BBB fallen angels and fake ETF liquidity

Yesterday and today, there’s been a bit of back and forth on Twitter about vulnerabilities in the high yield space. I thought I would weigh in via this newsletter because I think it’s an important issue regarding faulty market structure.

For me, there’s a liquidity mismatch problem. And eventually, it will catch up to us. I don’t have a solution ready-made. But the problem reminds me a little bit of the equity circuit breaker rules that went into after Black Monday in 1987, to prevent markets gapping down in panic.

Junkier US corporate credits

Back in August I was talking to an old college friend of mine who still works in the European high yield sector that I left two decades ago. And he was explaining the fallen angel issue to me. I’ve tried to get him onto Real Vision for an interview, so I could boil down his arguments. But it hasn’t happened yet.

As I understand what he told me, the issue is more a US-specific issue and is not really a problem in Europe. And that’s because US companies are becoming ‘junkier’. And this has been going on for some time. For example, here’s Tracy Alloway and Michael Mackenzie in the FT back in 2014 with some insight into the problem we were discussing on Twitter. I’ve bolded some important bits:

Sales of US corporate bonds are increasingly reflecting lower credit ratings as companies take advantage of historic low interest rates and yield-hungry fixed-income investors to borrow record amounts in wide-open debt markets.

Much of the borrowing is being used to return cash to shareholders or finance acquisitions, in a move that is boosting leverage levels at many American companies. At the same time, bond investors appear to be ignoring ostensibly weaker corporate balance sheets in their hunt for higher returns.

That could come back to haunt them if interest rates rise and spark defaults – at which point investors could rue their failure to differentiate between credits.

“If everything is coalescing around one or a few ratings then that would suggest that the risk embedded in the company is the same. But, as we know, if a company has a different business model or different leverage it’s not the same,” says Rob Smalley at UBS. “Once the tide changes we’ll start to see more differentiation.”

In 2008, sales of bonds issued by triple-A and double-A rated companies – or high quality credits – accounted for 47 per cent of overall bond sales, according to Dealogic. So far this year, that figure is running at a meagre 12 per cent.

In contrast, issuance by triple, double and single-B rated companies – riskier credits – represented 21 per cent of total issuance during 2008 and is running at 42 per cent in 2014.

The focus is on BBB credits

To pick apart the argument here, it’s that US corporates are loading up with debt to, among other things, buy back shares and boost their E.P.S. numbers. And that helps management get a larger paycheck, by the way, since their remuneration is usually tied to earnings.

The result is a cascade down toward the lower end of the investment grade spectrum, with few companies choosing their credit rating over their ability to squeeze out more profit through balance sheet leverage.

When I spoke to David Rosenberg about this issue on Real Vision last year, he told me that the problem is even worse in the sense that the average BBB company has a balance sheet like a BB of yesteryear. And he believes the companies can get away with that because they have shown ratings agencies that, when push comes to shove, they can cut capital investment in a heartbeat to preserve cash and prevent a ratings problem. This, Dave told me, added a bit to the downside during 2019’s capital investment recession.

By the way, Dan Zwirn also told me the same thing a couple weeks ago about BBB credits.

“Today’s BBB was yesterday’s BB” says @Dan_Zwirn of @arenainv to @edwardnh as they discuss the explosion in BBB rated credit. How does this all end? #DebtWeek https://t.co/sO1nyWPiBL pic.twitter.com/o4Cxb97aTc

— Real Vision (@realvision) January 13, 2020

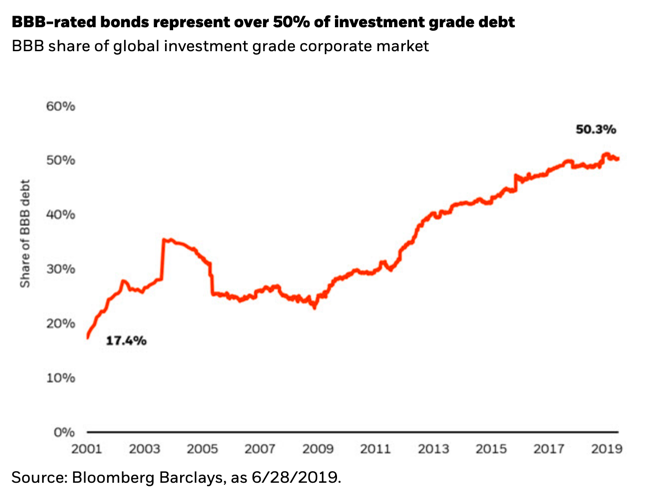

And BBB credits are an increasingly large part of the investment grade landscape – over half of all debt outstanding according to BlackRock.

Here’s what they say:

The investment-grade corporate debt market has grown rapidly in recent years. Global capitalization reached over $10 trillion in 2019 from just over $2 trillion at the start of 2001. In the U.S., corporate debt as a percentage of GDP now stands at 47%, its highest level since 2009.1

At the same time, the lowest rated part of the investment-grade market has grown particularly quickly. Globally, BBB debt makes up over 50% of the market versus only 17% in 2001.

[…]

We believe the sharp increase in the proportion of BBB-rated constituents has made the investment-grade bond sector riskier than in recent years. BBB-rated bonds are typically the most vulnerable of all investment-grade debt in a recession. Any downgrade of such bonds would relegate them from the investment-grade universe to the high yield universe (making them “fallen angels”), which would negatively re-rate their value.

Analysis by Morgan Stanley has found that significant volumes of BBB-rated bonds were downgraded in previous credit downturns. In the 2007-09, 2000-03 and 1989-91 downturns, between 23% and 45% of investment-grade bonds were downgraded to junk. If downgrade rates were to remain at such levels, the next downturn could see approximately $600 billion of BBB bonds consigned to junk status.

[…]

Given many of these companies rely on access to investment grade capital markets to fund business operations, a significant portion of the BBB-universe is highly motivated to remain investment grade. If faced with being downgraded, companies can cut or eliminate stock dividends, share repurchase programs and M&A activities.

That last bit echoes David Rosenberg’s comments. And it should be seen as a source of downside risk for investors buying dividend-paying stocks in particular and equities in general.

High Yield and BBB credits

Now the bit regarding high yield is where my London friend comes into play. He told me that the problem with fallen angels is the size of the issuance. A downgrade of GE, AT&T or Ford, for example, would bring in an issuer so large that high yield bond indices could not – under size allocation rules – absorb. Put simply, no issuer in a HY index can be above a certain percentage of the index. And GE, Ford or AT&T would violate that principle.

Completely beside the investment grade selling issue, this is a big problem in terms of demand for those bonds in the high yield space. What you would then have is a fallen angel with a lack of both high yield and investment grade investor demand. In a worst case scenario, this could cause selling of that specific issue to leak into funds selling other issues in order to meet redemption demand, adding a significant amount of contagion to the bond market.

And to make matters even worse, high yield bond funds like HYG give investors the false sense of security that they can sell on demand, even though the underlying high yield investment universe is relatively illiquid. The reality is that bonds are much less liquid than stocks. Long-term investors often buy and hold to maturity. And single name companies release a multiplicity of bond issues, whereas they generally have only one publicly-traded stock issue. That further decreases liquidity. For bond ETFs that’s a big problem when there is heavy selling.

My view

So my view here is that we have a disaster waiting for a trigger. And the disaster is a selling wave of high yield bonds and bond ETFs. Ostensibly, to the degree this is merely a liquidity problem, this could present a buying opportunity for investors. But, to the degree the trigger is a downgrade to fallen angel status caused by a recession, you have the makings of a rout in high yield that could lead to refinancing risk, especially in the CCC space.

Personally, I think when the music stops, there will be a lot of defaults at the lower end of the credit spectrum. And the dynamics of fallen angels and high yield ETFs will only exacerbate the fundamental issues by heightening the loss of liquidity.

In my view, regulators need to fix the bond ETF liquidity mismatch issue before investors get hurt. Right now, it’s a question of when, not if.

Comments are closed.