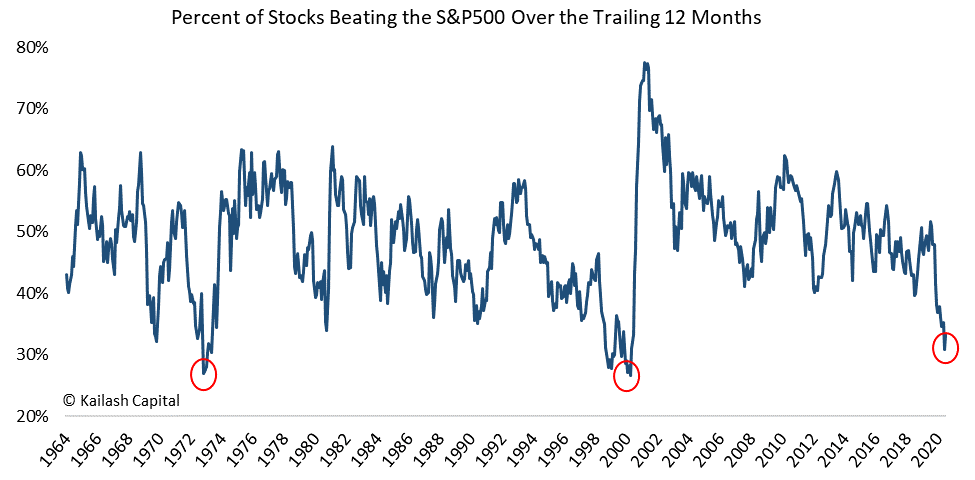

The question then goes to what happens to the growth vs value narrative and how much does it drive the indices. Here’s an interesting chart from Callum Thomas of Top Down Charts, a chart-driven macro house.

The clear implication of the three areas circled in red is that the narrow leadership of the market today mirrors the narrowness as the Nifty Fifty came crashing down in the early 1970s and as the tech bubble popped in 2000. All of the market gains are coming from a very select few companies whose earnings just happen to be pandemic resistant.

We get four out of five FAANG stocks after the market close today, Amazon, Apple, Facebook and Google. I will interested to see what their earnings and their guidance look like.

Irrespective of how their earnings do, I see two dueling narratives here. In the first, we are in a period of low growth where growth is at a premium. And given the low yields on bonds, it means we should be willing to pay up for ‘moat’ stocks with pandemic-resistant business models that exhibit operating leverage from scalability. These are companies that can grow earnings per share faster than revenue and can grow revenue faster than the economy. That’s a growth over value narrative. And it’s one that has caused the extreme levels in Callum Thomas’ chart.

A second narrative is one where the Callum Thomas chart is extreme and mean-reverting. And the only question is the trigger, meaning, to the degree we get a third wave of coronavirus that impacts the overall economy, it could be a catalyst for that mean reversion, with the FAANG-like stocks falling more than everyone else.

These two narratives are starkly different. And it shows you that there is a major opportunity now for out- or under-performance depending on which one proves correct.

Bond yields and inflation

To end these three macro-themed posts, let’s talk about safe asset yields and inflation. I think the convergence to zero is just about played out. There is more juice to squeeze, but you have to take on duration risk to get it. We’re talking 30- or 50-year paper from the Anglo-Saxon government issuers. That’s where the yields and convexity are highest. And therefore, that’s where you can get bond return offset if equities melt down.

A 60-40 portfolio is going to get crushed by the fall in equities unless it is long in duration on the bond side. There just isn’t enough convexity and yield convergence to zero left to act as risk mitigator unless you go far out on the duration spectrum. And that only works in Canada, New Zealand, Australia, the UK and the US.

The worry here is inflation, cyclical inflation. I think the secular trends in place that are keeping a lid on inflation are still in place. So the secular trend toward disinflation has a strong gravitational pull. But, to the degree we get through the third wave well, there could be supply bottlenecks that cause inflation to spike, and, therefore, a steepening of the yield curve.

But overall I see the cyclical inflation outcome as a tail risk. I am more concerned about equities, and, therefore, more likely to go longer duration as a hedge against their fall.

My take

All of this is very much dependent on the coronavirus. The pandemic is the elephant in the room. On a relative basis nothing else matters.

My own view on the pandemic has changed. Whereas in May, as we headed out of lockdown, I thought some sort of ‘herd immunity’ was possible via a vaccine, now I believe a vaccine won’t be a ‘medical bailout’ simply because the virus will mutate enough and immune responses will wane enough to facilitate reinfection.

As usual, take my view with a grain of salt since I am not an epidemiologist. But, to the degree the Covid-19 virus remains deadlier than influenza, it should mean we are headed into a new post-pandemic normal. And lots of trends remain in place for the foreseeable future.

Comments are closed.