On the Collapse of the Shanghai Composite

Shanghai’s channel surfing Panda bears are speaking with a little higher pitch this weekend after getting their ‘hood caught in a vicious squeeze and reversal. The stock index has bounced 8.7 percent off its January 6th lows after falling 31 percent from last April’s 12-month high. The Shanghai was down 39 percent from its August ‘09 post-crash high before reversing earlier this month. Hugh Hendry nailed it.

We don’t know if the bottom is in but it seems clear to us the government doesn’t want the stock market to fall any further. They have unleashed the Dragon on the bears with a series of policies to prop up the market.

Christopher Wood’s excellent Greed & Fear piece wrote this past week,

Speaking of monetary easing, there has continued to be a lack of significant monetary easing in China. Still investors received more signals this week that the PRC does not want the local stock market to go any lower with the announcement of increased quota for QFIIs.

Thus, the China Securities Regulatory Commission reported on Monday that it granted 14 foreign investors QFII licenses in December, compared with 15 licenses granted in the first 11 months of 2011. The State Administration of Foreign Exchange (SAFE) has also approved US$950m in new QFII quotas since October following a five-month hiatus since May (see Figure 4). The local press also reported on Wednesday that the QFII quota will be increased significantly from the current US$30bn limit.

Meanwhile, investors should expect more reserve requirement cuts with the latest data on foreign exchange reserves showing that capital has continued to flow out of the country. Thus, foreign exchange reserves fell by US$92.6bn or 2.8% in the last two months of 2011, after increasing US$72.1bn in October. Still the main purpose of any RRR cut will be to offset the effect of such outflows, just as the numerous RRR hikes since November 2010 were designed to sterilise the impact of hot money inflows.

Stock trading in mainland China will be closed all of next week and Monday through Wednesday in Hong Kong for the New Year holiday as the country effectively shuts down during this period. We will be monitoring labor demand from Chinese factories when workers return from the holiday and will watching how the Shanghai trades with respect to further monetary measures.

The index has reclaimed the 50-day moving average and it does look and feel like a break above the upper bound of the Shanghai’s classic downward channel is in the cards when the market reopens. Disciplined traders will, of course, wait for confirmation before acting, but, a break-out would further boost confidence in risk markets and commodities.

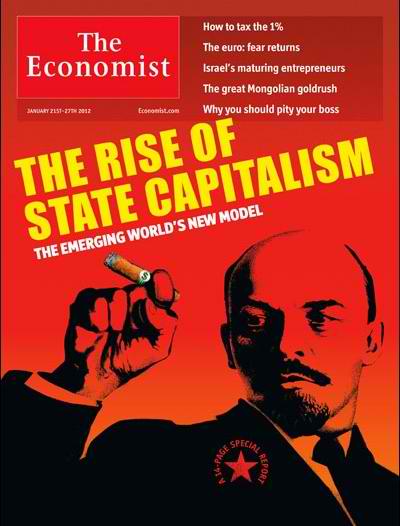

Interesting Economist cover this week with a series of articles on state sponsored

multinational corporations as the new model for capitalism. We find it interesting, however, that China is attempting to prop up equities by deregulation and lifting restrictions on foreign investors. This while developed markets become more and more distorted with massive quantitative easing money printing and negative real interest rates. China also has negative real interest rates, by the way.

We’re now wondering if markets will ever clear again. Conventional metrics are tossed aside and market signals will become increasingly difficult to discern and read as the interventions drag on in this Year of the Dragon – and the Draghi!

Asset bubbles, anyone? Who said this business was easy.

Comments are closed.