The Macro Themes That Matter, Part 2, Mea Culpa Double Dip Edition

It ain’t over until the fat lady sings. That’s what they say, isn’t it? Well, apparently this is also true about my September/October economic pivot call too.

If you recall, I’d been saying that September and October would be a tricky period with a lot more forward clarity on whether the economy had gained enough speed to avoid a double dip. We saw the jitters around that question in early September. But those early worries subsided and it was off to the races again, with jobless claims and the unemployment rate coming down, with economic data beating expectations, and companies beating earnings. So I called all clear earlier this month. See here for example.

That was the wrong call. Mea Culpa. Things are unraveling now – and fast.

Let me put this together below – with the emphasis on the two economic buckets of my macro themes that matter, jobs and the consumer.

It’s all about the lockdowns now

My view for the last several months has been that we were unlikely to see sweeping economic shutdowns except as a last ditch effort. The initial lockdowns were so debilitating to the economy and destructive to small businesses that governments would avoid anything similar at all costs. Let me pause here and look for a self-quote.

I don’t think full-scale lockdowns are politically viable anymore given the massive private sector economic hit and government deficits they entail. I would go so far as to say they won’t happen except in extremis.

That means the potential for epidemic levels of viral spread and death are possible in second, third and fourth waves until we build a sort of herd immunity….

[…]

It’s hard to believe we are going to get a decent recovery here given the downside risks on the policy and viral fronts. I’m not saying it can’t happen. But, the outline I just went through points to some of the challenges.

[…]

If we are left blindsided by a second post-lockdown wave or a third fall/winter coronavirus wave in the Northern Hemisphere, it’s because we didn’t prepare. The risks were there for all to see. And the deaths will have been preventable.

Policy errors matter and they cost lives.

This is grim stuff.

Read the May 21 quote above again because I am not backtracking on it now. I am about to double down. Here’s the logic:

- Full-scale lockdowns are not politically viable except in the worst of scenarios.

- “That means the potential for epidemic levels of viral spread and death are possible in second, third and fourth waves.”

- Why? Because “just a couple of weeks delay in responding vigilantly (and correctly) to the coronavirus pandemic cost tens of thousands of lives”.

- So, we have had to hope and pray we prepared ourselves well enough to prevent the worst-case outcomes that precipitate lockdowns. In Europe, we didn’t. So, we’re getting more generalized lockdowns.

- And eventually, we will get them in the US – only after even worse public health outcomes here than in Europe, because the US is even more resistant to lockdowns than the Europeans.

Translation: Likely, we are now quickly moving into the double dip outcome in Europe, with the US not far behind.

Jobs and Consumption

The question is what happens to jobs and income under different response regimes. For example, in Europe, they are locking down, with governments expected to make large swathes of the population whole until the lockdown is over. We know that these ‘make whole’ schemes are imperfect. And so we should expect another wave of lower consumer demand, business closure and GDP contraction.

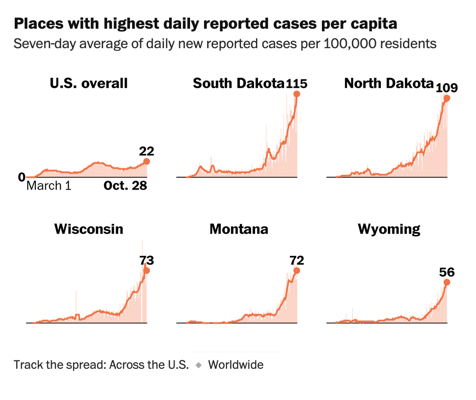

In the US, by contrast, the focus has been on keeping things open at all costs. And the US is consumed by an historic presidential election. How bad do things in the upper midwest have to get before we get a policy response?

Source: Washington Post

Will this wave dissipate on its own without government changes? Will consumers pull back in fright before any response comes? How will jobs be affected? We don’t know the answer to these questions. However, I believe that the virus will not dissipate until people change their behavior. And by that time, death tolls will be of epidemic proportions. And the result will be lost consumption and, therefore, jobs.

This is a prediction. It doesn’t have to turn out this way. I could be wrong. But when it comes to outcomes from viral contagion and the resulting policy responses I have been right more often than not. The way I see it, all of this is predictable, as my May 21 post shows. So, as much as I would like to be proved wrong, evidence suggests that a delayed response simply leads to greater death and, therefore, worse economic outcomes.

Markets

I am going to get into markets in the third part of this newsletter series. But I do want to say a few words about markets now.

I had thought we were safely through this predicted period of Fall volatility. But, the selloff today in Europe of 3 1/2% on the back of two prior days of choppiness tells you it’s not over.

And the fact that Europe is leading the charge down tells you this isn’t about US politics or technical factors or anything else. It’s about the coronavirus and the potential that the Fall wave’s is leading to a double dip recession.

Notice that bonds aren’t doing anything to mitigate the downside here. As equities have topped and then sold off to levels lower than at the end of September, 10-year yields are not a ton lower.

That tells you that there is considerable downside from here from the total return perspective of a 60-40 portfolio

My View

Potentially, we are back to February here – meaning what is happening now is similar to what happened from a viral perspective in February and March. East Asia has mastered the virus, relatively-speaking. And so, while the West grapples with another wave, East Asia is somewhat insulated, especially to the degree they restrict travel to and from the West.

From an economic perspective, I think the controlling variable is about how late we leave it. Control measures left late cost lives. And the paradigm that says there’s an economic/public health trade-off doesn’t work for me. More lives lost means greater economic disruption, greater long-term hysteresis effects, and potentially greater downside economic risk.

Europe has clearly left it late. The US will be even worse. I do not expect President Trump to change tack and do anything like a national lockdown while he’s still in office. And so, I believe this Fall/Winter wave will be worse than the first wave. Since I am not an epidemiologist, you can take that with a grain of salt. But to the degree this is a reasonable worst case outcome, it makes sense to consider how that impacts the economy, markets and politics.

For now, my base case is for lower jobless claims and unemployment to reverse by early December. I expect Q4 growth expectations to ratchet down accordingly, with recession already as a reasonable probability outcome (though not yet a base case).

And I was just starting to get more hopeful too :(

Comments are closed.