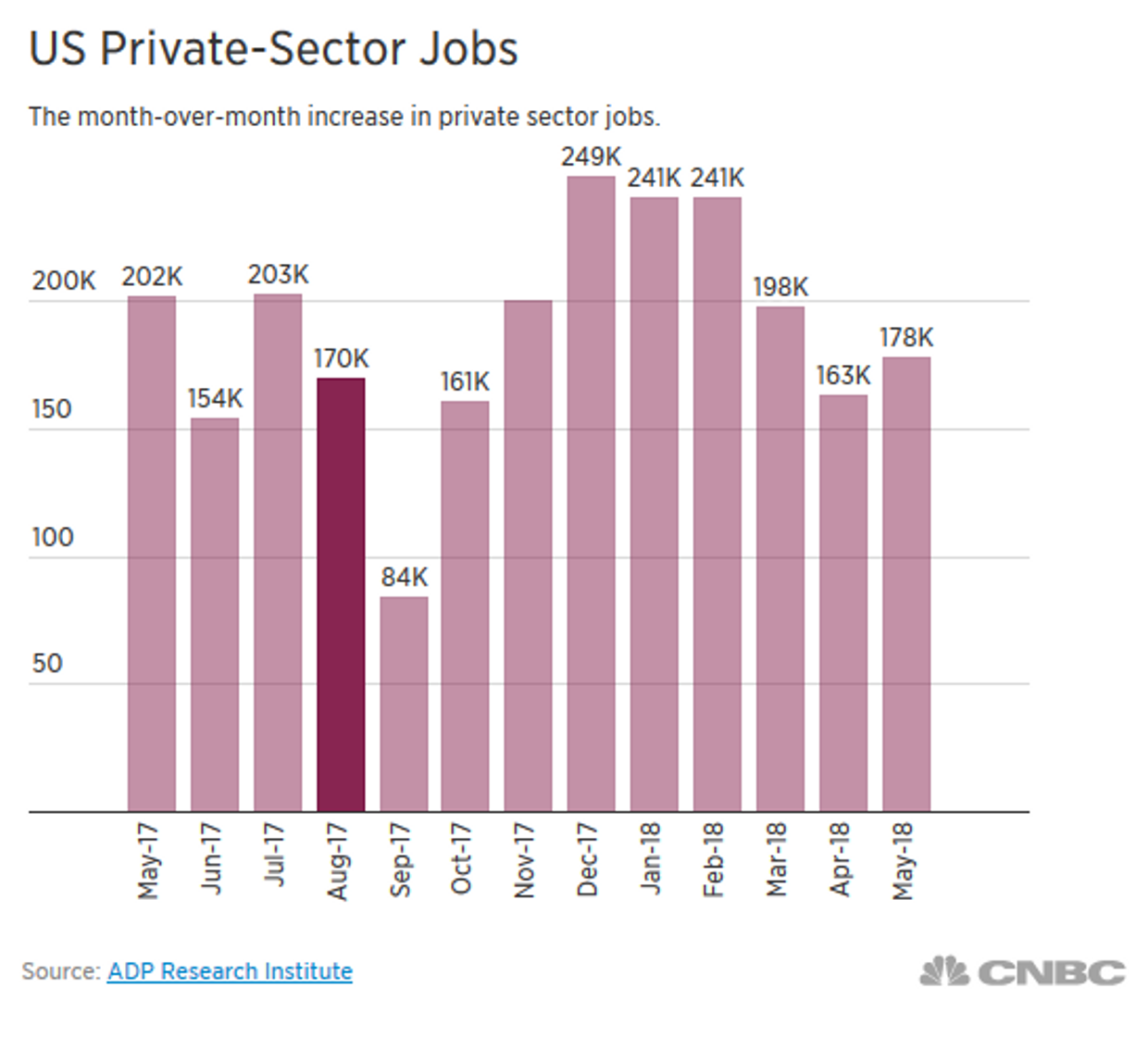

Quick message here prompted by the ADP payroll numbers

Now, the ADP numbers don’t line up with the official payroll numbers released two days later but they are a good proxy for directionality if you look at the rolling 12-month change in payrolls.

Job growth in 2018 is slowing. And that’s to be expected. As I pointed out in January, growth in non-farm payrolls peaks mid-cycle. You simply won’t get the kind of numbers now that you got in 2016 or 2017.

So when you read news stories telling you the ADP number of 178,000 was short of expectations of 190,000, take that with a grain of salt. It doesn’t matter. Not only is 178,000 close enough statistically that it doesn’t matter, but it also is high enough that it won’t change the Fed’s tightening bias.

The Fed is going to raise the Fed Funds rate in June. That much is clear. What matters now, then, is whether it hikes two more times in 2018 or just once more – and what kind of guidance it gives regarding how it sees the economy affecting monetary policy decisions.

The number that matters the most at this point is the unemployment rate because we are already well into what the Fed considers full employment territory. The lower the headline unemployment rate number goes, the more likely the Fed is to guide to two rate hikes in 2018.

And remember that, with the Italian crisis, market sentiment has shifted. The US is now considered an outlier economically. And that means expectations for policy convergence have diminished. Expect more upward pressure on the dollar and more volatility in emerging markets.

Comments are closed.