Asset market distress is mounting

My default position recently has been more about volatility than a directional call on any specific asset class. But, in a world in which asset prices have been rising, increased volatility is almost always associated with price declines, like the ones we’re seeing now. And we’re seeing these declines across the board – from oil to equities to high yield to interest rates. This is a wholesale reduction of risk by investors cognizant that they were underweight safe assets.

When October ended, I said that I wasn’t concerned about the slump in shares continuing because there was nothing in the real economy to support a sharp decline. But that has changed in December, with the problems in the real economy, credit markets and politically mounting.

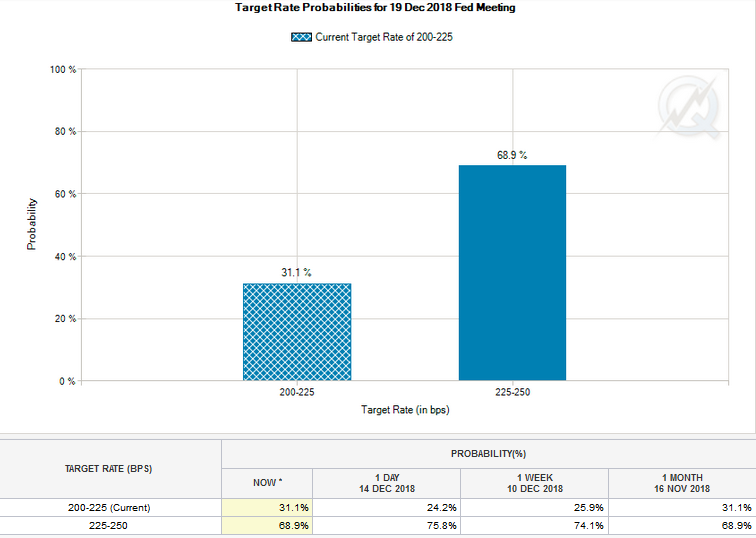

The clearest indication of that change is the strange 31.1% implied probability of a Wednesday Fed rate hike pause.

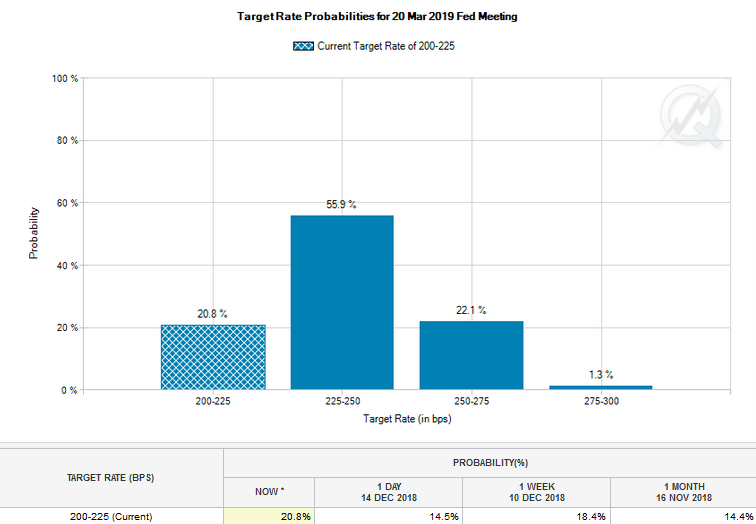

Move this out to March, and you see the implied probability of the two rate hikes thru March that the Fed has explicitly guided the market toward is now just 23%.

This is the market telling the Fed what it thinks

So, the market is strongly advising the Fed to pause or to change guidance to allow a pause. If the Fed continues to stick to its existing guidance, asset markets will feel caught out. And we will likely see more selling pressure. The implied probabilities for Fed Funds rates are a second bond market signal, after the partial yield curve inversion, telling the Fed that it risks over-tightening if it sticks to its timetable guidance.

Today, I was looking at the price action in US equity names like Consolidated Edison and Dominion Resources, which are low beta, relatively high dividend stocks that are considered ‘safe havens’. Con Ed was down almost 4%. Same for Dominion Resources. The fact that we saw heavy selling pressure on utilities, consumer staples and REITs speaks to the mood in today’s selloff.

At the same time, we also saw oil sell off pretty substantially, with WTI falling $2 to end below $50 a barrel at the close of trading. That’s a sign that the selling pressure is being caused by concerns over a potential economic slump, one that I told you earlier today I don’t see happening in the next six months.

But I’ve heard stories of CEOs thinking that the recession could begin in Q4 i.e. right now. That’s what a recent NY Times survey reveals at least.

Almost half of the respondents thought the U.S. could wind up in a recession by the end of the month. The greatest threats to U.S. markets, 67 percent said, are U.S. political instability and trade negotiations.

And note the intersection of the political and economic here. The anxiety is all being driven by Donald Trump’s agenda.

Right now, the US stock market is on track for its worst December since the Great Depression. The Trump Bump has become a Trump Slump.

— Edward Harrison (@edwardnh) December 18, 2018

What is the problem?

I think it’s preposterous to believe we’re in a recession right now as this CEO survey implies. But that’s the mood. And we see it playing out in the marketplace. It’s not just CEOs though. An NBC/WSJ poll released this weekend showed that 33% percent of Americans expect the US economy to get worse. That’s up from just 20% at the beginning of the year.

Will this play out in terms of demand? Or is it just people reacting to the unrelenting pace of negative political news? I think the retail sales season will be the arbiter here. So December is not necessarily the beginning of a trend.

For me, it’s big sectors of capital investment that I worry about – like housing and the oil patch. A fall in capital investment and employment there can take us from stall speed to recession relatively quickly in my view.

Most people I pay attention to say the vulnerabilities there are not as pronounced as they were a decade ago. So we don’t have the makings of a horrible financial crisis. Even so, not every country can say that.

Look at Canada and Australia. For example, according to Corelogic, since the peak, Sydney house prices are down -10.5% and Melbourne’s are down almost 7%. In Canada, the Toronto Star was recently running a headline saying, “Vancouver home prices fall most since 2008, extending declines“. Toronto prices are still advancing. If we are on the verge of a global recession, these last two housing bubble markets, Canada and Australia, will feel a lot of pain, more than most.

My view

I continue to see a relatively bright near-term outlook economically. That’s at odds with all of the selling pressure we see in risk assets, and with the decline in yields both in the US and the Eurozone, where German Bunds are at 0.25% and the Italian 10-year is under 3%. So I tend to think of the selling as a reflection of political uncertainty as much as anything else.

But in the mix are unmistakable signs of disquiet about the pace of demand growth. We see it in falling commodity and oil prices. And we see it in falling long-term yields and the partially-inverted US Treasury yield curve.

So, there are two big variables here. The first is whether the growth path continues to decelerate, and, if so, how fast. If we see a stabilization, the asset market volatility will diminish. However, if the slowing continues or even accelerates, expect more problems in risk assets.

The more important question is the policy response, of course. The US government bond markets are sending an unmistakable signal to the Fed that it has to stand down or risk over-tightening. ironically, as yields have fallen, the curve has steepened slightly, with the 10-year ending today 16 basis points wide of the 2-year. So that’s a positive. It says the market expects slowing, followed by a Fed pause. If they expected over-tightening, we would see the yield curve move toward inversion. And we aren’t seeing that yet.

Therefore, policy makers have an opportunity to change course and mitigate some of the damage. This goes both for fiscal policy and monetary policy. In the US, we face a partial government shutdown on Friday over funding a border wall with Mexico. If that shutdown goes ahead, I expect the Christmas to New Year’s week coming to be unsettled.

So I am looking to Wednesday and the Fed’s policy statement and Friday and the government shutdown standoff as keys to how the markets will develop over the next couple of weeks. Afterwards, it’s going to be more about the holiday sales numbers. How ever you look at it, 2019 is likely to be a very unpredictable year.

Comments are closed.