Money Strong founder Danielle DiMartino Booth is out with her latest newsletter. And this one is on housing. Her view is that house affordability at the entry level has declined significantly. Moreover, Danielle notes that houses in the lowest-price quintile have gone up at a 8.5% annual rate for 67 months on the trot. With a 20% down payment as standard, many people are priced out of the housing market.

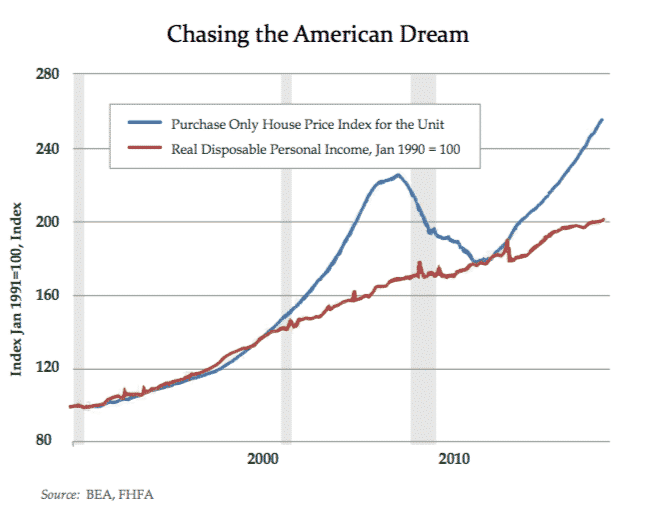

Two charts speak volumes.

Less affordable housing

First, there’s the growth in real disposable income vs. the growth in house prices indexed back at 1990.

Source: Money Strong

Case-Shiller Index

The second chart shows the S&P/Case-Shiller index from 1987.

Source: Money Strong

Danielle’s conclusion is spot on: residential property in the US may not be in a bubble. Still, residential property is certainly not cheap.

I don’t want to steal Danielle’s thunder. So read the rest of her analysis here.

Comments are closed.