Emerging Markets Continue To Outperform Developed Markets

By Win Thin

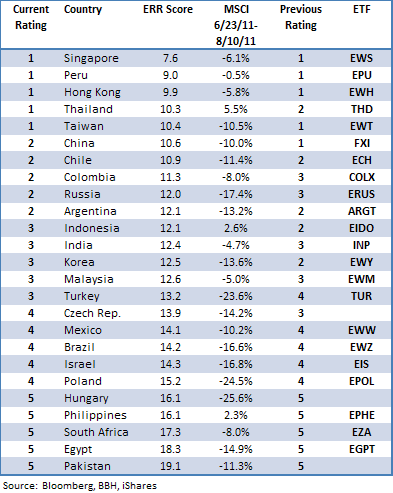

We have produced the following Equity Risk Rankings (ERR) model to assist equity investors in assessing relative sovereign risk and optimal asset allocation across countries in the emerging markets universe. The countries covered include 20 of the 21 countries in the MSCI Emerging Markets Index as well as 3 (Israel, Hong Kong, and Singapore) from the MSCI Developed Market Index and 2 (Argentina and Pakistan) from the MSCI Frontier Markets Index. A country’s ERR is determined through a weighted composite of 14 economic and political indicators that are each ranked against the other 24 in our model EM universe. Categories include industrial production growth, real interest rates, export growth, expected P/E ratio, bank lending, current account, real money growth, GDP growth, GFCF/GDP, inflation, ease of doing business, economic freedom, and FDI/GDP.

EM Ratings Summary

A country’s ERR directly reflects its attractiveness for equity investors – the likelihood that its equity market will outperform the rest of our emerging markets universe over the next 3 months. A country that is typically ranked first in many of the categories will end up at the top of our ERR composite ranking. Exchange rate fluctuations can have significant effects on the dollar return to foreign investors, and so we have chosen several variables that tend to highlight exchange rate risk. Others were chosen as leading indicators of economic growth. Our last change in the rankings was released June 23, 2011.

From 6/23/11 to 8/10/11, the MSCI Emerging Markets (EM) Index fell -11.3%, while the MSCI Developed Markets (DM) Index fell -11.8% and the MSCI US Index fell -12.6%. It is very encouraging that EM equities were able to outperform DM during this very difficult period. Going forward, we think EM can continue to outperform DM under our base case scenario of further euro zone turmoil.

Looking at regional performance, MSCI Asia fell -8.9% during that period, MSCI Latin America fell -14.4%, and MSCI EMEA fell -14.9%. This is entirely consistent with the widely held view that the EMEA region has the worst fundamentals, and Asia has the best. While we have been constructive on Latin America, we think that sharply lower commodity prices will end up hurting this region despite good fundamentals.

Let’s see how our model has done during the forecast period from 6/23/11-8/10/11. Within our model universe of 25 EM countries, those that were in the top fifth of our rankings with 1 rating (VERY OVERWEIGHT equity position) fell an average -3.5% during this period. Those with 2 rating (SLIGHTLY OVERWEIGHT) fell an average -12.0%, while those with 3 rating (NEUTRAL) fell an average -8.8%. This compares to an average loss of -16.4% during the same period for those with 4 rating (UNDERWEIGHT) and -11.5% average loss for those with 5 rating (VERY UNDERWEIGHT). Furthermore, 2 of the 5 best performers during this period were rated 1 or 2, while 3 of the worst 5 performers were rated 4 or 5. Average performance for 1 and 2 rated countries together was -7.7%, average for 3 rated was -8.8%, and average for 4 and 5 rated countries together was -14.0%. In other words, our model has so far done a very good job identifying the markets that would outperform and underperform. While no investors will be happy to experience such losses, they can at least be thankful when even bigger potential losses are avoided.

We believe that this most recent correction in EM markets will help fundamentals to matter more. The easy part of this EM rally is over, so it will become much more important for global investors to continue focusing on the fundamentals. We remain optimistic that risk assets (including EM) will continue to bounce back after the current period of turmoil ebbs. Why do we expect an eventual recovery in EM equities? Because EM fundamentals in general are the strongest they’ve been in a generation. However, we acknowledge that this asset class remains hostage to swings in generalized risk appetite. We remain concerned that the European crisis will deteriorate further in the coming months, which will surely impact EM negatively. But at the same time, we remain confident that the strongest EM credits will be able to outperform again in the event of another generalized drop in risk appetite. For now, we believe that picking the EM equity markets with solid fundamentals remains a good strategy for global equity managers in this current environment.

Comments are closed.